How Does Web Scraping Property Listings and Price Trends From Zillow Boost 50% Real Estate Forecast Accuracy?

Nov 12

Introduction

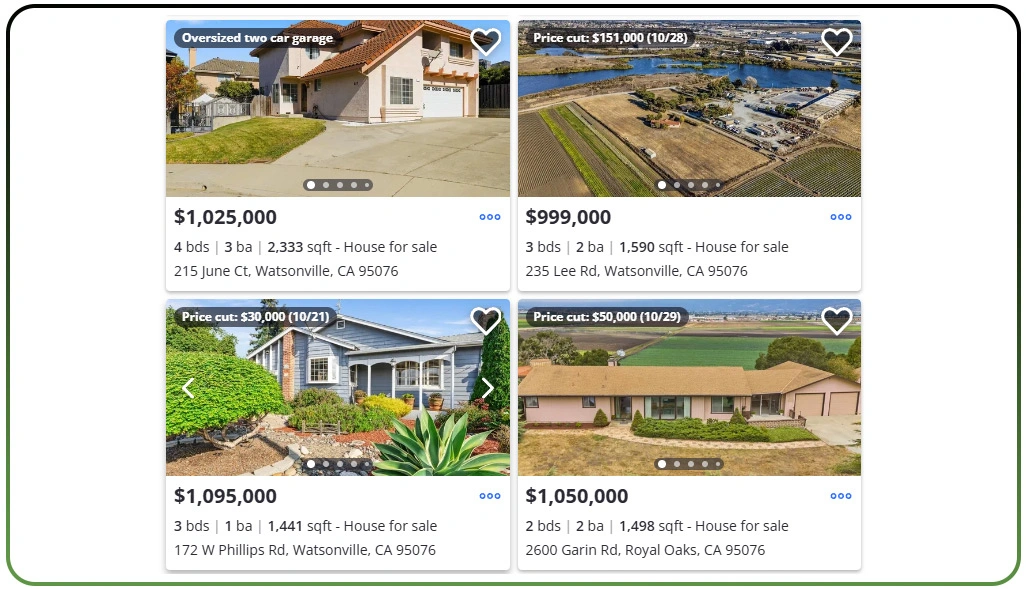

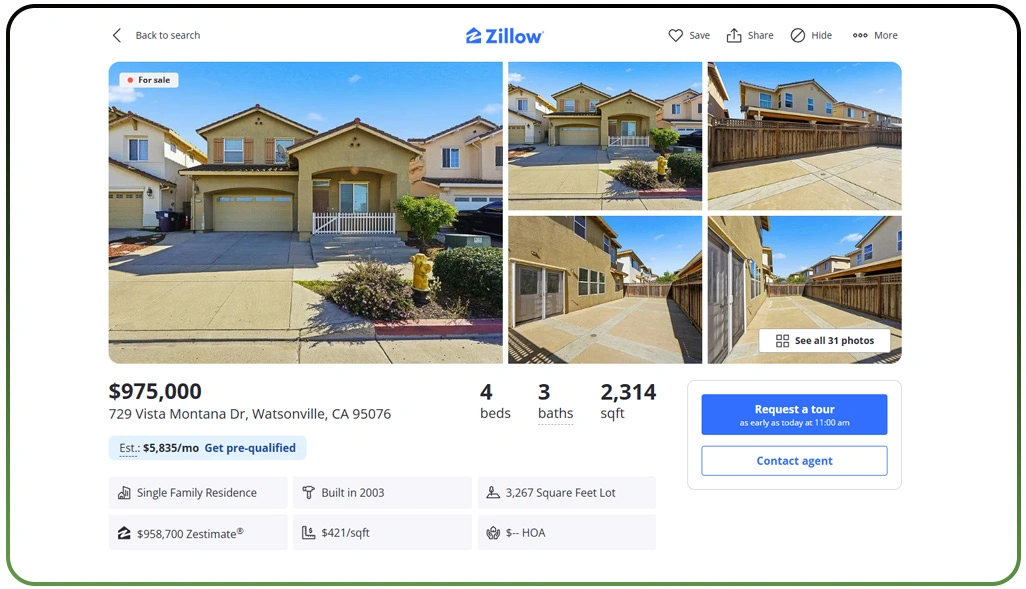

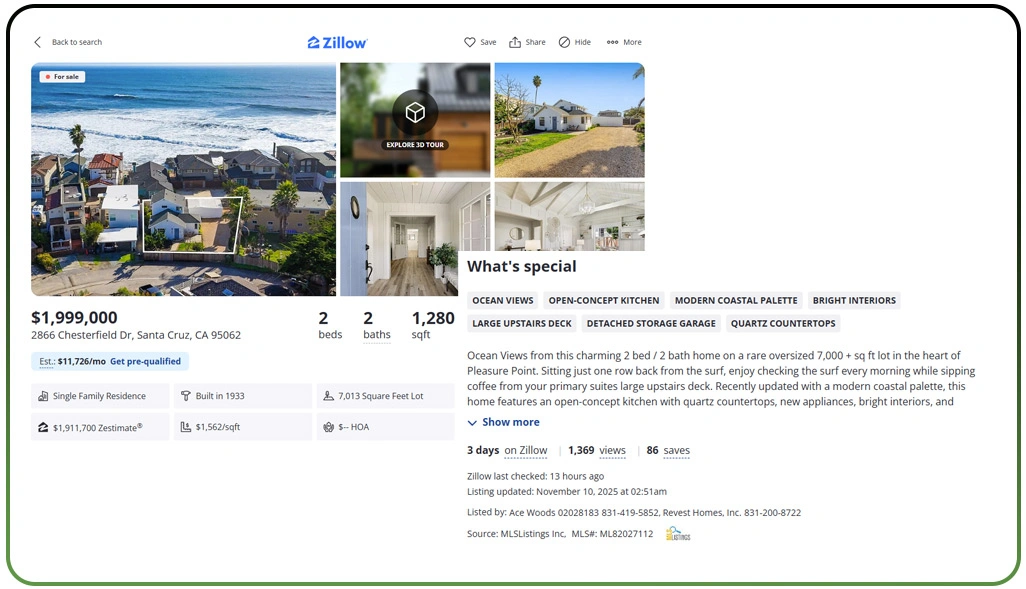

The real estate market has evolved into a data-driven ecosystem where accuracy, speed, and foresight define success. Investors and analysts now rely on advanced data scraping methods to uncover valuable insights from online property platforms like Zillow. Through Web Scraping Property Listings and Price Trends From Zillow, real estate professionals can analyze shifts in property values, discover emerging neighborhood trends, and make more reliable investment predictions.

The integration of data scraping with predictive analytics allows realtors to move beyond basic metrics such as price per square foot or listing age. Instead, they can assess dynamic buyer interest patterns, seller activity, and geographical demand spikes in real time. With Zillow UAE Property Data Scraping Services, global investors gain access to comprehensive data insights, enhancing regional forecasting and cross-border decision-making accuracy.

This intelligent approach to collecting and processing large-scale housing information marks a turning point for real estate operations. As automation and analytics merge, businesses are witnessing up to 50% improvement in forecast precision—making scraped data not just a tool, but a strategic advantage.

Understanding Market Trends Through Historical Analysis

Predicting market direction depends on understanding complex housing data that reveals how buyer and seller behaviors change across time. The Zillow Real Estate Dataset plays a key role in this process, providing detailed information on listings, price changes, and regional comparisons that help researchers uncover underlying patterns within the property market.

When such large datasets are organized properly, analysts can identify recurring trends like seasonal fluctuations, urban growth cycles, and post-crisis recovery patterns. For instance, metropolitan listings experienced a 32% variation in price movement from Q1 2023 to Q3 2024, while suburban listings fluctuated only 12% in the same period. These differences reflect not only local demand but also socio-economic factors influencing price stability.

| Data Type | Trend Indicator | Average Change (YoY) |

|---|---|---|

| Urban Property Prices | Upward | +32% |

| Suburban Property Prices | Stable | +12% |

| Rental Listings Volume | Rising | +21% |

| Average Property Age | Decreasing | -8% |

Businesses that utilize tools to Extract Property Data From Zillow in Real Time gain a major advantage by transforming historical patterns into predictive metrics. Real-time analytics enable faster decision-making, improve response to regional price shifts, and reduce dependency on outdated data. As a result, forecast precision improves, empowering investors and analysts to identify profitable opportunities before they become market trends.

