How Can MyLiquor Pricing Data Scraping for Alcohol Demand Analysis Track 42% Regional Buying Trends?

Feb 06

Introduction

Alcohol retail markets are no longer driven by guesswork. In many regions, liquor buyers respond instantly to discounts, premium brand promotions, and availability updates. This is why businesses need structured, real-time alcohol pricing visibility across cities and store networks.

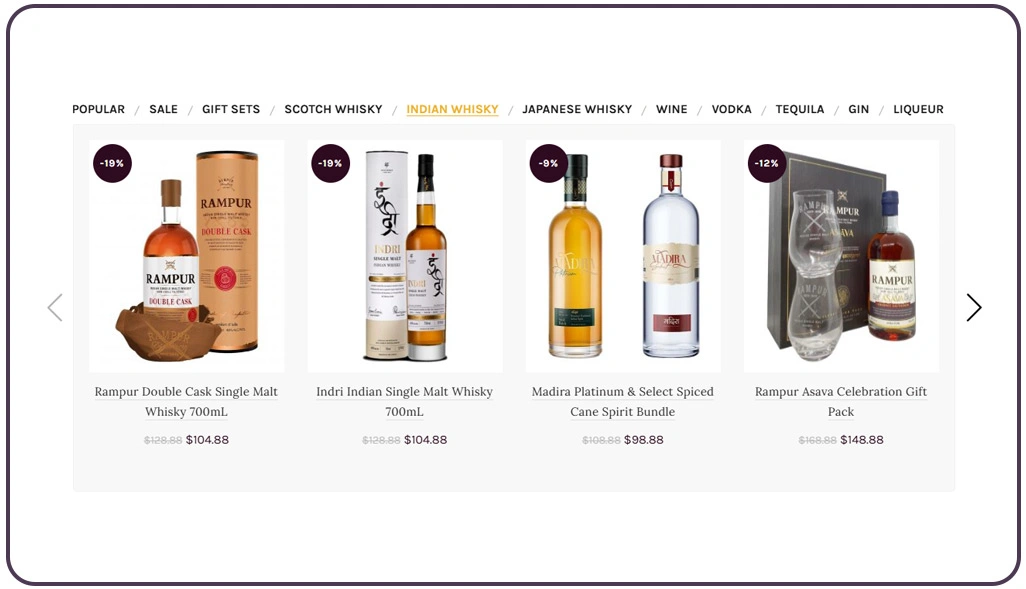

MyLiquor is a key platform where customers compare alcohol products, explore local store listings, and review pricing differences across regions. With advanced MyLiquor Store Liquor Data Scraping Services, businesses can collect accurate product price updates, promotional offers, and category-level variations without relying on manual tracking.

More importantly, data-driven liquor demand tracking supports forecasting models and improves supply planning. This is where MyLiquor Pricing Data Scraping for Alcohol Demand Analysis becomes a competitive tool, helping alcohol businesses identify high-performing zones and track regional buying behavior with precision.

Understanding City-Level Buying Behavior Through Pricing Signals

Alcohol demand varies sharply across regions due to festivals, tourism, income groups, and lifestyle patterns. That is why regional pricing visibility has become a major factor for suppliers, distributors, and alcohol retailers. Market studies indicate that liquor demand can fluctuate by 35%–45% between metro areas and tier-2 locations based on pricing differences and promotional timing.

To create structured demand insights, businesses often depend on Liquor Datasets that include pricing, product categories, and store-level listings. This helps them measure which products are trending and which ones are losing demand in specific zones. When price drops happen, buyers often react instantly, especially for popular whiskey and vodka categories.

Using tools to Extract MyLiquor Pricing Trends by Region, businesses can map regional demand clusters and understand which alcohol categories dominate in each location. This process also helps identify premium-focused markets versus price-sensitive markets.

| Region Type | Dominant Category | Avg Price Change | Demand Movement |

|---|---|---|---|

| Metro Cities | Premium Whiskey | +6% | +19% |

| Tier-2 Cities | Rum & Vodka | -4% | +27% |

| Tourist Zones | Beer & Wine | +8% | +21% |

| Rural Areas | Economy Spirits | -3% | +14% |

Tracking Competitive Price Changes for Smarter Decisions

Liquor buyers today are highly price-aware and frequently compare products across stores before finalizing purchases. In competitive alcohol markets, even minor price variations can influence store switching behavior. Reports show that a pricing difference of around 7%–10% between outlets can drive demand shifts of nearly 25% in high-volume liquor zones.

