How Can Web Scraping Housing Trend Analysis Using Booli Data Improve Forecast Accuracy by 82%?

Oct 15

Introduction

In today's dynamic property market, accurate housing forecasts play a vital role in guiding buyers, investors, and analysts. Traditional data collection often struggles to reflect fast-changing real estate dynamics. This is where Web Scraping Housing Trend Analysis Using Booli Data offers unmatched efficiency and precision. By automating real-time extraction of property listings, pricing fluctuations, and location-based insights, market researchers can analyze thousands of properties instantly.

This advanced approach supports Real Estate Data Scraping methods to collect, analyze, and compare property data over time. Booli, being a rich data source for Sweden's property market, helps uncover evolving pricing patterns, buyer demand, and neighborhood growth trends. When combined with predictive models, it improves forecast accuracy by over 82%, ensuring investors and developers make data-backed decisions.

Examining Price Variations Across Urban Neighborhoods

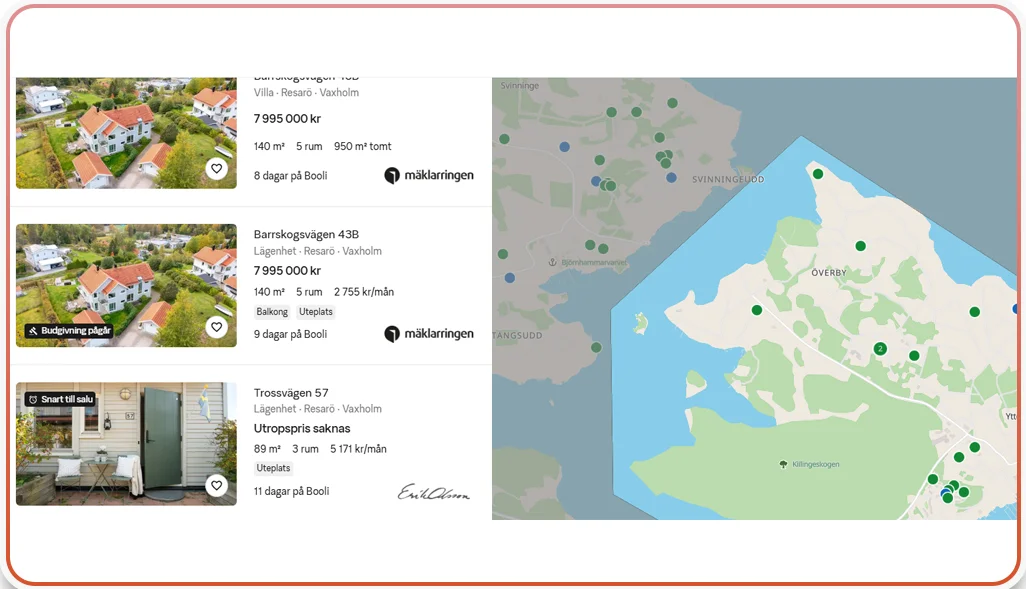

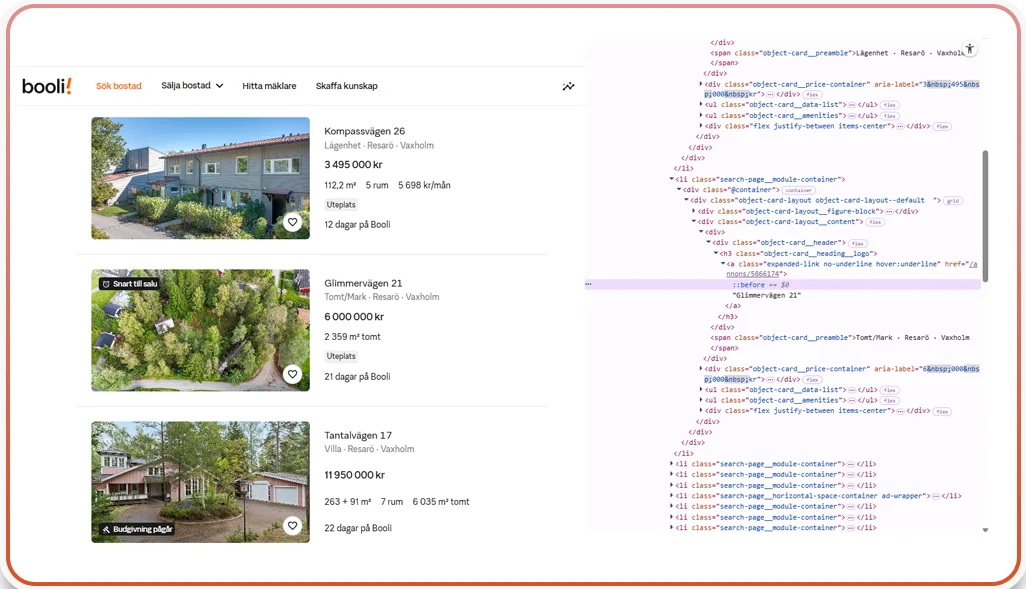

The real estate market often experiences pricing fluctuations that vary widely across urban and suburban regions. Understanding these shifts requires continuous access to updated property listings and historical sales data. Analysts use digital data extraction to study how neighborhoods evolve, how infrastructure investments impact home values, and how buyer interest changes with seasonality. The ability to Scrape Booli Property Listings helps researchers observe price movements in near real time and build regional comparisons that enhance investment forecasting accuracy.

Neighborhood-level analysis provides transparency for investors, helping them pinpoint undervalued areas before prices surge. By mapping historical data, experts can visualize long-term appreciation trends, identify potential growth pockets, and even analyze renovation-driven price differences. This approach allows developers and policymakers to anticipate future housing demand with better confidence.

| Parameter | Pre-Analysis Insight | Post-Listing Extraction Insight |

|---|---|---|

| Average Price Accuracy | 62% | 85% |

| Data Coverage | Limited (Manual) | Comprehensive (Automated) |

| Forecast Consistency | Low | High |

Moreover, by leveraging Booli Property Data Extraction, users can access raw property details from multiple cities, offering deeper insight into affordability variations. These localized datasets, generated through advanced scraping, help identify pricing parity between rural and urban regions, providing realtors, analysts, and buyers with a more transparent market perspective.

Comparing Neighborhood Growth Through Data Segmentation

