How to Scrape Fashion Product Data From Myntra, Meesho & Ajio for Tracking 65% Online Apparel Trends?

Oct 24

Introduction

India’s fashion e-commerce industry has witnessed rapid digital transformation, where consumer preferences evolve every season and brands rely heavily on accurate product data for decision-making. The massive influx of clothing, footwear, and accessories listed across platforms like Myntra, Meesho, and Ajio presents valuable insights into what Indian shoppers truly want. For capturing these insights, it’s vital to Scrape Fashion Product Data From Myntra, Meesho & Ajio, helping retailers monitor prices, track trends, and predict future demands.

By analyzing Fashion Datasets, fashion brands can uncover patterns in consumer buying behavior, preferred color palettes, fabric selections, and seasonal demand surges. This helps optimize inventory, reduce unsold stock, and tailor marketing efforts that directly appeal to buyers. Moreover, scraping e-commerce platforms enables data analysts to detect which segments—such as casual wear, ethnic outfits, or streetwear—are dominating online sales charts.

From real-time product updates to monitoring price variations and promotions, the integration of data extraction with market intelligence creates a unified strategy for fashion brands to thrive in an increasingly competitive marketplace. The result is a more responsive and insight-driven business model that connects directly with consumers’ changing preferences.

Understanding Market Dynamics through Fashion Data Intelligence

India’s digital apparel ecosystem has transformed rapidly, with e-commerce becoming a key channel for discovering new trends and brands. Retailers today rely heavily on analytical insights derived from structured fashion data to decode market momentum and optimize inventory. Through Apparel Trend Analysis, fashion companies can assess how seasonal changes, cultural shifts, and social media influences are reshaping the choices of millions of Indian consumers.

Analyzing trend movements helps businesses identify which product categories—like streetwear, ethnic collections, or sustainable wear—are gaining traction. By comparing past and present demand cycles, they can anticipate future consumer behavior with better accuracy. This insight empowers them to focus on relevant styles, maintain an optimal stock balance, and avoid markdown losses.

Using large-scale datasets collected from multiple online marketplaces, fashion analysts measure variations in average order value, conversion rate, and customer engagement. It’s this combination of quantitative accuracy and market observation that supports smarter business forecasting.

| Metric | 2023 | 2024 | Growth % |

|---|---|---|---|

| Online Apparel Buyers (Million) | 180 | 295 | +64% |

| Average Order Value (INR) | 1,450 | 1,920 | +32% |

| Trend-Focused Product Listings | 38% | 59% | +55% |

Structured data interpretation offers not just surface-level understanding but a clear, measurable view of how preferences evolve in real time. Integrating fashion analytics into retail strategy ensures every collection launch or promotion is built around verified insights rather than assumptions, turning apparel merchandising into a precise, data-driven art form.

