What Snapdeal vs Meesho Data Scraping for Pricing & Seller Trends Shows About 28% Price Volatility?

Jan 13

Introduction

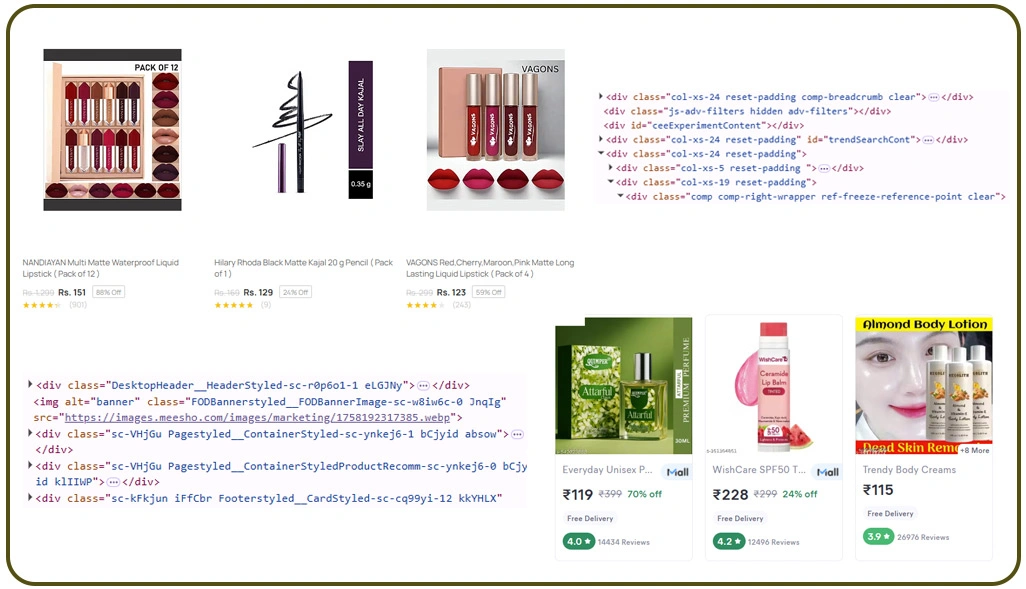

The eCommerce landscape is evolving rapidly, and understanding pricing patterns is crucial for businesses striving to remain competitive. Scraping tools to Scrape Snapdeal Product Data allow companies to monitor real-time seller pricing, discounts, and product availability. Insights from these platforms reveal how sellers adjust prices dynamically, especially in high-demand categories like electronics, fashion, and beauty products.

For instance, Snapdeal sellers often adopt aggressive pricing during festive seasons, whereas Meesho sellers use bundle discounts and regional promotions to drive sales. The data collected from these scraping initiatives not only highlights pricing fluctuations but also uncovers seller behavior trends. This intelligence is critical for businesses seeking to improve profitability, manage inventory, and anticipate competitor moves.

Through structured Snapdeal vs Meesho Data Scraping for Pricing & Seller Trends, companies gain actionable insights into stock levels, dispatch timelines, and promotional strategies, ultimately allowing for better decision-making and targeted market interventions.

