What Do Web Scraping LoopNet Rental, Lease, and Sale Price Trends Say About 2025 Commercial Property Moves?

Dec 15

Introduction

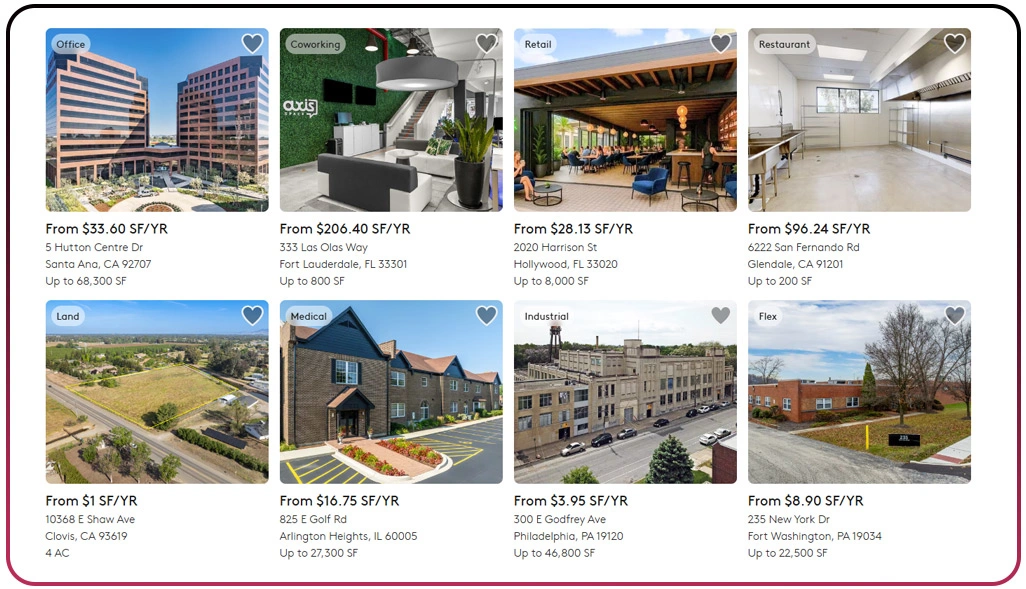

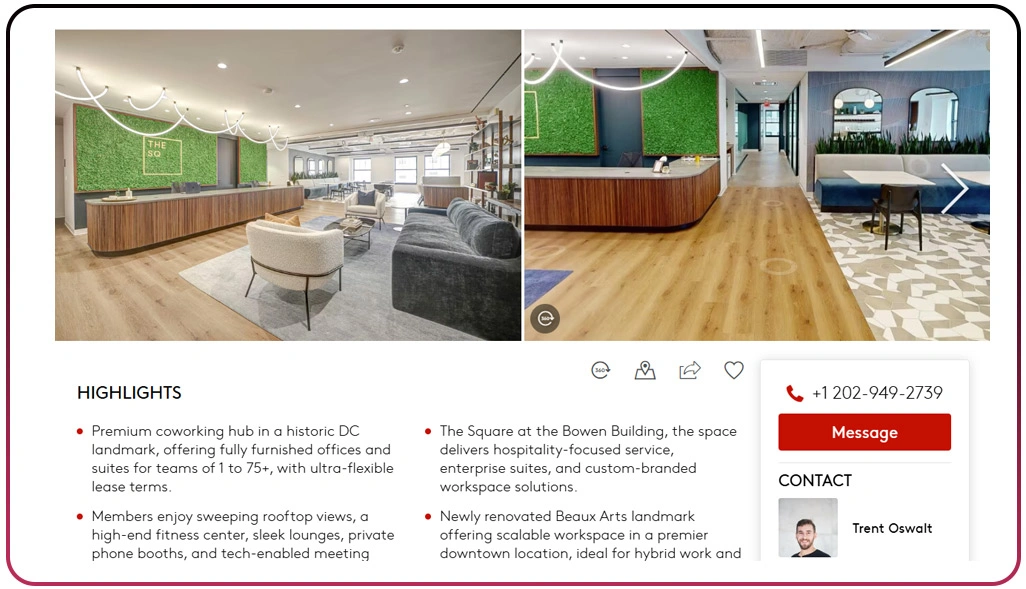

The commercial real estate landscape is undergoing significant shifts in 2025, making it crucial for investors and stakeholders to monitor pricing movements accurately. With changing demand across office, retail, and industrial spaces, understanding rental, lease, and sale price patterns can provide a competitive edge. One of the most effective ways to achieve this is through Web Scraping LoopNet Rental, Lease, and Sale Price Trends, enabling professionals to analyze data at scale and identify opportunities early.

