How 3x Faster Insights Emerge Using UCC Data Scraping for Business Filings & Company Status in US?

Dec 29

Introduction

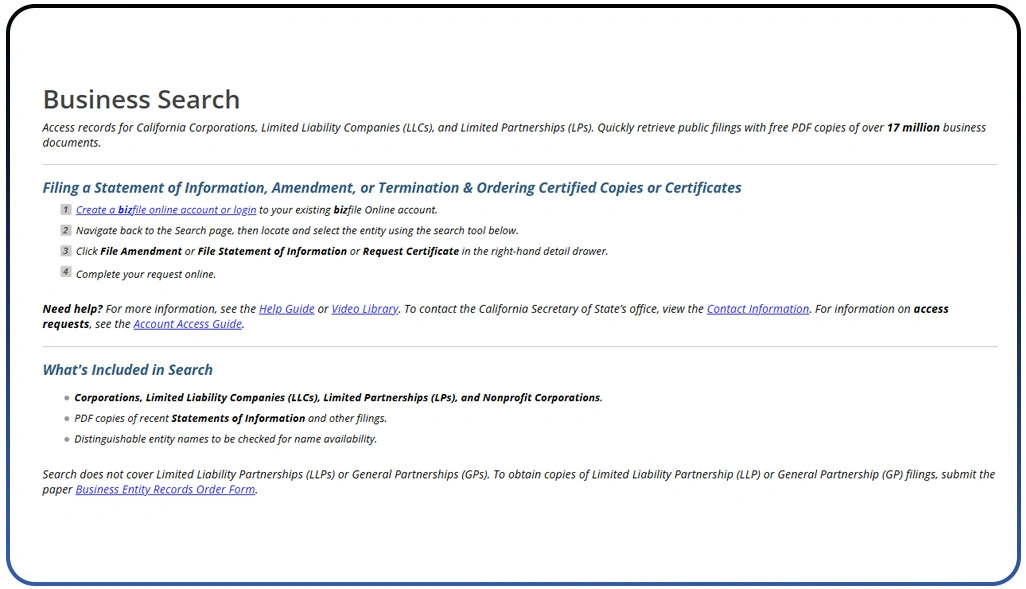

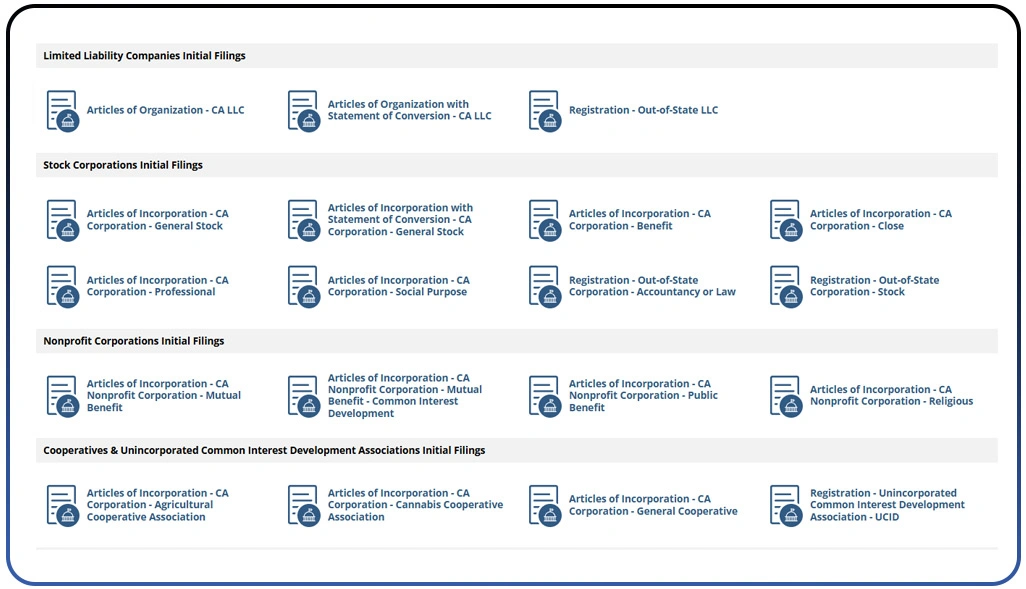

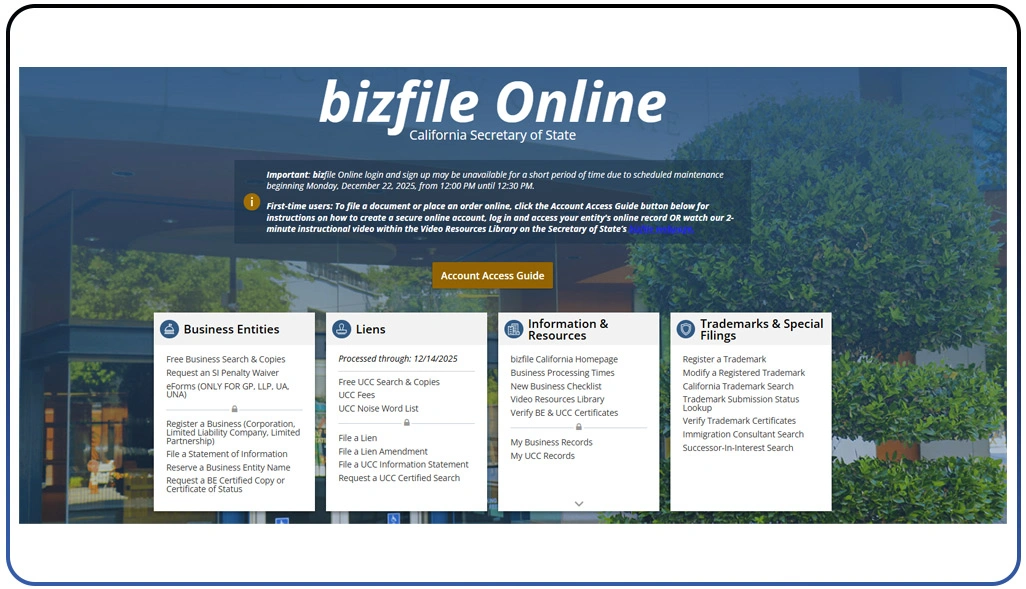

Lenders, insurers, compliance professionals, and investment analysts depend on verified filing records to evaluate risk, confirm ownership structures, and validate operational credibility. At the core of this assessment are Uniform Commercial Code filings, which capture liens, collateral commitments, amendments, and terminations across U.S. jurisdictions—often accessed and analyzed through Secured Transaction Data Scraping to ensure accuracy, timeliness, and compliance at scale.

This is where UCC Data Scraping for Business Filings & Company Status in US becomes a catalyst for faster intelligence. By programmatically collecting standardized filing records across state-level registries, organizations can shift from reactive verification to proactive risk evaluation. This speed is particularly valuable in credit underwriting, supplier vetting, mergers, and compliance audits, where delayed insights can translate into financial losses.

Additionally, the integration of automated UCC intelligence into broader Market Research initiatives enables organizations to correlate filing behavior with industry trends, regional risk patterns, and competitive positioning. When filing frequency, lien density, and ownership changes are analyzed together, businesses gain a clearer view of market stability and counterpart reliability.

Faster Risk Identification Through Automated Filing Intelligence

Modern organizations face increasing pressure to evaluate financial and legal risk at speed, yet traditional filing review processes remain slow and fragmented. When risk teams rely on manual state-by-state checks, delays occur due to inconsistent registry formats, outdated records, and human interpretation errors.

Automated intelligence systems solve this challenge by transforming raw filing data into structured insights that are instantly usable. Advanced AI Web Scraping Services enable intelligent classification of filings, distinguishing active records from terminated ones while identifying unusual filing patterns that indicate heightened exposure. By applying automation to Extract Business Filing Data via UCC Crawler, organizations reduce dependency on manual lookups and improve response times across underwriting and compliance workflows.

Operational benchmarks show that automation reduces verification turnaround by over 60%, while accuracy improves significantly due to standardized data normalization. Risk visibility improves not only at the entity level but across entire portfolios, enabling earlier detection of problematic filing behaviors.