Evaluating Seller Pricing Trends Across Multiple Platforms

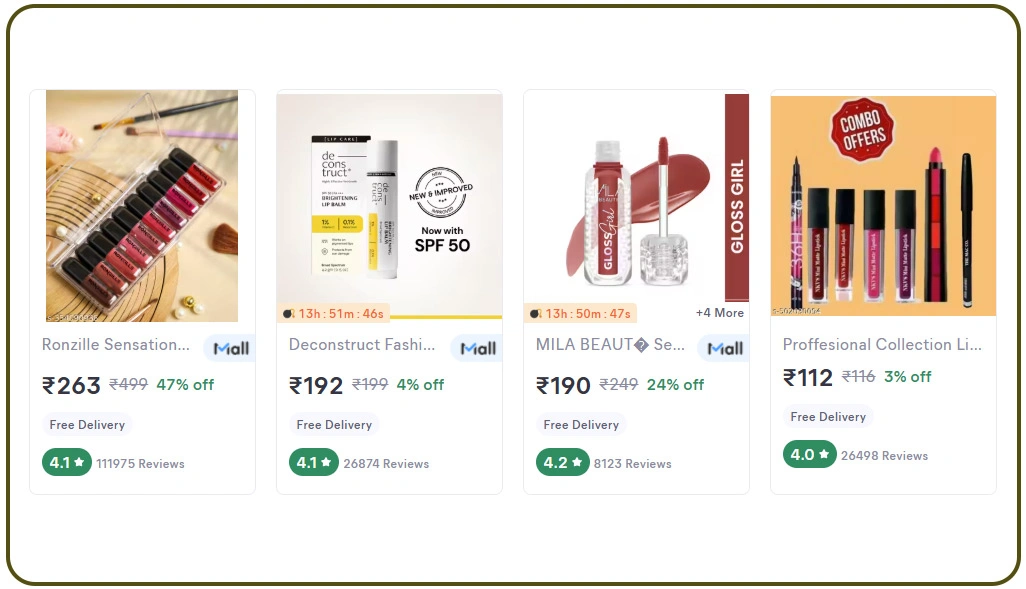

Monitoring pricing trends on eCommerce platforms has become increasingly critical for businesses seeking competitive advantage. Platforms often exhibit variations in product pricing, promotions, and seller behavior, which can directly impact revenue and customer retention. By carefully analyzing data from Snapdeal and Meesho, businesses can identify patterns that lead to fluctuations in pricing, especially in high-demand categories like electronics, fashion, and beauty.

| Metric | Snapdeal Avg Price | Meesho Avg Price | Price Difference (%) |

|---|---|---|---|

| Electronics | 1,250 | 1,120 | 11% |

| Fashion Apparel | 780 | 850 | 9% |

| Beauty Products | 950 | 1,020 | 7% |

Tools such as Meesho and Snapdeal Price API Scraper allow businesses to access real-time pricing across platforms, while Snapdeal Seller Price Monitoring Using Web Scraping provides insights into seller-specific pricing trends. Integration with the Meesho E-Commerce Data API enables companies to gather extensive product information, including discounts, promotional offers, and regional price differences.

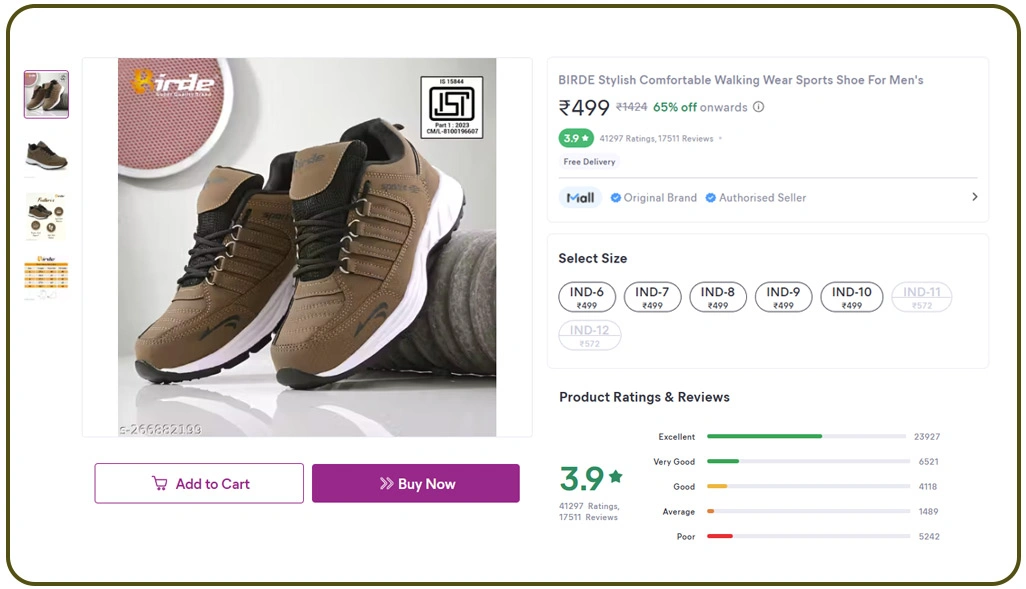

Additionally, Seller Feedback Extraction From Snapdeal helps brands understand consumer sentiment and reactions to price adjustments. Sellers maintaining consistent pricing often achieve better ratings and repeat purchases, whereas volatile discounting can negatively impact trust.