Evaluating Style Diversity and Competitive Fashion Metrics

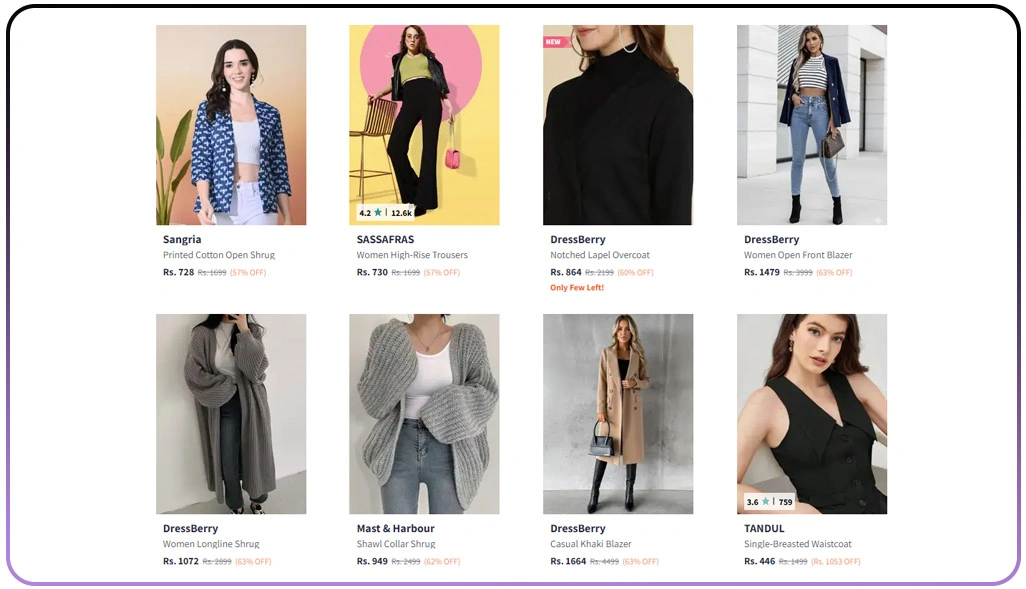

India’s fast-growing online fashion scene thrives on variety and competition. Understanding how different brands perform across various product categories is crucial for identifying growth opportunities. Through E-Commerce Fashion Intelligence, retailers can collect, structure, and compare information from multiple online stores, enabling them to study trends, pricing behavior, and consumer responses.

Data-backed intelligence helps map how luxury brands, local sellers, and emerging labels position themselves within the marketplace. By measuring customer ratings, average pricing, and product engagement, retailers gain visibility into which brands lead specific categories such as casual, ethnic, or streetwear.

Detailed analytics also reveal which designs or fabrics are trending regionally, and how product availability impacts overall conversion rates. When integrated into pricing and promotional strategies, these insights guide fashion enterprises toward a more predictable and profitable product cycle.

| Platform | Top Selling Category | Avg. Price Range (INR) | Rating Range |

|---|---|---|---|

| Myntra | Casual Wear | 799–2,499 | 3.8–4.7 |

| Meesho | Ethnic Sets | 499–1,499 | 3.5–4.4 |

| Ajio | Streetwear | 699–2,299 | 4.0–4.8 |

With a comprehensive view of market competition, fashion leaders can refine their assortment, identify under-served niches, and respond faster to shifts in consumer sentiment. The result is a data-informed ecosystem that merges creativity with measurable business intelligence.

Utilizing Structured Product Analytics for Myntra Insights

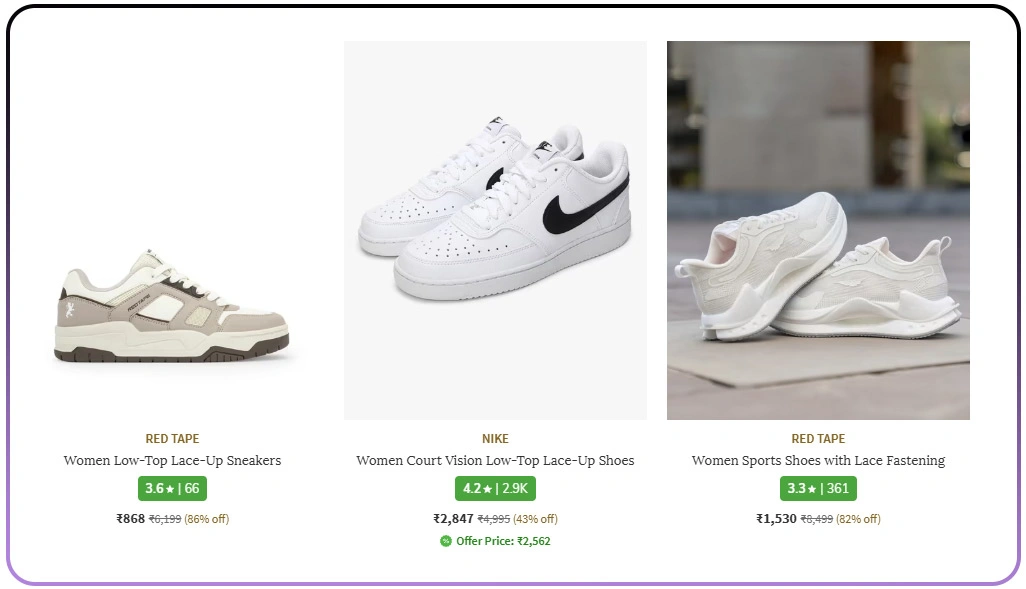

Myntra stands as one of India’s largest fashion hubs, driving consumer preference through its wide selection and data-rich environment. Using Myntra Data Scraping, brands can analyze thousands of listings to measure factors like visibility, engagement, and discount influence. When businesses plan to Scrape Myntra Product Data, they extract detailed insights about styles, price points, and customer sentiment to refine marketing decisions.

