How does Web Scraping Fincaraiz Property for Colombia Market Insights decode 25% Colombia market changes?

Dec 16

Introduction

Colombia's property ecosystem is undergoing rapid structural changes influenced by shifting buyer preferences, evolving rental behaviors, and location‐centric price fluctuations across major cities. Through Web Scraping Fincaraiz Property for Colombia Market Insights, businesses now access comprehensive datasets that reveal how property categories, amenities, and neighborhood attributes shape pricing outcomes.

This approach not only exposes emerging growth pockets but also highlights where rental values have surged—especially in zones influenced by infrastructure expansion and rising domestic mobility. With demand rising for condo-style living, flexible lease terms, and hybrid work–friendly homes, digital housing platforms offer unmatched visibility into consumer shifts.

This intelligence becomes even more valuable when combined with Fincaraiz Property Data Scraping Services, enabling analysts, investors, and developers to understand not only what is changing but why market movement is happening. As we dive deeper into the sections ahead, this blog unpacks the transformation of Colombia's real estate space and how structured web data intelligence supports smarter forecasting and risk-free decision-making.

Growing Buyer Behaviour Changes Shaping 2025 Market Shift

Colombia's property landscape is shifting as affordability concerns, lifestyle expectations, and new infrastructure developments reshape demand across major urban and semi-urban regions. Home seekers increasingly evaluate properties based on walkability, modern amenities, and future neighborhood potential, which has caused notable redirection in buying interest.

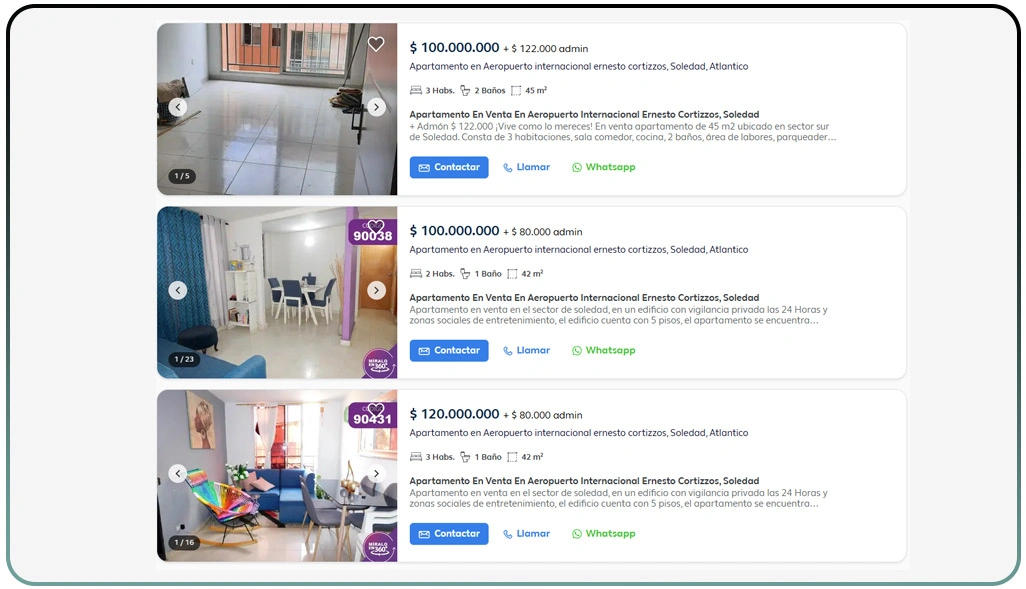

At the center of this assessment, tools like Fincaraiz Property Listings API Scraper provide structured datasets that help companies review how listing density, property maturity, and renovation quality vary from city to city. The shift is clear—buyers now assess proximity to lifestyle clusters, secure housing features, and balanced pricing advantages before finalizing their preferences.

Market analysts also benefit from studying amenity-level variations across regions, as these factors determine whether neighborhoods attract short-term interest or long-term occupancy. With location-based competition rising, urban buyers weigh trading central locations for suburban areas that offer stronger value-to-price alignment.

Regional Demand Comparison Table:

| Region | Buyer Demand Growth | Rental Demand Growth | Main Contributing Factor |

|---|---|---|---|

| Bogotá | 18% | 26% | Accessibility & hybrid work |

| Medellín | 22% | 31% | Lifestyle benefits |

| Cali | 15% | 19% | Price-driven interest |

| Barranquilla | 17% | 23% | Infrastructure growth |

With models supported by Popular Real Estate Data Scraping, decision-makers can recognize early indicators of market opportunity and accurately match supply with evolving consumer expectations.

Changing Rental Preferences Reshaping Price Variations Nationwide

Colombia's rental segment is undergoing visible transformation as tenants become more selective about property types, amenities, and lease flexibility. Urban residents increasingly lean toward compact, well-connected spaces that balance affordability with convenience, resulting in growth spikes across mid-range and furnished units. These shifting preferences influence not only monthly rental thresholds but also long-term investment strategies for property owners.