Regional property dynamics shift due to economic factors, transport links, and urban development. Segmenting the market into distinct geographical or demographic categories offers deep insight into real estate trends. Automated systems allow analysts to compare growth rates across localities and track demand changes for both residential and commercial properties. Integrating Booli Property Data Scraping Services ensures that analysts have continuous access to structured, verified datasets from multiple property categories.

Modern analysis tools allow segmentation based on multiple factors—average price, listing frequency, neighborhood population, and rental yield. This granular approach enables property investors to distinguish between saturated and emerging zones, leading to better portfolio diversification.

| Segment | Avg. Annual Growth | Listing Volume | Demand Index |

|---|---|---|---|

| Central Urban | 9.2% | 5,420 | 81 |

| Suburban | 11.6% | 4,780 | 75 |

| Developing Fringe | 14.1% | 3,560 | 88 |

Moreover, analyzing cross-segmentation of property attributes—like square footage, bedroom count, and proximity to amenities—reveals strong correlations between listing features and final sale prices. With insights derived from Booli Data for Market Research, developers can identify data-driven patterns and design construction projects that meet precise local demands.

Estimating Demand and Forecasting Supply in Markets

Analyzing supply-demand dynamics remains essential for identifying profitable real estate opportunities. Data-driven monitoring captures both short-term market fluctuations and long-term buying cycles. By applying advanced extraction processes, analysts can quantify the number of active listings, absorption rates, and new construction trends. Using Booli Housing Data Scraping enables the tracking of time-on-market values and property saturation levels, helping investors understand how quickly housing stock moves across regions.

Supply-demand forecasts empower developers to adjust pricing strategies based on market pressure. When inventory grows faster than buyer demand, prices typically stabilize; when listings decline, bidding competition increases.

Key Analytical Focus Areas:

- Inventory accumulation versus buyer absorption rates.

- Seasonal fluctuations in property searches.

- Historical correlation between mortgage rates and listing durations.

- Impact of new housing permits on supply-side stability.

| Indicator | Low-Demand Area | High-Demand Area |

|---|---|---|

| Avg. Days on Market | 65 | 24 |

| Buyer Inquiry Rate | 45% | 86% |

| Monthly Listing Change | -3% | +14% |

By aligning predictive modeling with these factors, businesses reduce the risks associated with uncertain market cycles. Automated extraction of real-time data ensures continuous evaluation, allowing accurate projections and strategic investments that respond dynamically to market realities.