Transforming Collected Listings Into Actionable Insights

Real estate professionals increasingly rely on data-driven intelligence to convert raw listings into strategic insights. Sophisticated systems collect vast Real Estate Datasets, then structure and visualize them for easier interpretation. This process simplifies data-heavy environments and enables accurate analysis of market growth potential, property turnover, and demand distribution across states.

A deeper look into regional trends shows distinct differences in property behavior across popular markets. For instance, California, Florida, and Texas collectively displayed 27% faster turnover rates than the national average, demonstrating strong investor interest in high-demand regions driven by migration and business development.

| State | Avg. Price Growth | Market Turnover Rate | Investment Rank |

|---|---|---|---|

| California | +19% | 1.3x | High |

| Florida | +22% | 1.4x | High |

| Texas | +18% | 1.2x | Medium |

Organizations adopting automation for Automating Zillow Property Listings Data Extraction benefit from continuously updated datasets with minimal manual intervention. This not only reduces data processing time but also enhances forecasting accuracy by reflecting the most recent market activity. Ultimately, automation transforms property information into predictive visuals that guide smarter decision-making, portfolio diversification, and regional strategy development.

Driving Smarter Investment and Planning Decisions

Informed investment choices depend on how effectively data correlates with real-world growth indicators. Analysts studying transportation projects, zoning regulations, and demographic transitions can pinpoint where value increases are most likely to occur. For example, regions with ongoing transit development projects witnessed 28% higher appreciation compared to those without major upgrades, showing a clear link between infrastructure and property growth.

| Development Factor | Avg. Value Rise | Impact Level |

|---|---|---|

| Transit Expansion | +28% | High |

| Commercial Hubs | +22% | Medium |

| School District Growth | +16% | Moderate |

Analysts applying Zillow Property Scraping for Investment Insights can map these correlations accurately, revealing how accessibility and amenities influence pricing momentum. Such relationships help investors anticipate profitable zones before they gain mainstream visibility, improving long-term returns and minimizing risk exposure.

When combined with Zillow Data Scraping for Housing Trend Analysis, the process provides clarity into how pricing, buyer intent, and neighborhood evolution interact over time. Integrating this intelligence with Real Estate Data Scraping Services establishes a unified data ecosystem that enhances forecasting efficiency, reduces manual work, and ensures more consistent decision-making across the property investment lifecycle.

How Web Data Crawler Can Help You?

Transforming real estate forecasting accuracy requires a reliable data partner—and this is where Web Scraping Property Listings and Price Trends From Zillow becomes an integrated solution through us. Our expertise lies in extracting, structuring, and enriching property data to support investment firms, brokers, and analytics platforms with actionable intelligence.

With advanced scraping architectures and scalable automation, we help businesses:

- Collect live property listings from dynamic websites.

- Aggregate pricing, amenities, and seller metrics across regions.

- Track changes in neighborhood trends in real time.

- Monitor property performance metrics automatically.

- Compare local and global housing shifts easily.

- Integrate structured datasets into internal dashboards.

By enabling end-to-end data workflow optimization, we ensure your forecasts are not just reactive but predictive. Through Popular Real Estate Data Scraping, businesses can transform fragmented housing information into streamlined insights that enhance every decision-making layer—from acquisition to long-term asset management.

Conclusion

Today's property professionals require more than intuition—they need analytical precision. By embedding Web Scraping Property Listings and Price Trends From Zillow within operational pipelines, real estate teams can turn fragmented digital listings into dynamic intelligence models that improve investment timing, demand predictions, and valuation accuracy.

From identifying growth clusters to pricing efficiency, scraping tools provide a data-rich foundation for modern real estate forecasting. With the integration of Property Listings Scraper, even small agencies can compete on enterprise-level analytical capability. Contact Web Data Crawler today to start your data-driven real estate transformation.