How can Retailers Grow 37% Faster with Web Scraping Woolworths Grocery Data for Market Research Insights?

Nov 18

Introduction

Australia’s grocery landscape is evolving at record speed, with shifting consumer demands, rising competition, and rapidly changing price movements. For retailers, analysts, and FMCG brands, accessing precise and real-time intelligence has become crucial for strategic decision-making. This is where Web Scraping Woolworths Grocery Data for Market Research emerges as one of the most impactful data-driven methods.

As digital commerce grows, brands are increasingly adopting Woolworths Data Scraping to enrich their research workflows. Clean, accurate, and continuously updated data helps businesses identify gaps in category performance, understand localised demands, and evaluate how top competitors modify prices or launch promotions.

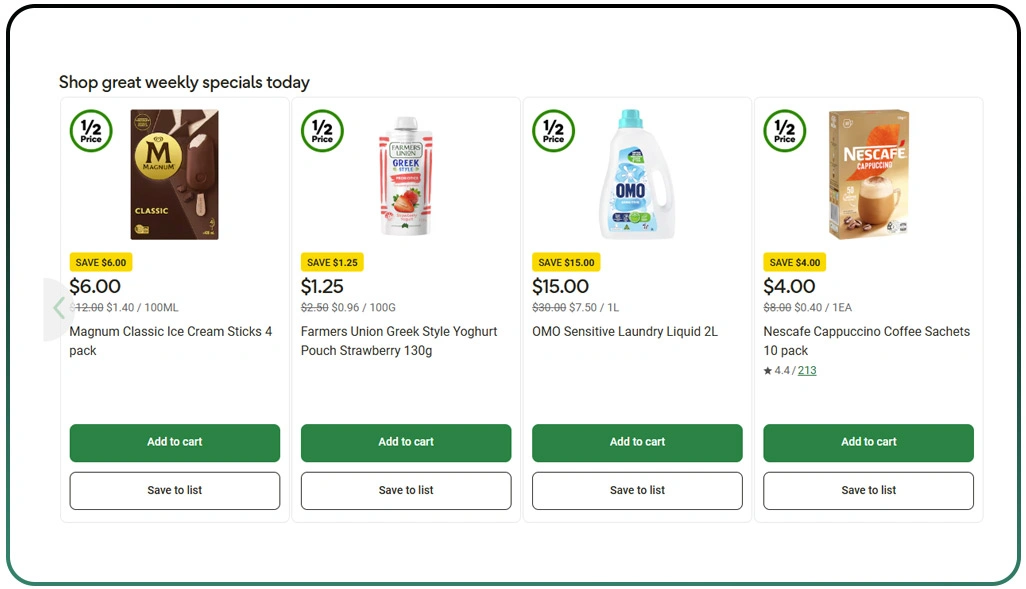

Whether it is weekly pricing fluctuations, changes in featured products, or shelf visibility patterns, granular insights from Woolworths strengthen fact-based decisions. By analysing this data at scale, decision-makers gain a more realistic understanding of the grocery market—offering unparalleled visibility into key pricing signals, discount cycles, and demand-driven adjustments.

Understanding Grocery Market Patterns Through Deeper Insight Models

Australia’s grocery environment continues to change rapidly, with shifting household budgets and new shopping expectations redefining how retailers approach category decisions. To navigate these shifts, businesses increasingly rely on structured datasets that reveal pricing variations, product movements, and promotional cycles. Incorporating reliable methods to Scrape Grocery Items, Prices, and Promotions From Woolworths helps retailers track patterns that influence purchasing behaviour across regions and formats.

With competition rising, businesses also use the expanding ecosystem of Quick Commerce Datasets to compare traditional and fast-delivery performance across key categories. These datasets highlight how on-shelf behaviour aligns with online demand signals. Seasonal pricing shifts, repeat promotion cycles, and stock variations become clearer when data is captured continuously.

Below is an example of category behaviour insights that retailers monitor weekly:

| Category | Avg Weekly Price Change | Promotion Frequency | Stock Variation |

|---|---|---|---|

| Fresh Produce | +3.1% | High | Medium |

| Pantry Items | +1.4% | Low | Low |

| Beverages | +2.3% | Medium | High |

| Frozen Foods | +0.9% | High | Medium |

Using tools designed to Extract Product and Price Data From Woolworths in Real Time, retailers can take timely action based on these fluctuations. From forecasting demand to adjusting local offers, real-time intelligence creates a stronger link between pricing decisions and consumer expectations. As competition intensifies and categories expand, this type of structured visibility helps teams build resilient planning strategies rooted in current, reliable grocery signals.

