How to Scrape EdgeProp Property Data for Price, Trends & Investment for 55% Deeper Singapore Property Trends?

Dec 02

Introduction

Singapore’s property market has evolved into one of the most data-driven real estate ecosystems in Asia, where investors rely heavily on intelligent digital insights to make accurate and confident decisions. For buyers, sellers, agents, and analysts, understanding shifts in pricing, rental yields, location performance, and development trends is essential. This is where the ability to Scrape EdgeProp Property Data for Price, Trends & Investment becomes a powerful advantage.

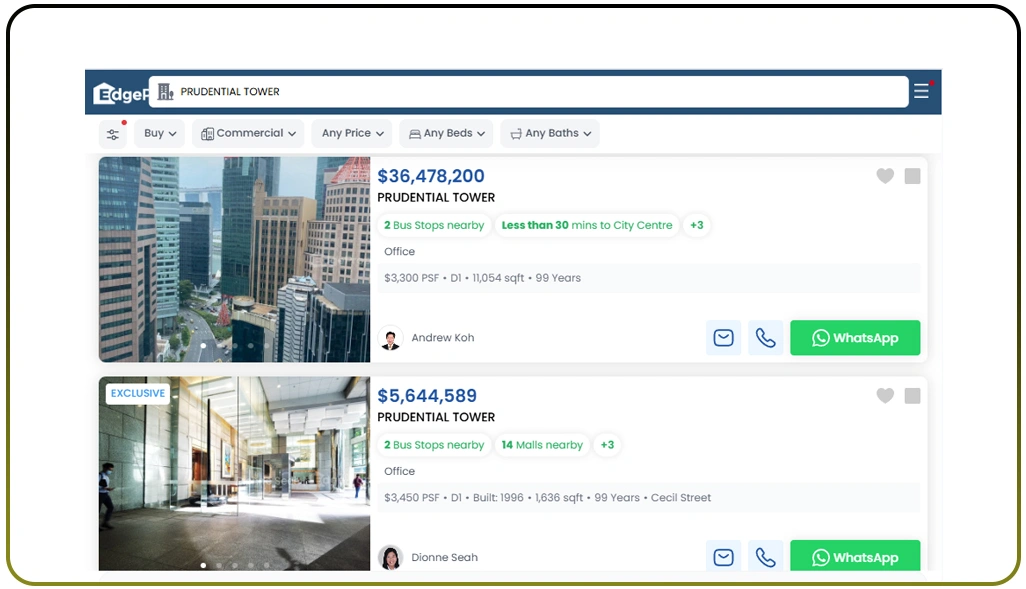

As competition rises, traditional research methods alone no longer provide the speed or precision required. Businesses increasingly turn to EdgeProp Property Data Scraping Services to access structured market intelligence, enabling them to decode emerging hotspots, supply-demand imbalances, and hidden investment opportunities. With the right data crawling approach, everything from project-specific analytics to neighborhood-level valuations becomes accessible in real-time.

This blog walks you through how data extraction enhances decision-making, presents three problem-solving sections backed with stats and tables, and explains how automation transforms property intelligence. Whether you are an agency, investor, or enterprise, these insights will elevate your market understanding and strengthen long-term investment strategies.