This structured approach to analyzing seller pricing trends empowers companies to optimize product pricing, enhance inventory planning, and remain competitive without sacrificing margins. Data-driven monitoring ensures that market opportunities are not missed and decisions are informed by accurate, up-to-date insights.

Understanding Inventory Impact on Product Pricing Strategies

Effective inventory management directly influences pricing strategies on eCommerce platforms. Fluctuating stock levels, delayed dispatches, and supply-demand imbalances often result in noticeable price variations. By studying comprehensive datasets, businesses can understand how inventory levels affect pricing and identify opportunities to maintain competitive rates while maximizing profits.

| Platform | Average Dispatch Time (Days) | Stock Out Rate (%) | Price Impact (%) |

|---|---|---|---|

| Snapdeal | 2.3 | 12% | 5% |

| Meesho | 2.8 | 15% | 7% |

Simultaneously, Extracting Snapdeal & Meesho Stock Availability enables precise monitoring of real-time product availability. Sellers with stable stock can maintain consistent pricing, while scarcity-driven situations may lead to temporary price hikes.

Analysis of niche segments like Snapdeal Beauty Sellers Data Extraction for Strategy demonstrates that specialized products are particularly sensitive to stock levels. Meesho sellers often leverage bulk discounts when stock is abundant, while Snapdeal sellers may employ time-sensitive pricing strategies to attract purchases.

By leveraging insights from E-Commerce Datasets, businesses gain actionable intelligence on inventory-driven pricing patterns. This information supports better supply chain management, informed pricing decisions, and enhanced operational efficiency. Proactive monitoring ensures that companies can anticipate market shifts and respond strategically, avoiding revenue loss due to stock-related price fluctuations.

Leveraging Market Analysis to Optimize Competitive Pricing

Strategic pricing requires a deep understanding of market behavior and competitor actions. Businesses can derive actionable insights from studying pricing patterns, delivery efficiency, and seller promotions across multiple platforms. Proper analysis allows companies to fine-tune their pricing strategies and maximize profitability in a competitive eCommerce landscape.

| Category | Average Competitor Price | Recommended Pricing | Variance (%) |

|---|---|---|---|

| Electronics | 1,230 | 1,210 | 2% |

| Fashion Apparel | 820 | 800 | 2.5% |

| Beauty Products | 980 | 950 | 3% |

By employing Dispatch Time Comparison for Meesho & Snapdeal via Scraping, businesses can identify sellers leveraging faster deliveries as a competitive advantage, which may justify slightly higher pricing. Insights into promotions and discounts are further enhanced using Meesho Price and Discounts Comparison Scraper, allowing companies to assess competitor pricing strategies across categories.

Integrating Market Research with seller-specific analytics ensures companies understand both macro and micro-level pricing trends. Businesses can anticipate price changes, optimize discount campaigns, and align their marketing strategies with actual platform behavior. Understanding these dynamics helps brands avoid overpricing or underpricing while targeting growth effectively.

Companies using these analytics gain the ability to make precise decisions, mitigate revenue risks, and maintain a competitive edge. Continuous monitoring of pricing, stock levels, and dispatch performance empowers businesses to refine strategies, enhance operational efficiency, and drive higher returns from eCommerce operations.

How Web Data Crawler Can Help You?

Businesses looking to respond effectively to market dynamics must rely on sophisticated web data analytics. Snapdeal vs Meesho Data Scraping for Pricing & Seller Trends enables companies to uncover pricing gaps, seller strategies, and stock patterns across platforms.

Our solutions allow businesses to:

- Track competitor pricing without manual monitoring.

- Compare discounts across multiple sellers.

- Identify high-demand products.

- Monitor stock levels across platforms.

- Analyze dispatch times and delivery performance.

- Generate actionable reports for decision-making.

Additionally, tools like Meesho Price and Discounts Comparison Scraper make it easier to benchmark promotions, understand seller behavior, and refine discount strategies for better profitability.

Conclusion

Understanding pricing dynamics is no longer optional for eCommerce businesses. Insights from Snapdeal vs Meesho Data Scraping for Pricing & Seller Trends reveal a clear 28% price volatility, emphasizing the critical role of data-driven decisions in competitive markets.

Equally important, tools like Snapdeal Seller Price Monitoring Using Web Scraping provide actionable insights into seller behavior, stock levels, and product promotions. Contact Web Data Crawler to implement robust solutions tailored to your business needs.