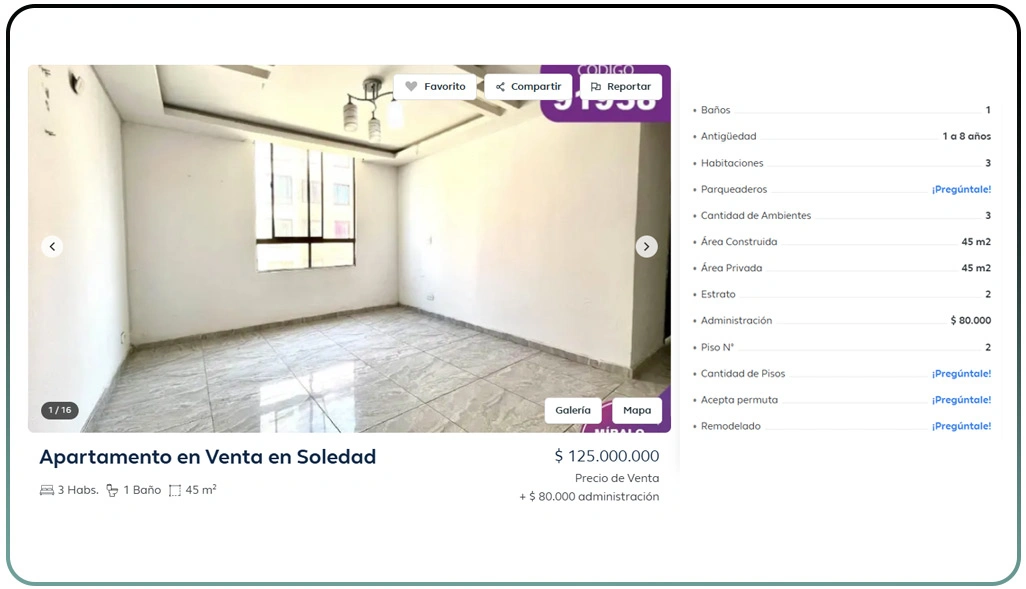

Tools such as Fincaraiz Real Estate Data Extractor enable deeper assessment of unit configurations, floor area distribution, and amenity presence across hundreds of listings. Investors can identify neighborhoods experiencing the fastest rental shifts, particularly zones affected by expanding business districts, university proximity, and improving transit systems.

The following table outlines rental price changes across common property categories between 2024 and 2025:

| Property Category | Avg. 2024 Rent (USD) | Avg. 2025 Rent (USD) | % Change |

|---|---|---|---|

| Studio Apartment | $280 | $315 | 12.5% |

| 1-Bedroom Apartment | $340 | $385 | 13.2% |

| 2-Bedroom Apartment | $480 | $553 | 15.2% |

| Furnished Rental Units | $520 | $595 | 14.4% |

These fluctuations reveal how market growth differs by property size and location. With increased data visibility from solutions designed to Extract Colombia Property Rental & Sale Data, rental forecasting becomes more precise. This clarity helps property owners refine pricing, evaluate tenant expectations, and position their listings strategically.

Supported by high-quality Real Estate Data Scraping, analysts can form rental matrices that reflect true market demand, ensuring models remain competitive and aligned with real-time consumer behavior.

Evaluating Local Factors Driving Property Appreciation Potential

Colombia's real estate landscape increasingly hinges on neighborhood characteristics—connectivity, safety, lifestyle options, and infrastructure readiness—when shaping property value. As cities expand and new transport projects influence mobility, investors carefully study location-specific elements that impact appreciation potential.

Advanced data tools designed to Scrape Fincaraiz Location & Amenities Data allow businesses to examine live variations in neighborhood quality. Analysts use these models to map property clusters, compare amenity density, and review infrastructure-driven growth. Modern buyers prioritize convenience, security, and access, leading to rising demand for communities offering these benefits.

Below is a breakdown of how specific amenities influence appreciation strength:

| Amenity Type | Appreciation Impact | Buyer Priority Rating | Observation |

|---|---|---|---|

| Metro & Transit Access | High (18–22%) | Very High | Strongest price driver |

| Education Zone Proximity | Moderate (12–16%) | High | Attractive for families |

| Retail & Lifestyle Centers | Moderate (9–11%) | Medium | Boosts rental interest |

| Healthcare Facilities | High (15–18%) | Very High | Ensures long-term appeal |

Investors assessing long-term profitability rely on structured Colombia Real Estate Market Trends to validate predictions and ensure they match broader market momentum. These insights feed directly into risk assessment models and investment roadmaps.

With expanding data ecosystems producing refined Real Estate Datasets, businesses can create forward-looking frameworks that accurately measure location performance and identify early market openings, strengthening both planning and investment strategies.

How Web Data Crawler Can Help You?

By integrating Web Scraping Fincaraiz Property for Colombia Market Insights into customized workflows, Web Data Crawler enables organizations to acquire accurate and high-volume datasets for rental, sales, amenities, neighborhood scoring, and market segmentation.

Our capabilities include:

- Collecting multi-city rental and sales datasets at scale.

- Monitoring price changes and listing turnover in real time.

- Identifying growing neighborhoods through infrastructure signals.

- Delivering structured datasets compatible with BI dashboards.

- Supporting cross-platform property research workflows.

- Providing enterprise-grade scalability for large property datasets.

This enhancement becomes especially powerful when connected with Fincaraiz Real Estate Data Extractor, allowing organizations to gain deeper visibility into Colombia's shifting housing landscape.

Conclusion

Strategic real estate decision-making becomes substantially stronger when market intelligence is backed by analytical depth. With insights powered by Web Scraping Fincaraiz Property for Colombia Market Insights, organizations can evaluate shifting buyer behavior, rental evolution, and regional property transformations that define Colombia's growing housing ecosystem.

The structured observations supported by Colombia Real Estate Market Trends bring clarity to pricing, supply-demand balance, and long-term appreciation potential. Connect with Web Data Crawler today to transform property data into smarter decision-making and achieve faster market advantage. Connect with Web Data Crawler today to transform property data into smarter decision-making and achieve faster market advantage.