How Can Web Scraping Whataburger Outlet Locations for Analysis Reveal 20% Faster Market Expansion?

Feb 10

Introduction

Whataburger has built a strong regional presence, but expanding into new markets requires more than brand popularity. It demands data-backed clarity about where customers are, where competitors dominate, and where demand is still underserved. This is where location-based intelligence becomes a powerful decision driver.

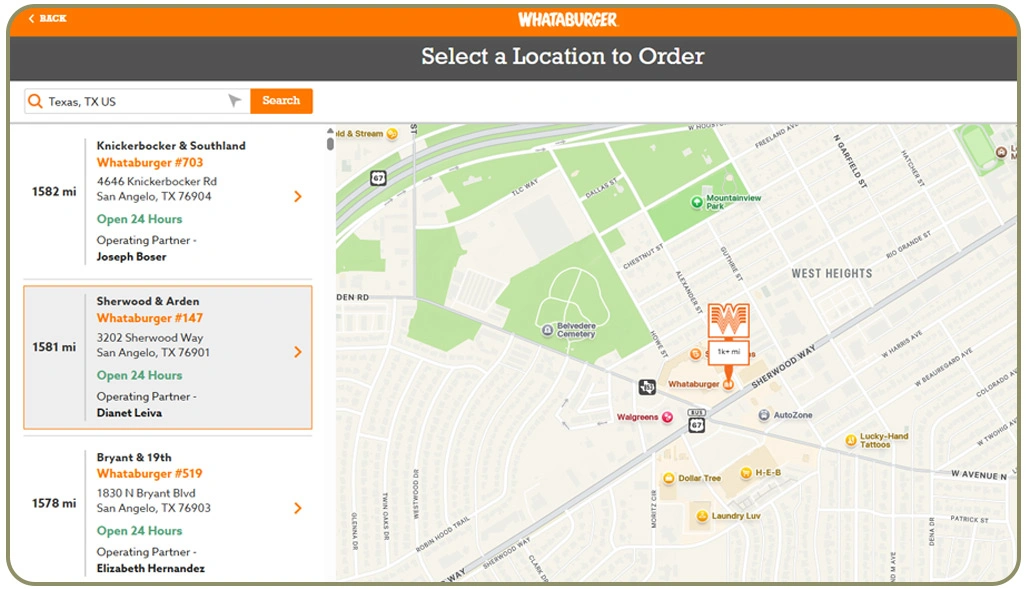

When brands plan growth, the biggest challenge is often not choosing whether to expand, but deciding where to expand first. By using methods to Scrape Whataburger Restaurant Locations Data in the USA, analysts can detect untapped metro areas, highway corridors with strong customer traffic, and regions where store clustering may already be saturated.

With Web Scraping Whataburger Outlet Locations for Analysis, businesses can map current footprints and compare them against demographic trends and competitive store placements. Instead of expanding based on assumptions, brands can expand based on measurable geographic opportunities that translate into real revenue growth.