Operational Impact Overview:

| Evaluation Metric | Manual Process | Automated Intelligence |

|---|---|---|

| Average review turnaround | 48–72 hours | Under 8 hours |

| Data accuracy consistency | Moderate | High |

| Risk flag detection timing | Delayed | Proactive |

| Analyst workload efficiency | Low | Optimized |

By eliminating friction in filing analysis, automated intelligence supports faster decisions without compromising data reliability.

Clear Ownership Mapping Supporting Smarter Decisions

Understanding who controls assets and obligations is central to informed financial decision-making. However, ownership and lien relationships are often buried within complex filing histories, amendments, and cross-entity references. Manual reviews frequently fail to identify indirect ownership signals or historical filing changes, creating blind spots during due diligence, partnerships, and acquisitions.

Automated data pipelines address this gap by transforming filing records into connected ownership narratives. Through scalable Web Scraping Services, organizations continuously monitor updates across registries rather than relying on periodic checks. When paired with a Company Ownership Intelligence Scraper, filing records are enriched with entity linkages, secured party relationships, and change histories that clarify true control structures.

This level of transparency enables teams to assess exposure more confidently, especially when evaluating counterpart stability or approving long-term engagements. Studies indicate that continuous ownership monitoring reduces post-transaction disputes and compliance escalations by nearly 40%, primarily due to improved upfront clarity.

Ownership Intelligence Outcomes:

| Insight Dimension | Traditional Review | Automated Mapping |

|---|---|---|

| Ownership relationship clarity | Partial | Comprehensive |

| Hidden lien exposure | Often missed | Consistently found |

| Monitoring frequency | Periodic | Continuous |

| Decision confidence | Moderate | High |

With clearer ownership mapping, organizations reduce uncertainty and support more resilient financial strategies.

Scalable Compliance Oversight Across Jurisdictions

Operating across multiple states introduces compliance complexity due to differing registry standards, filing formats, and update schedules. Manually tracking these variations increases the likelihood of missed amendments, expired continuations, or outdated records. As portfolios grow, this fragmented approach becomes unsustainable and audit risk escalates.

Scalable automation resolves these challenges by standardizing access to filing updates nationwide. Integrated systems powered by a Scraping API enable real-time ingestion of changes into internal compliance and risk platforms. By incorporating UCC Filing Search Automation Scraping, organizations gain advanced filtering and historical comparison capabilities that strengthen oversight across large portfolios.

Automated compliance monitoring has been shown to reduce audit preparation time by more than 50%, while significantly lowering the number of regulatory escalations caused by outdated data. Centralized intelligence also improves cross-functional collaboration between legal, finance, and risk teams.

Compliance Performance Comparison:

| Compliance Factor | Manual Oversight | Automated Oversight |

|---|---|---|

| Cross-state visibility | Fragmented | Unified |

| Update detection speed | Delayed | Near real time |

| Audit readiness effort | High | Reduced |

| Portfolio risk awareness | Inconsistent | Centralized |

Standardized compliance intelligence enables organizations to scale confidently without increasing regulatory exposure.

How Web Data Crawler Can Help You?

Modern organizations require more than raw data—they need structured intelligence delivered at operational speed. Midway through engagement, UCC Data Scraping for Business Filings & Company Status in US is seamlessly integrated into existing workflows, enabling faster validation and smarter risk evaluation without disrupting internal systems.

Key capabilities include:

- Nationwide coverage across state-level registries.

- Standardized data normalization for easy analysis.

- Continuous monitoring of filing changes.

- Scalable infrastructure for high-volume portfolios.

- Secure delivery aligned with enterprise compliance needs.

- Custom data outputs tailored to business objectives.

By extending intelligence with Corporate Registry Data Extraction Across the US, organizations gain a unified view of filings, ownership signals, and compliance indicators from a single, reliable data partner.

Conclusion

In a landscape defined by speed, accuracy, and accountability, organizations can no longer afford fragmented filing intelligence. By embedding UCC Data Scraping for Business Filings & Company Status in US into decision frameworks, businesses achieve faster risk evaluation, clearer ownership visibility, and stronger compliance alignment.

Strengthening due diligence with Company Lien and Filing Insights Data Extractor ensures decisions are backed by verified data, not assumptions. Connect with Web Data Crawler today to transform filing intelligence into confident, data-driven action.