How to Track Packaged Food Trends via Tasty Bites Scraper with 120K+ SKUs and 35% Faster Insights?

Feb 06

Introduction

The packaged food market is shifting faster than ever. New snack flavors, limited-edition variants, seasonal bundles, and pricing strategies are changing weekly across online platforms. With Tasty Food Delivery Data Scraping, brands can collect structured product information across multiple segments such as ready-to-eat meals, snacks, beverages, and packaged grocery items.

When businesses monitor SKU updates daily, they can identify what is rising in popularity, what is being discounted, and what is going out of stock in real-time. This is especially important for packaged food categories where customer preferences change quickly due to lifestyle trends, health awareness, and influencer-driven demand.

This approach supports better planning for promotions, product launches, and supply chain alignment. In this blog, we will explore how brands can Track Packaged Food Trends via Tasty Bites Scraper to analyze 120K+ SKUs, measure pricing movement, and generate 35% faster insights through automated data workflows.

Converting Massive Product Listings into Actionable Trends

In the packaged food space, the real challenge is not collecting data, but turning scattered listings into meaningful insights. Brands often struggle because new SKUs are introduced every week, while existing products frequently change pack sizes, labels, and category positioning.

This is where data-driven monitoring becomes essential. When organizations combine Food and Restaurant Datasets, they can compare packaged meal demand with restaurant-style ready food consumption patterns. This helps brands identify which packaged products are growing faster and which categories are losing traction.

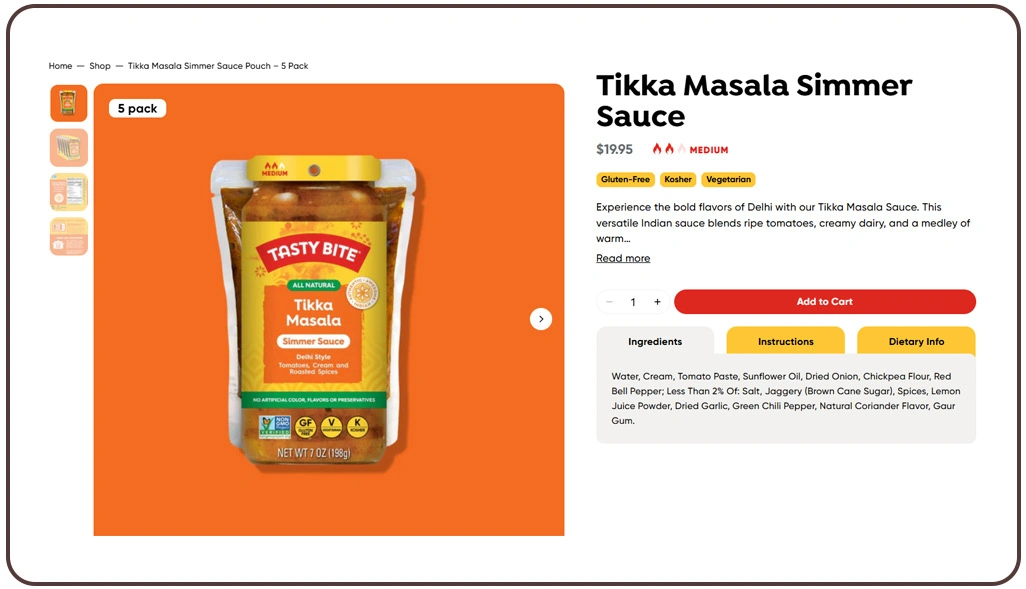

Additionally, modern platforms provide thousands of listings with different naming formats, making analysis difficult without automation. Businesses that build scraping pipelines to Scrape Tasty Bites Packaged Food Data can collect structured details like product titles, categories, pack sizes, and brand names.

Key Product Trend Monitoring Table:

| Monitoring Area | What Gets Captured | Business Value |

|---|---|---|

| New SKU Launches | Fresh packaged items added daily | Detect early market movement |

| Category Shifts | Snacks, beverages, ready meals trends | Better portfolio alignment |

| Pack Size Changes | Mini packs, family packs, bundles | Smarter pricing decisions |

| Brand Expansion | Emerging brands and private labels | Competitive benchmarking |

| Listing Consistency | Title and format variations | Clean reporting outputs |

A major advantage is early trend detection. When brands track product launches and SKU additions daily, they can predict upcoming consumer preferences and respond faster than competitors. By monitoring new additions and discontinued items, brands can improve assortment decisions and reduce slow-moving inventory risk.