Using Data-Backed Comparison Models for Competitor Strategy Planning

Price competition in the grocery sector demands sharper visibility into how rival retailers update their promotions, modify assortments, and shift category priorities. Businesses are increasingly adopting advanced analytics derived from Competitor Price Monitoring to understand how price changes influence customer preferences. These insights help retailers align promotional intensity, evaluate margin impact, and identify which categories are most sensitive to competitor actions.

Holistic datasets enable comparisons across multiple parameters including basket size, discount frequency, and product competitiveness. Using structured insights from Woolworths Grocery Price Monitoring, teams observe how pricing behaviours vary across suburbs and stores. These comparisons also highlight where competitive advantages exist—such as lower basket costs, better promotional reach, or stronger category leadership.

A sample table illustrating competitive pricing patterns is shown below:

| Competitor | Avg Basket Price | Promotion Ratio | Lowest Category Prices |

|---|---|---|---|

| Woolworths | $82.60 | 27% | Bakery / Dairy |

| Coles | $84.10 | 25% | Snacks / Frozen |

| Aldi | $78.40 | 14% | Pantry / Beverages |

| IGA | $86.20 | 18% | Fresh Produce |

By integrating structured signals available through the Woolworths API for Product and Pricing Data, analysts gain a clearer sense of promotional triggers and pricing reactions across the market. These insights allow teams to see how competitors reposition items, reduce or increase discounts, and shift focus between premium and budget lines.

Building Scalable Retail Intelligence With Comprehensive Data Pipelines

The retail ecosystem depends on fast, accurate, and scalable data collection to uncover daily changes in prices, stock patterns, and store-level variations. As a result, businesses increasingly use automated systems integrated with Woolworths Store and Category Data Extraction to build consistent intelligence pipelines.

These pipelines connect price shifts, stock availability trends, and category transitions into single, easy-to-read datasets. Structured workflows draw from strong technical infrastructure supported by specialised partners offering Web Scraping Services, enabling brands to scale their data requirements without operational disruption.

Below is a sample table showing how daily insights influence retail actions:

| Insight Type | Daily Updates | Decision Impact |

|---|---|---|

| Price Changes | 3–6 times/day | Dynamic pricing decisions |

| Stock Availability | Continuous | Supply chain optimisation |

| Promotions | Real-time | Better campaign timing |

| Category Shifts | Weekly | Improved assortment alignment |

With automated solutions designed to Extract Product and Price Data From Woolworths in Real Time, analysts can stitch together operational, pricing, and promotional insights to build a full picture of the retail environment. These datasets guide better forecasting, more accurate demand planning, and stronger product strategy development.

How Web Data Crawler Can Help You?

Retailers and FMCG analysts benefit significantly when Web Scraping Woolworths Grocery Data for Market Research is integrated into a broader analytics workflow. We automates large-scale extraction, ensuring accuracy, consistency, and real-time responsiveness.

Our platform provides:

- High-frequency data capture across all product categories.

- Clean, duplicate-free datasets ready for BI dashboards.

- Regional mapping for store-wise product availability.

- Trend identification across pricing, promotions, and stock.

- Seamless integration with existing analytics tools.

- Custom pipelines tailored for enterprise workflows.

With industry-level scalability and precision, we enable businesses to operate with complete data transparency. By the end of the process, your team receives fully structured datasets aligned with your objectives, supported by the reliability of Woolworths Store and Category Data Extraction.

Conclusion

Retailers operating in competitive markets rely heavily on data-driven insights to optimise demand forecasting, strengthen pricing decisions, and elevate category performance. Integrating Web Scraping Woolworths Grocery Data for Market Research into daily decision-making ensures strategies are shaped by real signals rather than assumptions. With comprehensive datasets, brands can create more precise market strategies and respond quickly to changing consumer patterns.

The ability to build consistent datasets from scalable extraction tools, supported by to Extract Product and Price Data From Woolworths in Real Time, empowers businesses to align promotions, evaluate competitors, and reinforce profitable decisions. Contact Web Data Crawler today to get started.