Brands often study product tags, fabric details, and variant combinations to determine what appeals most to buyers. This process provides a deeper understanding of product lifecycles, enabling companies to plan restocks more effectively and adjust pricing before competitors do.

By comparing variables like color, fit, and brand rank, fashion analysts gain clarity on which attributes drive maximum sales conversions. These insights also reveal how seasonality impacts demand, offering retailers a way to manage inventories proactively.

| Data Metric | Insight Gained |

|---|---|

| Discount Range | Optimal conversion seen at 30–40% |

| Preferred Colors | Black, Blue, and Pastel dominate |

| Popular Fabrics | Cotton blends and Polyester lead |

Through actionable intelligence derived from Myntra’s extensive database, fashion brands can identify emerging product opportunities, enhance customer engagement, and sustain profitability through real-time adaptation to ongoing fashion trends.

Interpreting Vendor and Product Dynamics on Meesho

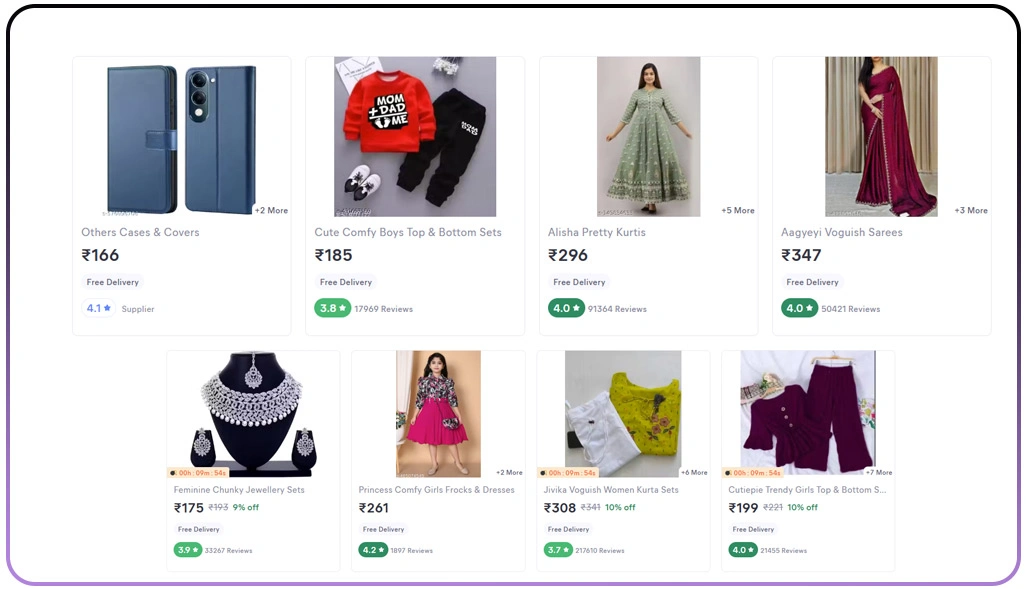

The rise of social commerce has made Meesho a vital marketplace for small-scale sellers and new fashion entrepreneurs. By applying Meesho Product Data Extraction, businesses can evaluate the competitive structure of the platform and understand what drives buyer loyalty and conversion.

Through structured data collection, analysts track how independent sellers price products, respond to customer feedback, and adapt to new trends. These insights enable brands to create more effective strategies for product differentiation, campaign timing, and margin optimization.

The platform’s strength lies in its diversity—millions of sellers contribute to a vibrant marketplace where affordability meets accessibility. Understanding category performance helps businesses make informed decisions about which apparel types are worth scaling.

| Parameter | Observation |

|---|---|

| Seller Growth Rate | +45% in 2024 |

| Repeat Buyer Ratio | 2.3× year-over-year |

| Top Category | Ethnic Fusion Wear |

Data from Meesho not only supports better competitive positioning but also informs long-term strategy for online fashion ecosystems. As retail transitions toward data-first models, these analytical techniques are becoming indispensable for maintaining agility and profitability in the digital apparel space.