Understanding Market Movements Through Detailed Property Insights

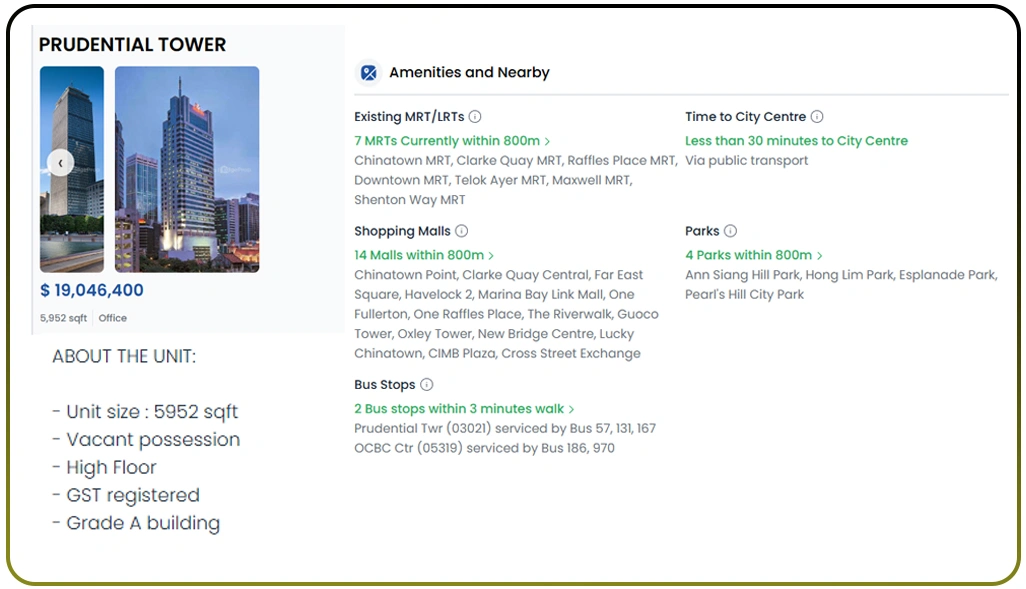

Singapore’s real estate ecosystem evolves rapidly, driven by economic shifts, policy reforms, transportation upgrades, buyer demographics, and supply-demand changes. Automated intelligence empowers users to interpret property pricing variations, rental trends, and neighborhood performance with exceptional clarity. Using refined tools such as EdgeProp Real Estate Insights Scraper, professionals can access multi-layered datasets that reveal hidden investment movement patterns across the island.

Accurately interpreting regional variations becomes essential for strategic planning. For example, zones undergoing infrastructure expansion often experience above-average appreciation rates, while mature districts maintain stable but moderate yearly increases. Capturing such contrasts manually can be demanding. Digital extraction supported by Popular Real Estate Data Scraping ensures rapid visibility into changing price benchmarks, listing fluctuations, and competitor dynamics.

Below is an illustrative comparison of price growth:

| Region Category | Avg PSF (2022) | Avg PSF (2024) | Price Change |

|---|---|---|---|

| Central Region | $2,180 | $2,640 | +21% |

| Mid-Central Region | $1,590 | $1,830 | +15% |

| Suburban Region | $1,350 | $1,540 | +14% |

Automated insights help users evaluate both short-term and long-term movement trends. This includes understanding project saturation levels, identifying price anomalies, monitoring buyer interest, and tracking listing turnover rates. With the support of EdgeProp Real Estate Pricing Trend Data Crawler, professionals access structured historical datasets that simplify deeper trend analysis.

Digital extraction also reduces decision-making errors by providing comparable metrics across multiple districts and property types. These structured datasets allow analysts to evaluate emerging hotspots, rising demand pockets, and stability indicators more efficiently. Overall, automated intelligence brings speed, accuracy, and reliability to property trend interpretation within Singapore’s dynamic real estate market.

Evaluating Buying and Selling Opportunities With Data Precision

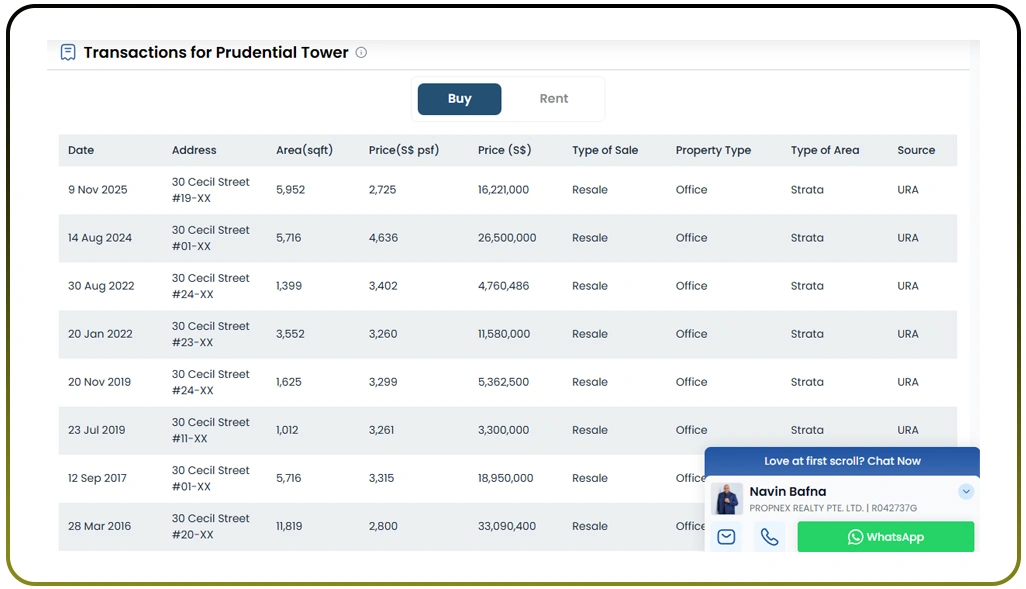

In Singapore’s fast-moving real estate space, identifying profitable moments to buy or sell depends on accurately reading market cycles, transaction pressure, listing availability, and valuation shifts. Automated extraction simplifies this process by giving users continuous access to structured listing datasets, transaction patterns, and comparative pricing views.