Mapping Delivery Reach to Spot Untapped Markets

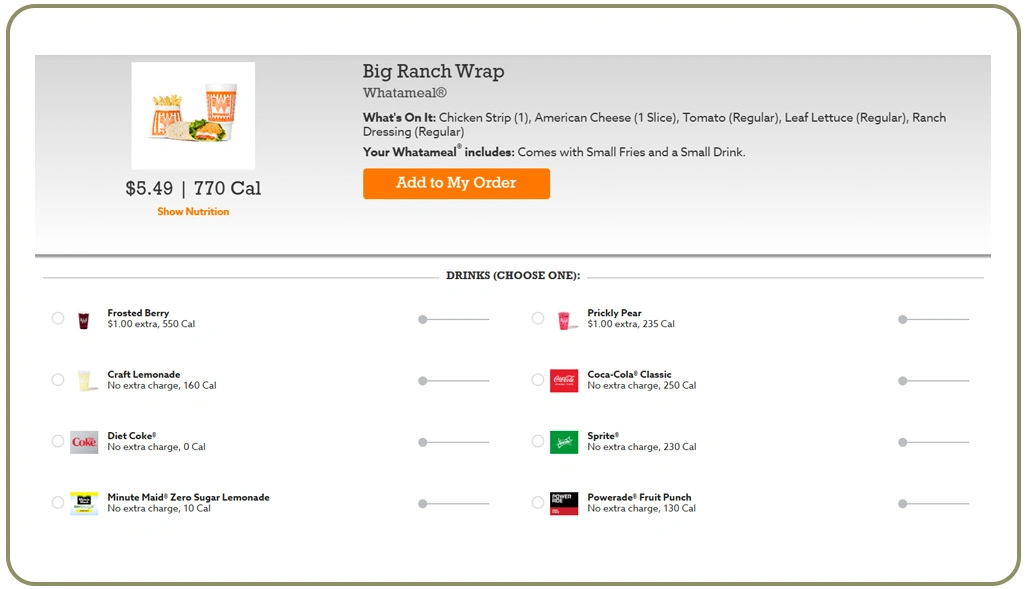

Fast market expansion depends heavily on understanding where customers can and cannot access a brand's food conveniently. Even if a restaurant exists in a city, the delivery radius often leaves large residential zones underserved. These hidden service gaps create strong expansion opportunities because demand may already exist, but fulfillment remains limited.

This is where Whataburger Food Delivery Data Scraping becomes valuable, because it highlights active delivery zones, unavailable neighborhoods, and regional ordering behavior patterns. By analyzing delivery-enabled areas, businesses can identify locations where store proximity is too far for consistent service.

For deeper planning, companies can also use techniques to Scrape Whataburger Store Location Data, helping them align delivery reach with existing store placement. Such insights support better forecasting, especially when linked with road access, neighborhood development, and consumer movement patterns.

| Delivery Intelligence Factor | What It Shows | Expansion Benefit |

|---|---|---|

| Delivery Radius Coverage | Service boundaries | Identifies underserved zones |

| Order Activity Heat Zones | Customer demand clusters | Helps prioritize new outlets |

| Distance From Nearest Outlet | Accessibility gaps | Reduces missed demand |

| Metro Area Service Balance | Market saturation level | Prevents over-expansion |

Additionally, structured Whataburger Restaurant Location Data Collection helps create geo-ready datasets that improve mapping accuracy and reduce decision delays.

Measuring Store Density to Reduce Expansion Risk

One of the most common reasons restaurant expansion fails is poor location selection based on assumptions rather than measurable coverage analysis. Many brands mistakenly believe that a city is fully served because it has several outlets, while in reality the majority of demand may be concentrated in suburban pockets, highway corridors, or newly developed neighborhoods.

A structured approach to Extract Whataburger Store Addresses and Geo Coordinates supports accurate mapping and distance evaluation. Studies in location-based retail planning suggest that store density optimization can reduce wasted investment by nearly 20% while improving revenue performance by 10%–15% in the first year of operations.

