What Web Scraping Skincare Brand Comparison of CeraVe and Cetaphil Shows From 1k+ Reviews and 28% Trends?

Feb 09

Introduction

Skincare shoppers today are no longer buying products based on packaging or influencer recommendations alone. They want ingredient transparency, real customer feedback, pricing clarity, and performance validation. This shift has pushed brands like CeraVe and Cetaphil into a constant battle of trust, formulation reputation, and product accessibility across marketplaces.

By gathering structured insights from online listings, businesses can monitor product trends, detect demand shifts, and understand which formulations are receiving the strongest customer loyalty. The rise of Enterprise Web Crawling has made it possible to gather thousands of product listings, reviews, and pricing records from multiple sources in a consistent format.

In this blog, we break down what Web Scraping Skincare Brand Comparison of CeraVe and Cetaphil reveals from 1k+ reviews, pricing fluctuations, and measurable trends. The focus will remain on real indicators like review sentiment, ingredient preferences, and competitive pricing strategies shaping customer decisions.

Pricing Patterns That Shape Buyer Decisions Daily

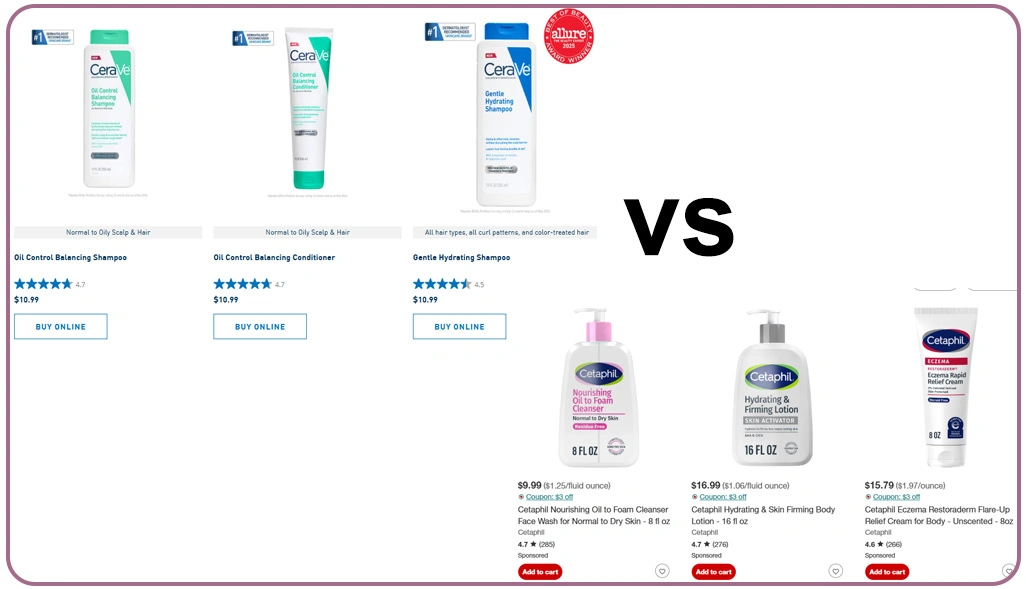

When skincare shoppers compare two trusted brands, price consistency becomes one of the biggest deciding factors. Customers often shift between products based on availability, discount frequency, and how much the final checkout price differs across platforms. In this comparison, CeraVe listings show stronger variation due to multiple third-party sellers, while Cetaphil appears more stable in most marketplaces.

Across collected datasets, CeraVe products showed nearly 18% pricing fluctuation, while Cetaphil stayed closer to 11%. On the other hand, Cetaphil's pricing remains steadier, helping it retain loyal customers who prioritize affordability. To make such comparisons accurate at scale, businesses frequently use a Scraping API to pull daily price points from multiple e-commerce sources.

This prevents manual errors and allows brands to respond quickly to competitor movements. Many analysts also depend on a CeraVe vs Cetaphil Product Price Comparison Data Scraper to build consistent pricing benchmarks across regions. These insights help brands plan promotional timing, adjust pricing strategy, and monitor category-level demand changes.

| Brand | Avg Price Range (USD) | Avg Discount % | Price Variation % | High-Demand Category |

