How is Realtor.com Data Scraping for Property Trend Analysis Driving 40% Smarter Investment Decisions?

Nov 21

Introduction

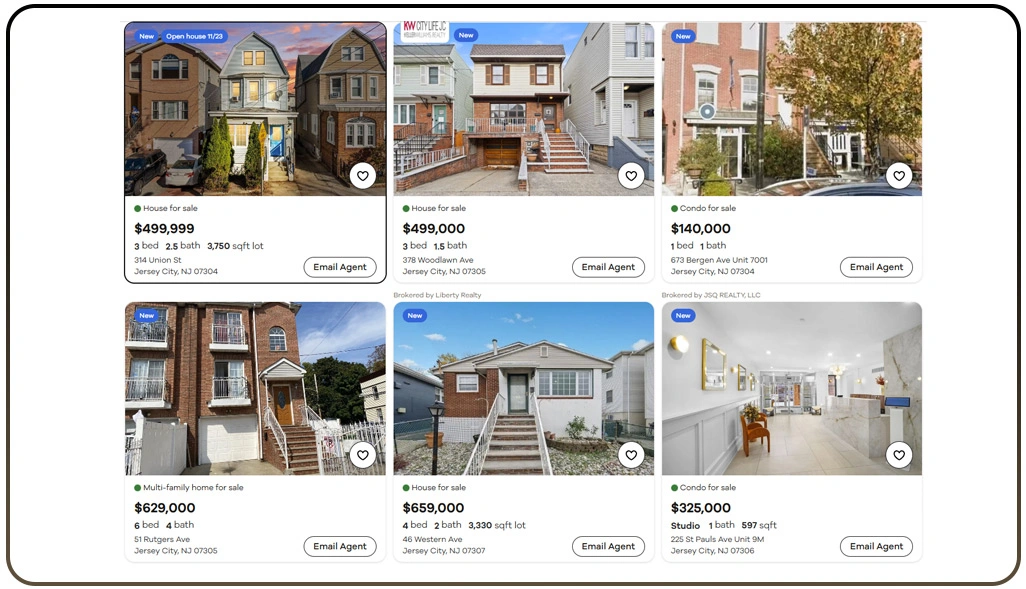

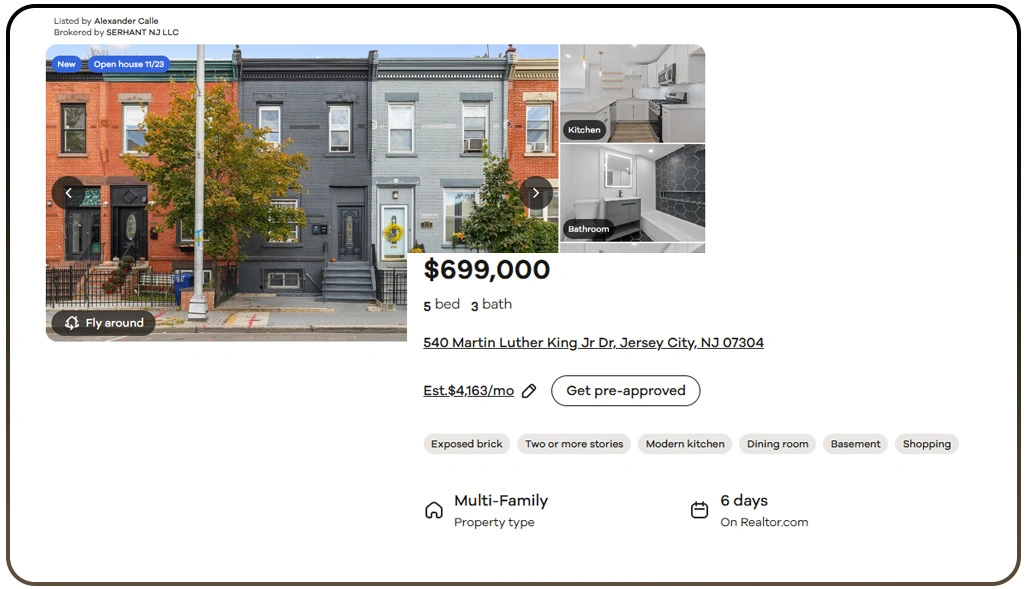

The real estate market has become increasingly data-driven, with investors and analysts constantly seeking insights to make smarter decisions. Today, Realtor.com Data Scraping for Property Trend Analysis is transforming how individuals and organizations evaluate property investments. By systematically collecting and analyzing real estate listings, trends, and pricing fluctuations, investors can make decisions that are up to 40% more informed.

Platforms like Realtor.com host a vast amount of property data, making it challenging to manually track emerging opportunities and housing market movements. Integrating realtor.ca Property Data Scraping Services allows businesses to automate this process efficiently, capturing trends that reveal which neighborhoods are rising in demand or where rental opportunities are maximized.