Tracking Market Price Movements and Stock Updates

Pricing is one of the strongest indicators of how the packaged food market is performing. Brands frequently adjust selling prices, introduce discounts, or push promotional bundles to attract customers. However, these updates happen quickly, and manual tracking often results in incomplete information.

Daily monitoring of stock status is equally important. Products that go out of stock too frequently can signal demand spikes, weak inventory planning, or supplier disruptions. Companies that track these patterns can improve forecasting accuracy and adjust replenishment models before losing market share.

With automation, brands can collect product-level pricing updates in a structured format and compare changes across categories. A scalable Web Crawler enables businesses to monitor thousands of packaged food listings without human effort, ensuring continuous data refresh.

Pricing and Availability Intelligence Table:

| Data Metric | What Brands Monitor | Strategic Outcome |

|---|---|---|

| Price Fluctuations | Daily selling price changes | Better competitor benchmarking |

| Discount Patterns | Limited-time deals and bundles | Smarter promo timing |

| Stock Status | In-stock vs out-of-stock | Stronger replenishment planning |

| Category Pricing Range | Lowest vs highest price points | Improved positioning strategy |

| Promotion Frequency | Repeat discounts on key SKUs | Better campaign decisions |

Businesses that rely on Web Scraping Tasty Bites Pricing and Availability Data can measure discount aggressiveness across competitors, identify which SKUs are consistently promoted, and understand which categories are most sensitive to price reductions.

Understanding Flavor Preferences and Variant Growth Patterns

In packaged foods, flavor innovation is one of the biggest growth drivers. Customers constantly shift toward new tastes, healthier ingredients, and trending combinations. This creates intense competition where brands must identify what is gaining popularity before it becomes mainstream.

This approach is also useful for identifying innovation strategies used by competitors. Companies can observe how often rival brands launch new flavors, whether they introduce premium packaging, and which pack sizes perform best. By collecting structured variant information, brands can detect emerging demand signals early.

When businesses Extract Tasty Bites Product Prices and Discounts, they can connect flavor-level performance with pricing movements. This becomes even more powerful when supported by Tasty Bites Flavor and Variant Trends Data Extraction, ensuring brands can analyze both innovation trends and sales-driving promotions in one workflow.

Flavor and Variant Trend Intelligence Table:

| Variant Insight Area | What is Captured | Business Benefit |

|---|---|---|

| Flavor Labels | Cheese, spicy, peri-peri, masala | Better product planning |

| Ingredient Trends | Millet, oats, protein-rich items | Health-focused innovation |

| Pack Format Shifts | Pouches, jars, combo packs | Packaging optimization |

| Category Variant Growth | New variants by segment | Early trend detection |

| Discount Linkage | Promo impact on variants | Smarter pricing strategy |

With automated pipelines, businesses can track flavor names, product tags, ingredient highlights, and packaging variations. Using Food Data Scraping, brands can capture product-level details at scale and compare how variants evolve across categories.

How Web Data Crawler Can Help You?

Brands today need automated intelligence to keep pace with rapidly changing packaged food markets. When businesses integrate Track Packaged Food Trends via Tasty Bites Scraper, they gain a clear advantage in identifying demand shifts and competitor pricing patterns.

What We Provide for Packaged Food Intelligence:

- Automated extraction workflows for large SKU catalogs.

- Daily tracking of pricing, discount, and stock fluctuations.

- Structured category-level trend dashboards for reporting.

- Variant-level monitoring for flavors, pack sizes, and formats.

- Data normalization for consistent product comparisons.

- Custom output delivery formats based on business needs.

With our infrastructure, businesses can scale product intelligence faster while maintaining high accuracy. We also support advanced models to Scrape Tasty Bites Packaged Food Data for brands that require continuous monitoring at enterprise scale.

Conclusion

Packaged food brands that respond faster to market shifts consistently outperform competitors in pricing, product launches, and demand planning. That is why Track Packaged Food Trends via Tasty Bites Scraper is becoming an essential strategy for FMCG analytics teams focused on real-time decision-making.

With automated extraction models like Web Scraping Tasty Bites Pricing and Availability Data, brands can build stronger forecasting models, improve supply chain planning, and adjust product positioning based on what customers are actively buying. Contact Web Data Crawler today to build a scalable packaged food intelligence pipeline that supports smarter and faster business growth.