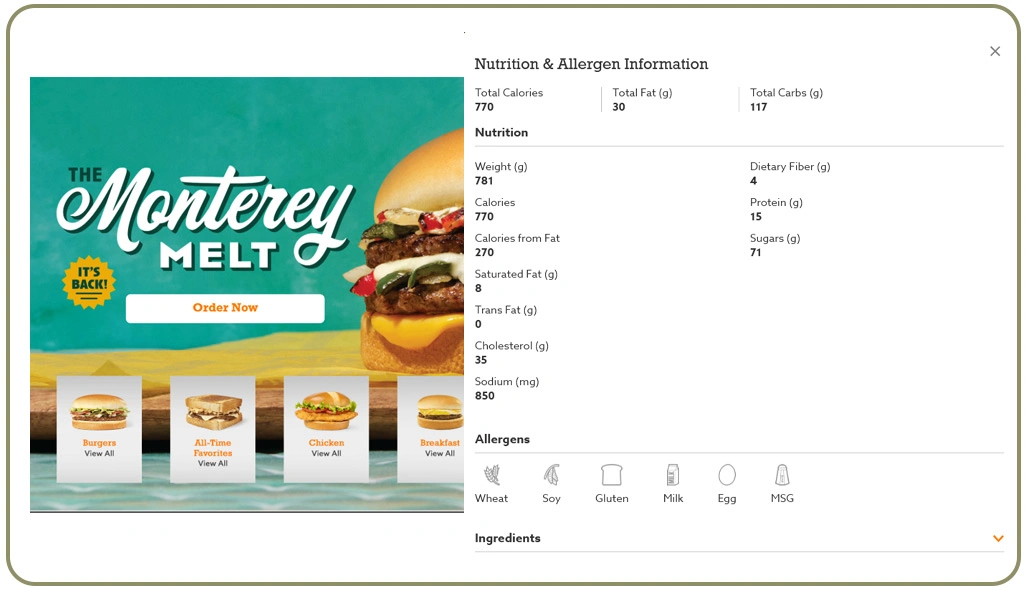

This process becomes even stronger when paired with Food and Restaurant Datasets, because it allows brands to compare outlet coverage against consumer demand trends, local business activity, and regional food spending behavior. Instead of blindly adding outlets, decision-makers can identify zones where customer reach is limited, even if the city appears saturated at a glance.

| Store Density Metric | What It Measures | Business Value |

|---|---|---|

| Outlet-to-Population Ratio | Coverage efficiency | Reveals demand gaps |

| Store-to-Store Distance | Clustering level | Prevents oversaturation |

| Suburban Growth Patterns | Future demand areas | Supports early entry strategy |

| Road Connectivity Access | Customer convenience | Improves footfall prediction |

This kind of location intelligence improves market entry decisions, supports long-term expansion sustainability, and ensures resources are invested where demand is proven rather than assumed.

Benchmarking Competitors for Smarter Market Entry

Entering a new market without competitive visibility often leads to slower growth, higher customer acquisition costs, and weaker store performance. Even if consumer demand is strong, excessive competitor density can divide market share and reduce profitability.

A major advantage of Popular Food Data Scraping is that it allows businesses to monitor competitor expansion trends and identify which brands are aggressively increasing their footprint in specific regions. This provides timing intelligence, helping brands enter markets before they become overcrowded. Research-based expansion studies show that brands entering balanced competition markets often achieve 12%–20% stronger early performance compared to those entering heavily saturated zones.

When decision-makers apply Whataburger Location Intelligence Data Scraping for Expansion Planning, they can compare competitor store clustering against existing outlet presence. This reveals which markets have strong demand but weak brand coverage, making them ideal targets for new store placement.

| Competitive Benchmark Factor | What It Reveals | Expansion Outcome |

|---|---|---|

| Competitor Density | Saturation level | Avoids low-profit markets |

| Competitor Distance Radius | Direct competition zones | Improves store positioning |

| Demand vs Supply Balance | Market opportunity score | Supports better forecasting |

| Expansion Timing Patterns | Competitor growth trend | Helps plan early entry |

With structured competitive benchmarking, expansion teams can prioritize regions using measurable indicators rather than assumptions. This approach strengthens market entry strategy, improves launch success, and supports faster, more confident expansion decisions.

How Web Data Crawler Can Help You?

We help brands collect and organize location intelligence with Web Scraping Whataburger Outlet Locations for Analysis, ensuring decision-makers can track store distribution patterns, delivery availability, and regional expansion gaps in a structured way.

What We Deliver for Expansion Teams:

- Accurate store location dataset structuring for planning.

- Geo-mapping ready outputs for density and demand modeling.

- Market-level comparison reports for strategic decision-making.

- Automated updates to ensure fresh store intelligence.

- Data quality validation to reduce inconsistencies.

- Customized datasets aligned with expansion requirements.

After delivering structured datasets, we also support advanced expansion insights through Whataburger Location Intelligence Data Scraping for Expansion Planning, enabling smarter market selection and faster decision cycles.

Conclusion

Market growth becomes faster when businesses understand exactly where store coverage is strong and where gaps exist. By applying Web Scraping Whataburger Outlet Locations for Analysis, expansion teams can map real-world store density, evaluate underserved zones, and prioritize regions that show strong demand signals without unnecessary trial-and-error.

With tools to Extract Whataburger Store Addresses and Geo Coordinates, brands can build structured maps, identify profitable entry points, and reduce launch delays significantly. Connect with Web Data Crawler today and start building a data-driven expansion strategy that delivers measurable growth results.