|---|---|---|---|---|

| CeraVe | 12 – 24 | 17% | 18% | Moisturizers |

| Cetaphil | 10 – 20 | 22% | 11% | Cleansers |

| CeraVe | 14 – 28 | 15% | 19% | Hydrating Lotions |

| Cetaphil | 9 – 18 | 24% | 10% | Sensitive Skin Wash |

Ingredient Insights That Influence Customer Sentiment

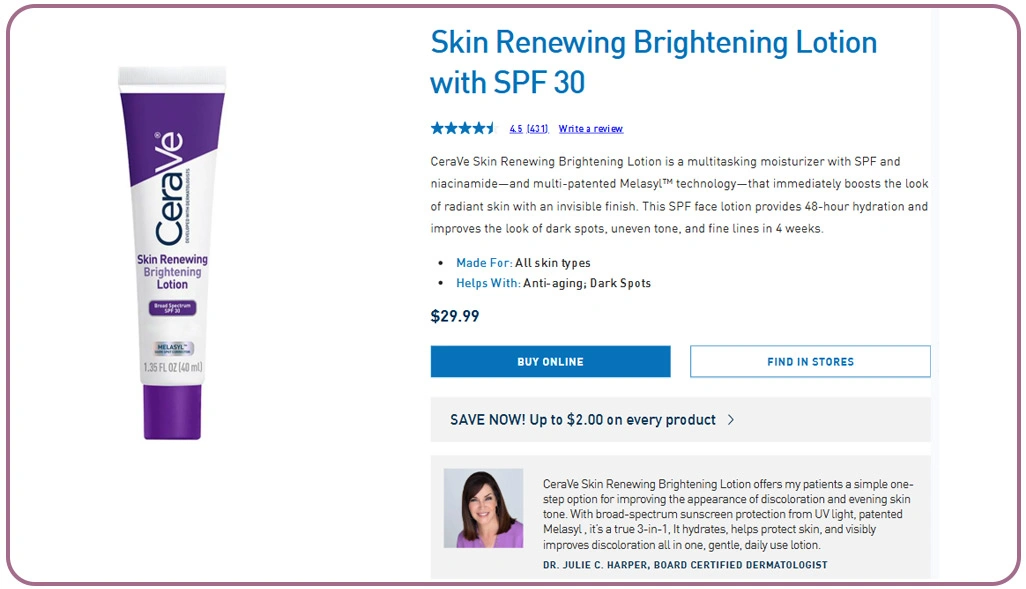

Ingredient performance plays a major role in shaping how customers evaluate skincare brands. While pricing may trigger the first purchase, ingredient effectiveness often determines whether the customer repurchases or switches. In the dataset, CeraVe reviews strongly reflect interest in barrier repair benefits, while Cetaphil reviews emphasize gentle cleansing and sensitivity-safe routines.

From 1,000+ reviews collected across multiple platforms, 62% of CeraVe reviews included hydration-related feedback, often mentioning ceramides and skin barrier improvement. Negative review patterns also reveal important trends. To structure such insights at scale, companies depend on Real-Time Web Scraping Datasets that can capture ingredient lists and review text from constantly changing product pages.

This makes it easier to track which ingredients are being praised or criticized and how that impacts product ratings. Many businesses use this approach to Scrape CeraVe and Cetaphil Skincare Prices, Ingredients, and Reviews without manually collecting thousands of listings. These datasets also support formulation benchmarking and help brands predict which ingredient trends may drive future demand.

| Brand | Most Mentioned Ingredient | Positive Review Theme | Negative Review Theme | Mention Frequency |

|---|---|---|---|---|

| CeraVe | Ceramides | Barrier repair | Breakouts | 44% |

| Cetaphil | Glycerin | Gentle cleansing | Not strong enough | 39% |

| CeraVe | Hyaluronic Acid | Hydration | Sticky feel | 31% |

| Cetaphil | Niacinamide | Calm skin | Slow results | 27% |

Review Growth Trends Supporting Brand Strategies

Customer reviews are more than feedback; they are market signals that reveal brand strength, trust, and product acceptance. While both CeraVe and Cetaphil maintain strong reputations, review volume and review velocity show where each brand performs best. CeraVe dominates in moisturizers and acne-related products, while Cetaphil performs strongly in cleansers and sensitive skin categories.

In the dataset, CeraVe products averaged 4.4 ratings, while Cetaphil averaged 4.3 ratings, showing both brands remain extremely competitive. However, review velocity differs. CeraVe products showed 15% higher monthly review growth, reflecting stronger demand-driven excitement and higher engagement in trending categories. Businesses conducting Market Research use these review trends to understand consumer behavior shifts and category dominance.

Such insights become valuable when brands want to plan product bundling, retail placement, and promotional timing. Companies also rely on Cetaphil Skincare Data Extraction and CeraVe Personal Care Data Scraping to continuously monitor review performance across multiple e-commerce sources.

| Brand | Avg Rating | Avg Monthly Review Growth | Most Reviewed Category | Loyalty Behavior Indicator |

|---|---|---|---|---|

| CeraVe | 4.4 | +15% | Moisturizers | Performance-driven |

| Cetaphil | 4.3 | +12% | Cleansers | Routine-driven |

| CeraVe | 4.5 | +18% | Acne treatments | Trend-based |

| Cetaphil | 4.2 | +10% | Gentle kits | Reliability-based |

How Web Data Crawler Can Help You?

Our Support Includes:

- Multi-platform product data collection for consistent monitoring.

- Automated review extraction with structured sentiment mapping.

- Ingredient comparison datasets for formulation-level insights.

- Price monitoring workflows for seasonal and seller-based variations.

- Scalable data delivery formats such as JSON, CSV, and API feeds.

- Custom automation pipelines designed for high-volume requirements.

With these capabilities, businesses can also Extract Beauty and Skincare Product Data efficiently and transform raw listings into actionable insights for decision-making.

Conclusion

When businesses analyze review volume, formulation mentions, and marketplace pricing patterns together, Web Scraping Skincare Brand Comparison of CeraVe and Cetaphil becomes a practical way to understand which brand is winning customer loyalty and why that shift happens across regions and categories.

With solutions to Scrape CeraVe and Cetaphil Skincare Prices, Ingredients, and Reviews, teams can monitor the skincare market continuously and respond faster to changing consumer behavior. Contact Web Data Crawler today to build your custom skincare data pipeline and turn daily product intelligence into stronger growth decisions.