How Real-Time Total Wine Accessories Data Scraping Unlocks 30% Faster Insights for the Beverage Market?

Jan 06

Introduction

The beverage retail landscape is becoming increasingly data-driven, where timely insights define pricing strategies, inventory planning, and consumer engagement. Retailers, distributors, and analysts are no longer satisfied with periodic reports; they require continuously updated intelligence that reflects real-world market movements. This is where Real-Time Total Wine Accessories Data Scraping plays a pivotal role in transforming raw retail listings into actionable business signals.

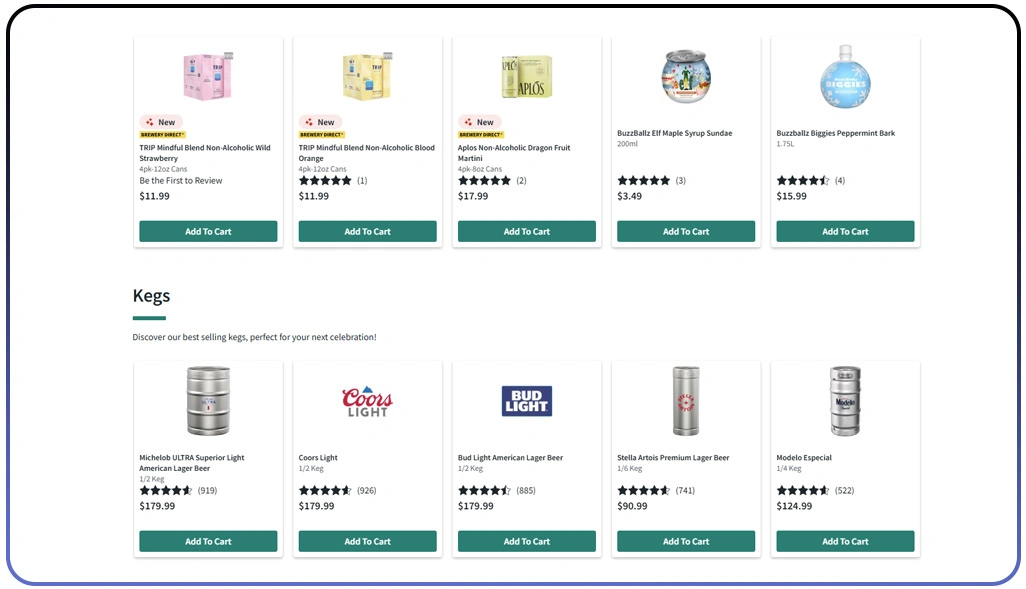

From corkscrews and glassware to bar tools and storage solutions, accessories often mirror shifting consumption trends across wine, spirits, and beer categories. Monitoring these changes across regions enables brands to anticipate demand spikes, adjust assortments, and refine promotional strategies. With Total Wine Liquor Data Scraping Services, businesses gain structured visibility into accessory pricing, product availability, and category performance across digital shelves.

In an environment where competitors react within hours rather than weeks, real-time intelligence helps reduce blind spots and accelerates decision cycles. Beverage companies can align accessory sales with core alcohol products, ensuring cohesive merchandising strategies. As consumer preferences evolve rapidly, real-time data collection becomes less of an advantage and more of a necessity for sustainable growth in the beverage market.

Understanding Accessory Pricing Gaps Across Markets

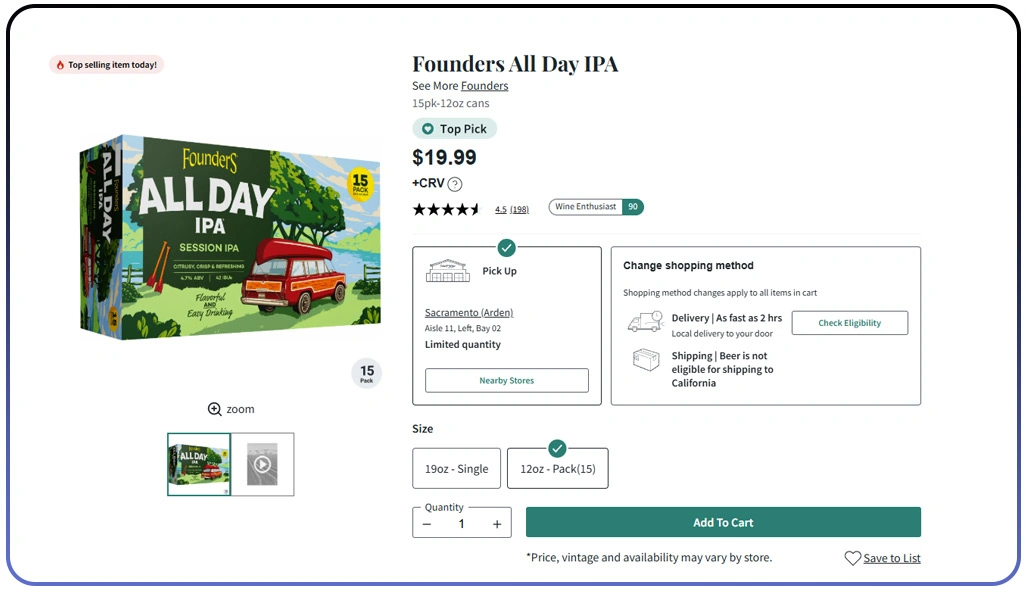

Pricing inconsistency remains a critical challenge for beverage accessory sellers operating at scale. Without unified visibility, organizations often rely on delayed reports or fragmented dashboards that fail to reflect real market behavior. By applying Total Wine Data Extraction for Wine, Spirits and Beer Insights, businesses can examine how accessory pricing aligns with broader beverage category movements, allowing smarter margin planning and synchronized promotional execution.