Identifying undervalued properties often depends on detecting price deviations from district-level norms. Units priced below the median range may indicate strategic opportunities for investors seeking long-term returns. Structured analysis is further enhanced using Real Estate Data Scraping, which provides consistent access to transaction histories, pricing brackets, and rental performance indicators.

Below is an example snapshot of investment-oriented property categories:

| Property Category | Avg PSF | Avg Rental Yield | Yearly Transactions |

|---|---|---|---|

| New Launch | $2,180 | 3.1% | 8,900 |

| Resale Condo | $1,650 | 3.8% | 11,400 |

| HDB Resale | $620 | 7.3% | 23,700 |

Advanced comparison tools help analysts filter properties based on yield benchmarks, price deltas, and rental demand. Another advantage comes from accessing automated valuation patterns supported through EdgeProp Valuation and Investment Insights Data Scraping, enabling users to understand pricing momentum, resale strengths, and comparative demand across districts.

Structured digital extraction transforms how buying and selling opportunities are evaluated. Instead of relying on partial insights, investors gain wider visibility into pricing cycles, transaction density, and property-specific performance indicators.

Strengthening Investment Assessment Through Predictive Intelligence Tools

Investment evaluation today requires a deeper blend of historical insights, current trends, and predictive modeling. Analysts equipped with refined tools like EdgeProp Listing and Pricing Datasets Scraper gain multi-dimensional perspectives on investment performance across property categories and regions.

Predictive forecasting becomes significantly more powerful when using large datasets that highlight vacancy levels, absorption rates, and yearly transaction growth. These insights help analysts determine whether an area is gaining traction or experiencing market fatigue.

Below is a simplified example of investment-related performance indicators:

| Indicator | 2020 | 2024 | Difference |

|---|---|---|---|

| Avg Rental Yield | 3.2% | 3.9% | +0.7% |

| Annual Transactions | 19,200 | 26,500 | +38% |

| Vacancy Rate | 6.1% | 5.0% | -18% |

Predictive analysis further improves when incorporating structured comparisons supported through Web Scraping EdgeProp Property Reports, enabling investors to identify stable neighborhoods, developing micro-markets, and long-term capital appreciation segments. Real-time extraction powered by Live Crawler Services ensures consistent updates across listing databases, giving analysts immediate access to price shifts, activity levels, and demand surges.

Additionally, advanced modeling becomes more intuitive with the support of EdgeProp Property API Scraping, offering deeper access to programmatically retrieved metrics essential for data-driven forecasting. By combining structured datasets, predictive modeling, and real-time updates, organizations build stronger investment frameworks that reduce risk and enhance returns across Singapore’s competitive real estate market.

How Web Data Crawler Can Help You?

Modern enterprises require reliable tools capable of performing multi-layered extraction, and accessing rich datasets becomes easier when integrating systems designed to Scrape EdgeProp Property Data for Price, Trends & Investment inside ongoing data operations. Businesses benefit from real-time monitoring, deep dataset coverage, and seamless automation that reduces manual complexity.

Benefits of using our solution:

- Extract complete listing history data.

- Compare pricing differentials across multiple developments.

- Monitor market shifts with real-time updates.

- Generate structured datasets for long-term analysis.

- Support API integration for enterprise workflows.

- Automate frequent data refresh cycles.

The system adapts to varied requirements, helping agencies, investors, analysts, and enterprises build deeper insights within shorter timeframes. The platform also supports advanced automation aligned with EdgeProp Valuation and Investment Insights Data Scraping, ensuring that organizations maintain consistent, accurate, and forward-driven intelligence.

Conclusion

Reliable property insights directly influence how effectively organizations interpret market trends. For investors and analysts, adopting intelligent extraction techniques to Scrape EdgeProp Property Data for Price, Trends & Investment strengthens forecasting accuracy, supports better valuations, and enhances long-term planning.

Integrating digital extraction improves real-time visibility, reduces manual analysis time, and ensures high-quality market interpretation when powered with EdgeProp Property API Scraping. Connect with Web Data Crawler today to build powerful property analytics solutions for your business.