Investors can access detailed insights with LoopNet.com Property Data Scraping Services, which consolidates listings and price information efficiently. By combining automated data extraction with market analysis, stakeholders can anticipate emerging trends, pinpoint high-value locations, and adjust investment strategies in real time.

In addition, tools like the LoopNet Housing Listings API Scraper ensure seamless access to structured data, which can be further analyzed to understand growth patterns and optimize leasing strategies. With these approaches, 2025 commercial property decisions can be more informed, timely, and data-driven, ultimately providing investors with a strategic advantage in an evolving market.

Key Factors Influencing Commercial Property Price Movements

By leveraging Popular Real Estate Data Scraping, investors can identify specific trends in property pricing, helping them make informed strategic decisions. Office spaces in major urban areas, for example, have experienced an average rental increase of 12%, while industrial properties remain stable because of high logistics demand.

| Property Type | Average Rent Increase (%) | Lease Duration (Months) | Sale Price Change (%) |

|---|---|---|---|

| Office | 12 | 24 | 8 |

| Retail | 7 | 36 | 5 |

| Industrial | 5 | 48 | 6 |

Monitoring these trends allows investors and businesses to forecast occupancy costs and negotiate better lease agreements. Additionally, tools like LoopNet Retail, Industrial, Office Data Crawler help aggregate historical and real-time data across property segments, enabling precise market comparisons.

This comprehensive approach provides insight into underpriced locations and emerging investment opportunities in high-demand areas. By focusing on granular property-level data, stakeholders can evaluate short-term profitability and long-term growth potential more effectively.

Understanding fluctuations in commercial property prices is essential for strategic decision-making. Incorporating technology-driven analytics ensures that investment decisions are based on robust datasets rather than speculation, enabling stakeholders to position themselves advantageously in a dynamic 2025 market.

Strategies for Maximizing Returns in Investment Decisions

In a competitive 2025 market, investors must rely on Web Scraping Real Estate Data to evaluate regional performance and optimize portfolio returns. Detailed insights reveal which areas are experiencing the fastest rental growth and which sectors are potentially oversaturated. For instance, industrial hubs near logistics corridors have recorded a 10% increase in lease rates, indicating strong demand.

| Market Type | Rent Growth (%) | Average Vacancy (%) | Predicted Sale Price (%) |

|---|---|---|---|

| Urban Office | 12 | 9 | 8 |

| Suburban Retail | 6 | 11 | 5 |

| Industrial Park | 10 | 5 | 7 |

Investors can use these insights to allocate resources strategically, adjust leasing offers, and develop long-term acquisition strategies. Integration of Commercial LoopNet Property Dataset with predictive analytics enables risk reduction while maximizing returns on property investments.

Analyzing regional and property-type specific data helps identify underappreciated markets or emerging hotspots for office, retail, and industrial sectors. This approach empowers investors to make timely interventions in portfolio management, ensuring profitability and sustainability.

Leveraging data insights alongside advanced technology tools offers a detailed view of property performance across various markets. Incorporating Real Estate Market Trends 2025, stakeholders can develop predictive models for rent, lease, and sale price movements, ensuring investment decisions remain evidence-based, forward-looking, and strategically robust.