Centralized Liquor Datasets play a crucial role in resolving this issue. They consolidate historical and live pricing signals, enabling teams to identify patterns such as seasonal markups, discount clustering, or regional pricing deviations. Accessories like wine openers or premium glassware often follow different pricing cycles than consumable products, making independent tracking essential for accurate analysis.

Another strategic advantage emerges when companies gain the ability to Extract Total Wine Liquor Prices Across the US. This geographic comparison uncovers disparities between urban and suburban markets, revealing opportunities for localized pricing optimization.

Pricing Visibility Snapshot:

| Accessory Segment | Price Movement Trend | Discount Activity | Regional Spread |

|---|---|---|---|

| Wine Accessories | Moderate Increase | Medium | High |

| Beer Accessories | Stable | High | Medium |

| Barware Sets | High Increase | Low | High |

When pricing intelligence becomes continuous rather than periodic, businesses reduce margin leakage and improve responsiveness. Structured accessory pricing insights ultimately help teams replace intuition with evidence-driven decisions.

Eliminating Retail Channel Intelligence Fragmentation

Accessory performance often varies dramatically across retail environments, yet many organizations still analyze channels in isolation. This fragmented approach creates blind spots that delay responses to shifting consumer preferences. Using Beer Data Crawling via Total Wine for Analytics, brands can correlate accessory demand with beer consumption trends, providing context that single-channel analysis cannot deliver.

The challenge intensifies when accessory data is spread across specialty retailers, urban stores, and online platforms. Integrating Web Scraping From City Market and Total Wine Data enables comparative assessments that highlight assortment gaps, promotional inconsistencies, and channel-specific pricing strategies. Such comparisons reveal how the same accessory may perform differently depending on store format and shopper intent.

Unified channel intelligence supports smarter distribution planning. Businesses can adjust SKU depth based on local demand signals, ensuring popular accessories are available where they sell fastest. It also improves promotional timing, as cross-channel insights clarify which platforms respond best to discounts versus value-based positioning.

Cross-Channel Performance Overview:

| Retail Channel | SKU Variety | Promotion Intensity | Sales Velocity |

|---|---|---|---|

| Specialty | High | Low | Medium |

| City Market | Medium | High | High |

| Online | Very High | Medium | High |

By resolving data silos, organizations gain a unified understanding of accessory behavior across markets. This clarity enables faster adjustments, better allocation decisions, and stronger alignment between accessory and beverage sales strategies.

Strengthening Inventory Planning Through Continuous Signals

Static forecasting models struggle to keep pace with changing consumer behavior, especially when accessories are influenced by seasonal promotions or beverage launch cycles. The ability to Scrape Wine, Beer & Spirits Data From Total Wine for Insight introduces real-time demand signals into inventory planning workflows.

Continuous monitoring highlights early indicators such as low-stock alerts, new product introductions, or assortment changes. These signals help planners anticipate demand rather than react to shortages. When inventory teams understand how accessory movement mirrors beverage sales trends, replenishment strategies become more precise and timely.

Improved stock visibility also supports better warehouse utilization and reduces excess inventory risk. Accessories tied to high-performing beverage categories can be prioritized, while slower-moving SKUs are adjusted before capital is locked into unsold stock. This proactive approach transforms inventory planning from reactive correction to strategic optimization.

Inventory Signal Tracking Table:

| Signal Type | Detection Speed | Planning Benefit |

|---|---|---|

| Low Stock Alerts | Fast | Prevents lost sales |

| New Listings | Medium | Identifies trend shifts |

| Bundle Offers | Fast | Improves demand pairing |

By embedding continuous signals into planning systems, businesses achieve stronger shelf availability and improved forecast accuracy. Inventory decisions become data-led, reducing operational friction while supporting sustained accessory performance.

How Web Data Crawler Can Help You?

Modern beverage intelligence requires more than manual monitoring or delayed reports. Within this framework, Real-Time Total Wine Accessories Data Scraping enables continuous data capture that feeds pricing, availability, and trend analysis workflows without interruption.

Key capabilities include:

- Automated tracking of accessory listings across categories.

- High-frequency updates for pricing and stock changes.

- Structured data delivery for analytics platforms.

- Regional-level intelligence for localized strategies.

- Scalable infrastructure supporting large SKU volumes.

- Compliance-focused data collection practices.

In the final stage of insight delivery, solutions such as Wine Spirits Data Scraper From Total Wine ensure accessory intelligence aligns seamlessly with broader beverage analytics, creating a unified data ecosystem that supports faster, more confident business actions.

Conclusion

Accessory intelligence is no longer peripheral to beverage strategy; it is a core driver of pricing accuracy, inventory balance, and market responsiveness. When powered by Real-Time Total Wine Accessories Data Scraping, businesses reduce insight delays and transform retail signals into timely strategic decisions.

Reliable stock visibility further strengthens planning precision, especially when supported by Spirits Stock Availability Extractor via Total Wine. If your organization is ready to accelerate insights and modernize beverage intelligence workflows, connect with Web Data Crawler today to build a future-ready data strategy.