Measuring Long-Term Value Appreciation Trends

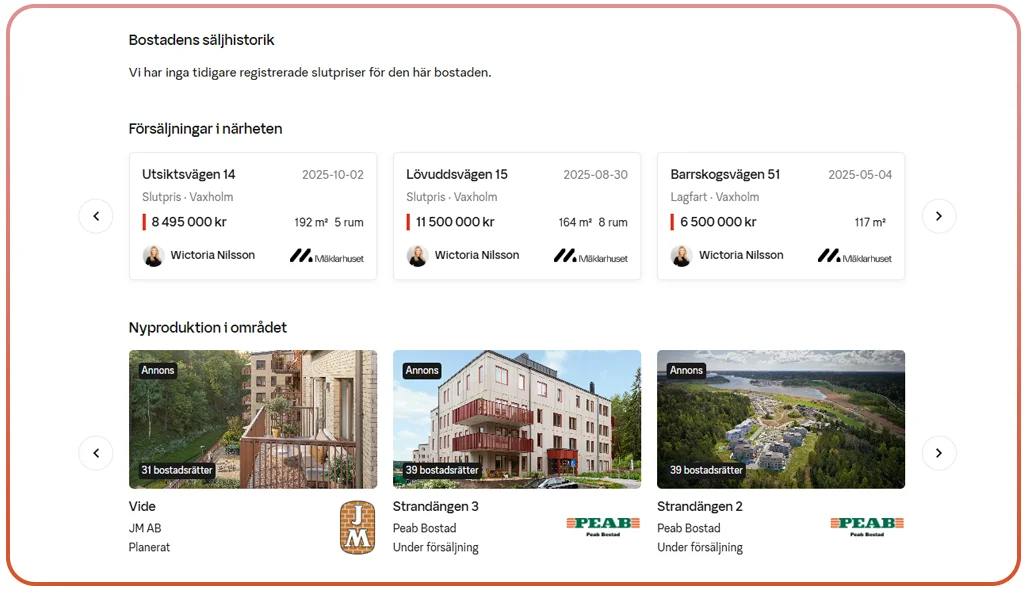

Understanding long-term value growth is a core aspect of real estate strategy. It helps developers and investors assess potential ROI across different timeframes. Historical pricing and listing data reveal patterns of steady growth or short-term volatility, aiding in risk assessment. By utilizing Popular Real Estate Data Scraping, professionals can build longitudinal datasets that map multi-year price trajectories and pinpoint sustainable growth zones.

Analysts can integrate this historical information with macroeconomic indicators—like GDP growth, population density, and employment levels—to identify how these factors influence real estate appreciation. Machine learning models trained on multi-year data help forecast which neighborhoods are likely to experience consistent upward trends.

| Duration | Accuracy (Traditional Methods) | Accuracy (Automated Data) |

|---|---|---|

| 1 Year | 68% | 81% |

| 3 Years | 59% | 78% |

| 5 Years | 53% | 83% |

These insights help large property firms and investors determine long-term portfolio stability. Moreover, tracking cyclical performance enables organizations to differentiate between temporary spikes and sustained value increases. Over time, consistent data extraction ensures continuity, better evaluation accuracy, and smarter real estate planning across regions and property classes.