Forecasting Commercial Property Opportunities Through Analysis

Forecasting property performance requires comprehensive evaluation of Real Estate Datasets to understand potential growth in rental, lease, and sale prices. Retail properties in developing urban centers are projected to experience a 9% increase in rent, while office hubs show moderate variation. By analyzing location-specific trends, investors can identify high-yield opportunities and avoid markets with limited growth potential.

| Property Type | Projected Rent Increase (%) | Sale Price Projection (%) | Market Demand Index |

|---|---|---|---|

| Office | 6 | 7 | 78 |

| Retail | 9 | 8 | 85 |

| Industrial | 5 | 6 | 80 |

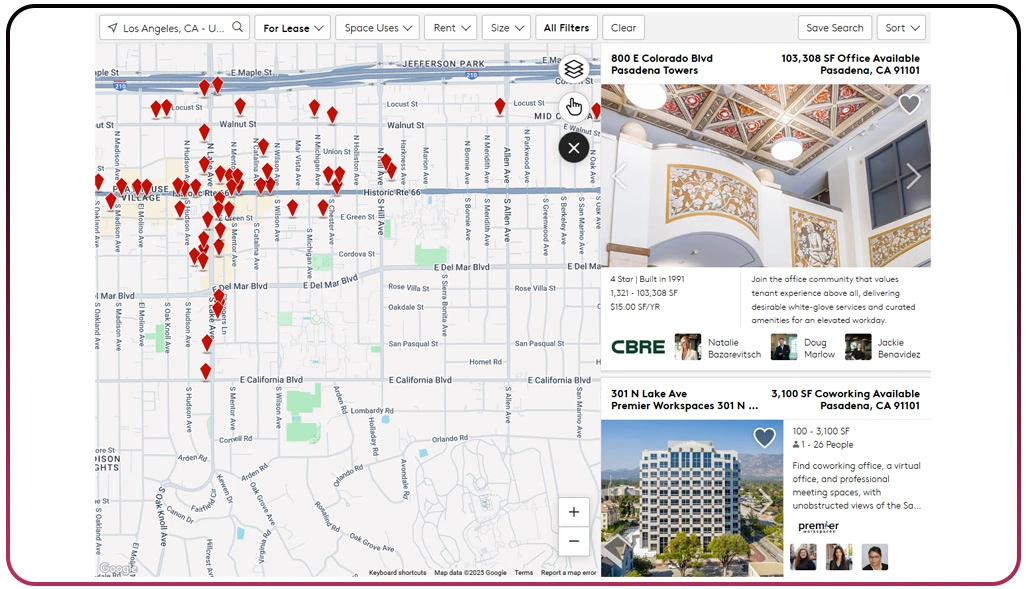

The application of LoopNet Property Location Intelligence Scraper allows users to visualize property data geographically, offering micro-level insights into market trends. This helps investors locate emerging hotspots, optimize acquisitions, and plan long-term portfolio strategies effectively.

Comprehensive datasets provide actionable intelligence for better capital allocation, lease negotiation, and risk management. Stakeholders can track historical performance alongside real-time updates, enabling informed decision-making in 2025's fast-evolving commercial real estate environment.

By combining location intelligence with robust data analytics, investors gain a strategic advantage. Detailed evaluation of property trends ensures that each investment aligns with market demand, providing a strong foundation for both short-term and long-term profitability.

How Web Data Crawler Can Help You?

For businesses aiming to understand 2025 property dynamics, our platform offers advanced data extraction capabilities. Web Scraping LoopNet Rental, Lease, and Sale Price Trends enables investors to collect, analyze, and visualize pricing information across multiple commercial sectors.

Key benefits include:

- Automated extraction of rental and lease information.

- Real-time monitoring of property listings.

- Detailed insights into sale price fluctuations.

- Aggregated historical and current data analysis.

- Comprehensive regional and market-specific trends.

- Efficient export and reporting options.

Additionally, our tools integrate with the LoopNet Property Location Intelligence Scraper, allowing clients to evaluate property potential based on geographic data. With these solutions, decision-making becomes faster, data-backed, and highly strategic for 2025 commercial real estate moves.

Conclusion

Navigating 2025 commercial real estate markets requires precision, insight, and reliable data sources. Web Scraping LoopNet Rental, Lease, and Sale Price Trends equips investors with the tools needed to assess pricing patterns, make informed lease negotiations, and strategically acquire properties.

Incorporating insights from the LoopNet Retail, Industrial, Office Data Crawler ensures every investment is backed by actionable intelligence. Begin optimizing your commercial property strategy today with our robust web scraping solutions and secure a competitive advantage in the evolving market. Contact Web Data Crawler to get started immediately.