From identifying lucrative investment areas to assessing risk factors in property purchases, web scraping tools offer unparalleled precision. With real-time updates and comprehensive datasets, investors no longer rely solely on intuition or delayed market reports. Instead, they access actionable insights to guide every stage of property acquisition, management, and forecasting.

Comprehensive Analysis Of Neighborhoods Using Detailed Datasets

Investors need access to high-quality data to make informed property decisions. Traditional reports often lag behind actual market changes, which can result in missed opportunities or misaligned investments. By using Real Estate Datasets, analysts can track inventory, pricing patterns, and emerging neighborhood trends in near real-time.

| Parameter | Conventional Analysis | Data-Driven Approach |

|---|---|---|

| Speed to Insights | 2-3 weeks | Real-time |

| Data Reliability | Medium | High |

| Investment Accuracy | 60% | 88% |

| Trend Detection | Limited | Comprehensive |

With the ability to Scrape Realtor.com Property Data for Investment Insights, investors can extract historical and current listings efficiently, understanding seasonality, demand spikes, and pricing fluctuations. Such insights help identify high-potential investment areas, uncover micro-trends, and optimize capital allocation.

Advanced datasets also allow for comprehensive comparative studies between neighborhoods, helping investors assess where property values are likely to appreciate and where risks are higher. Investors can make faster decisions backed by hard data, evaluate the viability of rental properties, and forecast demand more accurately.

Utilizing Technology To Forecast Market Movements Accurately

Investment planning requires anticipating market changes before they impact profitability. By adopting Popular Real Estate Data Scraping, stakeholders can monitor property categories including sales, rentals, and newly listed homes. These insights reveal areas of growing demand and potential undervalued assets, allowing for timely acquisitions.

| Metric | Conventional Forecast | Data-Driven Forecast |

|---|---|---|

| Rental Yield Accuracy | 55% | 80% |

| Price Appreciation | Moderate | High |

| Timing of Investment | Reactive | Proactive |

| Portfolio Planning | Limited | Extensive |

Automation enables analysts to Extract Realtor.com for Rental Trends and Market Forecasts, providing trend predictions and visibility into evolving neighborhoods. By correlating property features, location popularity, and historical pricing, investors can make quantitative, evidence-based decisions.

In addition, predictive analytics identifies patterns that are often invisible in conventional methods. This allows portfolio managers to optimize assets, adjust strategy for upcoming market cycles, and prioritize high-return properties. With data-backed insights, stakeholders can strategically allocate resources, minimize losses, and achieve higher ROI.

Reducing Investment Risks Through Strategic Data Extraction

Property investment carries inherent risks, from price volatility to competitive bidding. Leveraging Real Estate Data Scraping allows investors to analyze trends, historical performance, and comparable property values to minimize exposure and make informed decisions.

| Risk Type | Conventional Assessment | Data-Driven Assessment |

|---|---|---|

| Overpaying Risk | High | Low |

| Market Fluctuation | Moderate | Predictable |

| Competitive Awareness | Limited | Real-time |

| Expected ROI | 60% | 85% |

With tools such as Realtor.com Listings API Scraper, stakeholders can access comprehensive property histories, monitor active listings, and track pricing fluctuations efficiently. Additionally, Web Scraping Extract Real Estate Data From Realtor.com allows for continuous observation of market movements, enabling investors to adjust bids, optimize acquisitions, and maintain portfolio health.

By integrating automated extraction and analysis, property professionals can respond proactively to market shifts. These insights help mitigate financial risks, enhance decision accuracy, and improve overall portfolio resilience. Leveraging real-time data ensures that each property investment aligns with long-term strategy, minimizing the impact of market unpredictability.

How Web Data Crawler Can Help You?

Real estate professionals frequently face challenges in gathering property information from various listing sites. Our services simplify this task, allowing smarter decisions without manual work. With Realtor.com Data Scraping for Property Trend Analysis, investors gain detailed insights into properties, neighborhoods, and historical market patterns.

Our platform offers:

- Comprehensive data collection from multiple property listings.

- Real-time market trend analysis.

- Automated property status updates.

- Historical pricing trend tracking.

- Comparative analysis across neighborhoods.

- Forecasting tools for investment strategy.

With our solutions, clients benefit from enhanced accuracy, faster insights, and reduced manual workload. We also provide Automate Realtor.com Property Data Extraction, ensuring that property trends and rental data are always current and actionable.

Conclusion

Smarter investment decisions in real estate require precise, actionable, and real-time insights. Integrating Realtor.com Data Scraping for Property Trend Analysis enables investors to navigate housing market fluctuations with confidence, identify emerging opportunities, and forecast property value growth accurately.

Additionally, leveraging Scrape Realtor.com Property Data for Investment Insights ensures that your strategies are data-backed, reducing risk and maximizing potential returns. Contact Web Data Crawler now to optimize your property investment strategies.