Through Liquor Data Scraping, brands and retailers can monitor real-time price movements, detect discount patterns, and measure how buyers respond across different product segments. This approach becomes especially useful during festive seasons when alcohol promotions spike and buying patterns change overnight. Businesses can also track which brands are being aggressively discounted and which ones are maintaining stable premium positioning.

A common analytical method is Liquor Sales Trend Analysis via MyLiquor Scraper, which helps companies evaluate whether demand is growing due to promotions or shifting due to competitor pricing pressure. Such monitoring supports better pricing decisions, improved shelf planning, and stronger regional targeting.

| Pricing Activity | Buyer Reaction | Avg Demand Impact |

|---|---|---|

| 5% Price Drop | Higher switching behavior | +15% |

| Limited-Time Discount | Quick purchase surge | +30% |

| Bundle Offer | Increased bulk buying | +22% |

| Premium Price Increase | Reduced repeat purchases | -12% |

| Competitor Undercutting | Market share loss | -18% |

Forecasting Liquor Demand with Location-Based Insights

Demand forecasting in the liquor industry is no longer based only on historical sales reports. It now depends heavily on live pricing trends, product availability, and competitive store activity. Studies show that forecasting models supported by real-time market indicators can improve inventory accuracy by 35%–42%, reducing stockouts and limiting unsold inventory.

Using Popular Liquor Data Scraping, businesses can track which alcohol categories are rising in demand and which brands are declining in specific regions. When products go out of stock in a high-demand zone, buyers quickly shift to substitutes, creating sudden demand spikes for alternative categories. Monitoring these shifts ensures brands do not miss revenue opportunities.

Another strong approach is Web Scraping MyLiquor Alcohol Market Insights, which allows businesses to identify which brands maintain strong demand even when prices rise. This reveals customer loyalty patterns and premium market behavior. Such insights are essential for alcohol companies planning regional expansion, distribution strategies, and promotional planning.

| Forecasting Indicator | What It Tracks | Business Benefit |

|---|---|---|

| Price Change Frequency | Discount activity | Better promotion timing |

| Availability Updates | Stock movement | Reduced missed demand |

| Regional Ranking | Category popularity | Smarter supply planning |

| Competitor Activity | Market pressure | Faster pricing response |

| Seasonal Growth Patterns | Demand spikes | Improved forecasting accuracy |

How Web Data Crawler Can Help You?

Alcohol businesses need more than surface-level sales reports to understand what is happening across different cities and store networks. This is where MyLiquor Pricing Data Scraping for Alcohol Demand Analysis becomes a powerful foundation for smarter alcohol analytics.

What We Deliver for Alcohol Data Intelligence:

- Regional pricing collection across multiple store listings.

- Product-level monitoring for category performance tracking.

- Store-to-store comparison reports for pricing optimization.

- Daily and weekly trend-based pricing updates.

- Structured data output for analytics dashboards and forecasting.

- Automated data delivery in formats aligned with business needs.

By using tools to Scrape MyLiquor Liquor Prices to Track Alcohol Trends, our solution helps alcohol brands and retailers build reliable demand models and identify high-performing zones faster.

Conclusion

Regional liquor buying behavior is shaped by pricing, availability, and consumer preference patterns that shift constantly across locations. This is why MyLiquor Pricing Data Scraping for Alcohol Demand Analysis is essential for understanding where demand is rising and which products are dominating specific regional markets.

By applying Liquor Sales Trend Analysis via MyLiquor Scraper, alcohol brands and retailers can build stronger market forecasting strategies and respond to local buying signals before competitors do. Contact Web Data Crawler now to start your MyLiquor pricing data extraction project.