Assessing Premium Apparel Trends through Ajio Analytics

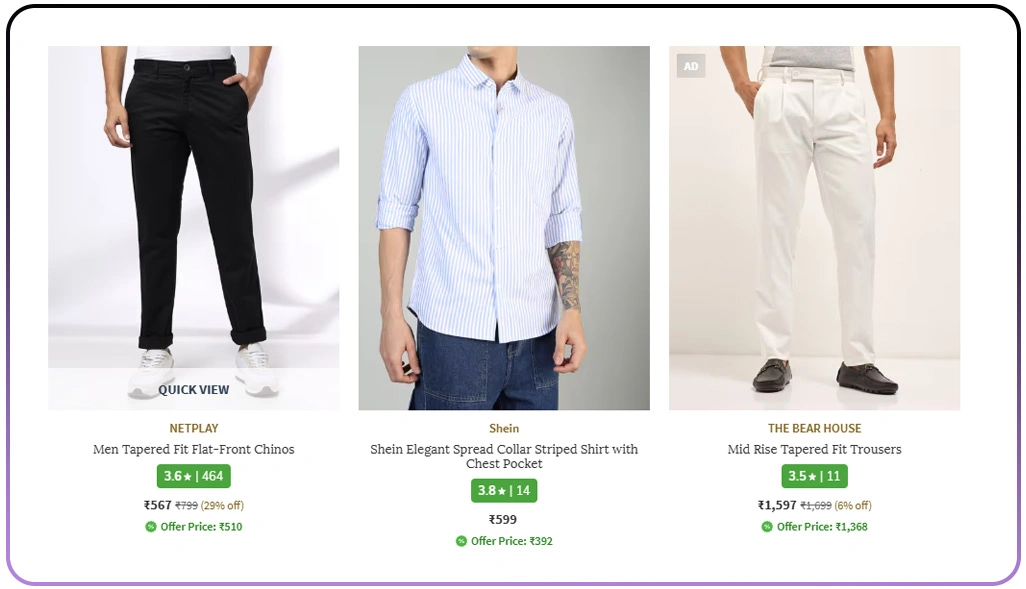

Ajio has successfully positioned itself as a trendsetter in India’s premium fashion segment, offering valuable insights into mid-to-high-end consumer patterns. Through Web Scraping Ajio Data, businesses can monitor product rotation, inventory consistency, and buyer preferences across diverse price brackets. Additionally, Ajio Price Comparison Scraper tools help identify how discounts influence conversion rates and customer loyalty.

This intelligence allows brands to understand how Ajio balances affordability with aspirational buying, giving clear indicators of price elasticity and brand positioning. Retailers use these insights to adjust discount strategies and assortment plans in real time.

Analysts also assess customer reviews to determine sentiment, product satisfaction, and feature relevance. Understanding these behavioral metrics translates into improved customer retention and more effective marketing alignment.

| Trend Factor | Key Insight |

|---|---|

| Discount vs. Conversion | 35% discount yields 48% higher sales |

| Rating Influence | 4.3+ ratings drive 60% repeat buyers |

| Restock Interval | Top items restock every 12 days |

The application of to Scrape Ajio Product Data strategies enables apparel companies to fine-tune product timing and optimize performance across online channels, turning consumer data into a strategic asset for competitive growth.

How Web Data Crawler Can Help You?

Businesses seeking to Scrape Fashion Product Data From Myntra, Meesho & Ajio can depend on our expertise in extracting structured, real-time data for actionable insights. Our solutions cater to large-scale data collection and competitive benchmarking that help apparel retailers make confident decisions backed by precision analytics.

Here’s how our specialized tools empower your operations:

- Automated data pipelines that track millions of listings daily.

- AI-enhanced dashboards for real-time visibility.

- Seamless data integration with BI platforms.

- Scalable solutions customized for global retail markets.

- Advanced filtering for trend-based and category-specific insights.

- Continuous monitoring to detect new arrivals and discount shifts.

By integrating our services, fashion brands can strengthen their competitive intelligence and ensure sustainable growth in a volatile retail environment driven by E-Commerce Fashion Intelligence.

Conclusion

Data-driven apparel retailing thrives when businesses use advanced extraction tools to Scrape Fashion Product Data From Myntra, Meesho & Ajio, creating transparency across digital platforms and revealing the strategies behind fast-selling fashion products.

With actionable insights from Apparel Trend Analysis, fashion leaders can reshape pricing, promotions, and assortments that match consumer sentiment perfectly. Partner with Web Data Crawler today to turn your raw data into powerful retail intelligence for smarter fashion decisions!