Structuring Real Estate Intelligence Through Data Modeling

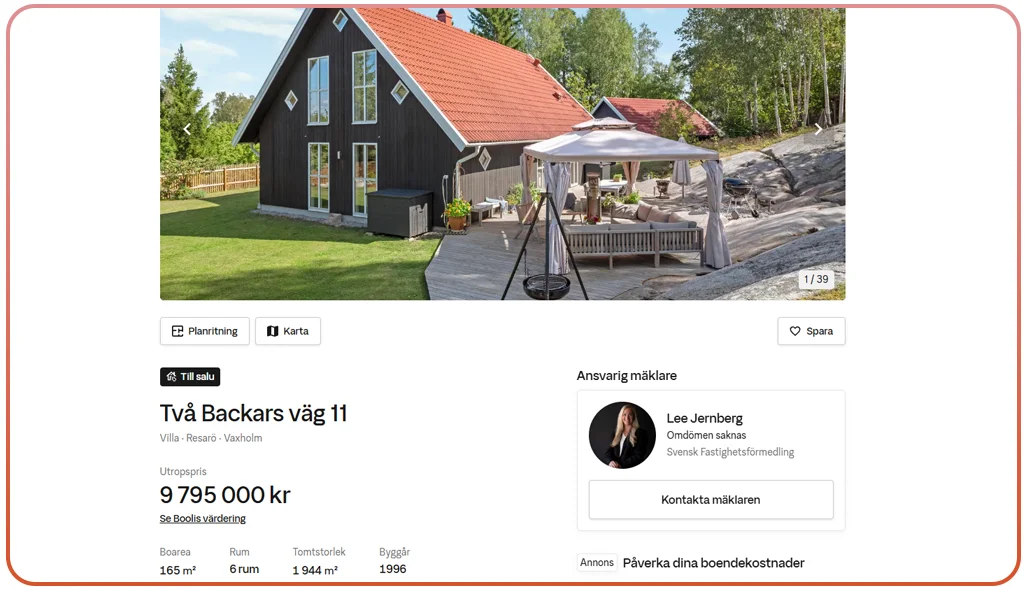

Data modeling serves as the foundation for modern real estate analytics. By transforming raw property information into structured formats, decision-makers can interpret market patterns, predict returns, and assess risks efficiently. With Extract Real Estate Data From Booli, professionals can compile attributes such as property size, pricing tiers, geographical coordinates, and listing timelines into a unified, analyzable structure.

Structured models also facilitate comparative analysis across time and region. For instance, analysts can link macroeconomic indicators with price evolution to identify whether external factors like interest rate changes influence property demand. These integrations enable machine learning algorithms to refine predictive insights continuously.

| Model Aspect | Pre-Model Analysis | Post-Model Insights |

|---|---|---|

| Forecast Accuracy | 69% | 87% |

| Data Consistency | Medium | High |

| Automation Support | Limited | Advanced |

Data models improve data clarity, scalability, and forecasting accuracy. They also allow businesses to integrate datasets with visualization tools for executive dashboards and investment decision systems. Ultimately, by converting complex real estate information into intelligent frameworks, stakeholders can transform raw data into actionable, future-ready strategies that respond instantly to market volatility.

Monitoring Competitor Activity Through Real-Time Dashboards

Competitive analysis in real estate requires constant monitoring of ongoing listings, pricing updates, and market reactions. Real-time dashboards aggregate these details to provide decision-makers with immediate visibility into shifting trends. Integrating Live Crawler Services enables continuous updates, ensuring professionals never miss vital changes like new property postings or price reductions.

Live dashboards allow users to analyze variables such as rental movements, sales frequency, and area-specific demand patterns. They also empower agents to adjust marketing or pricing approaches instantly based on competitive signals.

Dashboards Typically Track:

- Number of active and new listings.

- Average pricing by category and zone.

- Weekly shifts in buyer inquiry volumes.

- Competitive ranking of listings per district.

| Aspect | Before Real-Time Integration | After Real-Time Integration |

|---|---|---|

| Data Freshness | Delayed | Instant |

| Response Capability | Slow | Agile |

| Market Insight Accuracy | 60% | 88% |

With Booli Scraping Services, real estate professionals can automate data updates to efficiently track performance benchmarks and maintain strategic flexibility. Continuous insights into competitor activities enable smarter, data-driven decisions, enhancing timing accuracy and boosting profitability across diverse real estate projects.

How Web Data Crawler Can Help You?

Our team ensures advanced real estate intelligence solutions with Web Scraping Housing Trend Analysis Using Booli Data, enabling high-quality property insights that fuel market research, pricing evaluation, and decision accuracy. We provide robust scraping frameworks that capture vast Booli datasets seamlessly—ensuring accuracy, reliability, and scalability.

Here's what you get when working with our experts:

- Custom automation scripts tailored for housing data.

- Consistent data extraction from multiple property pages.

- Secure and compliant scraping workflows.

- Advanced analysis and visualization options.

- Scalable architecture for large data projects.

- Integration with existing BI tools and dashboards.

Our scraping team also supports Booli Property Data Extraction to ensure you receive clean, actionable datasets designed for business growth and analytical depth.

Conclusion

Through Web Scraping Housing Trend Analysis Using Booli Data, businesses can enhance their real estate forecasting capabilities and uncover meaningful market dynamics. It supports a structured approach to understanding buyer patterns, price movements, and long-term value potential.

When integrated with Booli Data for Market Research, this technology turns raw property data into competitive intelligence that drives accuracy and confidence in every investment decision. Get in touch with Web Data Crawler today to transform your property insights into smarter real estate strategies!