What Role Does John Lewis Product Data Extraction for Retail Pricing Insights Play in 40% Competitor Benchmarking?

Dec 12

Introduction

In today's evolving retail landscape, data-driven pricing decisions determine how effectively brands compete, scale, and position their products across major digital marketplaces. This growing reliance on actionable insights has made John Lewis Product Data Extraction for Retail Pricing Insights a crucial foundation for building competitive advantage across multiple product categories.

Businesses analyzing price sensitivity or monitoring market alignment often use curated datasets to evaluate where pricing gaps occur and how competitors adjust their strategies. Additionally, the growing need to Scrape Johnlewis Product Data reflects how brands increasingly depend on structured retail datasets to anticipate market patterns before they impact conversions.

By implementing a strategic extraction process, companies can enhance forecasting accuracy, improve margin controls, and conduct deeper product-specific evaluations. Ultimately, retailers gain a stronger command of data interpretation—turning raw marketplace information into meaningful direction for smarter pricing and improved benchmarking outcomes.

Strengthening Pricing Evaluation Through Streamlined Market Data Structuring

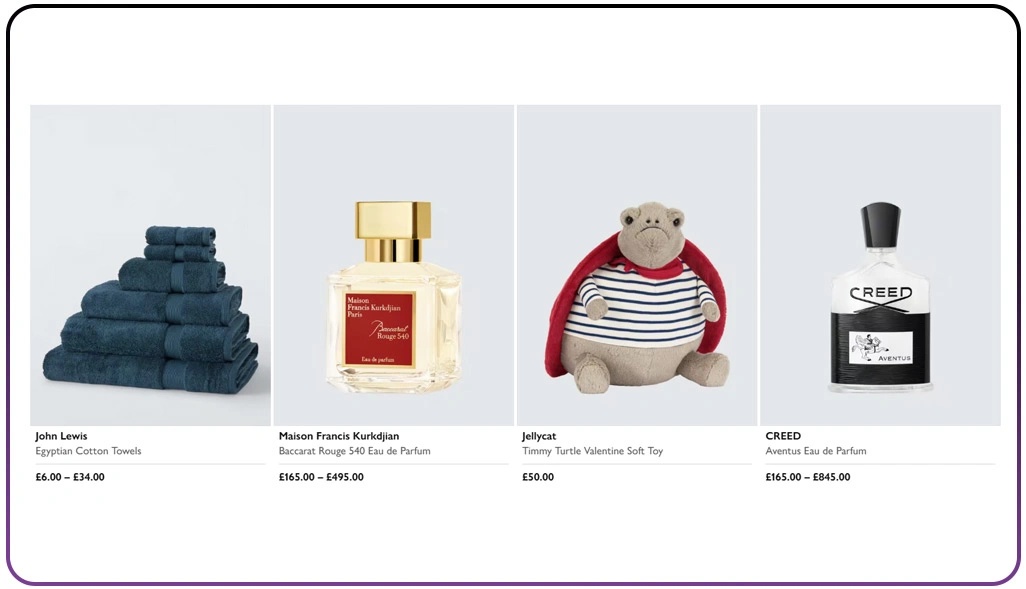

Retailers depend on accurately structured market data to analyze category variations, study product shifts, and shape smarter pricing decisions. However, as digital marketplaces continue to expand, extracting product-level information with consistency becomes more challenging due to frequent updates, dynamic product attributes, and varied listing formats.

Automated tools such as John Lewis Pricing API Scraper enhance this process by enabling consistent retrieval of product attributes, price variations, and availability patterns. Meanwhile, businesses seeking broader category visibility often require systems built to Extract John Lewis Catalog via Crawler, supporting deeper segmentation and extracting structured datasets for further analysis.

Retailers also strengthen their analytical capabilities by incorporating datasets derived from Popular E-Commerce Data Scraping, enabling improved visibility into broader pricing behaviors. These extracted insights support forecasting, margin improvements, and promotional timing evaluations.

Core Insights Retailers Gain From Structured Data:

| Insight Type | Description |

|---|---|

| Product-Level Price Tracking | Identifies price shifts across categories. |

| Demand Pattern Analysis | Helps determine seasonal and trend-based variations. |

| Attribute-Driven Pricing | Evaluates pricing impact of product features. |

| Market Position Assessment | Compares value positioning among competitors. |

By establishing consistent extraction workflows, businesses enhance their pricing evaluation, ensure improved accuracy, and achieve more confident and strategic pricing decisions across multiple product lines.

Improving Data Reliability for Enhanced Retail Intelligence Outcomes

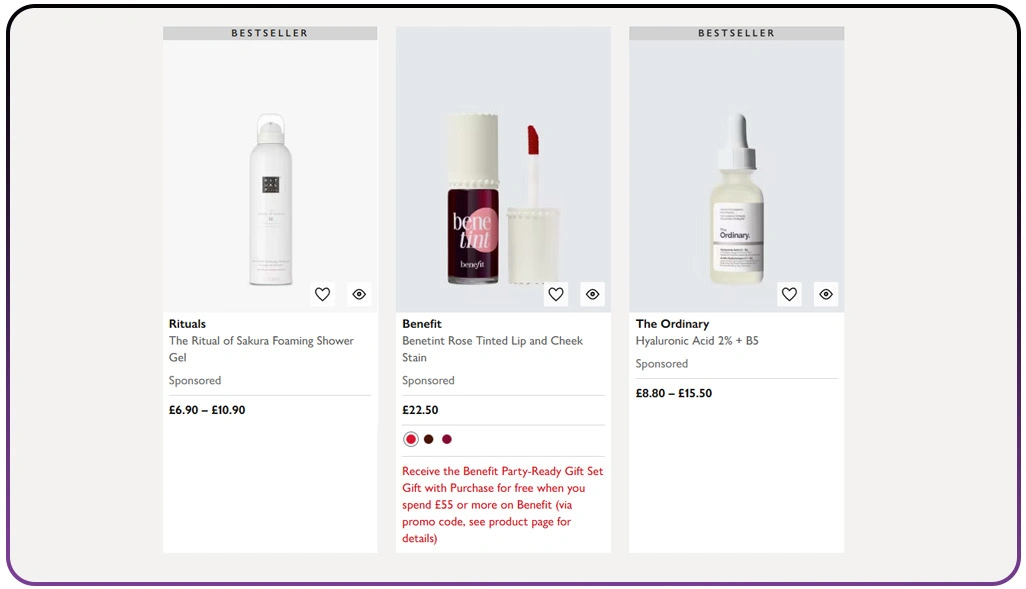

Accurate and updated datasets serve as the backbone of effective pricing strategies, yet marketplace inconsistencies often create gaps that weaken benchmarking precision. Many retailers face challenges stemming from mismatched product attributes, incomplete data points, irregular stock visibility, and misaligned product identifiers. These discrepancies reduce forecasting accuracy and restrict the ability to make informed pricing decisions.

For teams analyzing competitive categories, maintaining data quality ensures accuracy in segment-level evaluations. The integration of automated processes improves clarity, reduces human error, and ensures long-term consistency across analytical workflows. Retailers increasingly depend on automation driven by Web Scraping Ecommerce Data, which streamlines data collection and ensures real-time updates across volatile product categories.

The use of Web Scraping John Lewis Retail Data for London helps brands understand region-based variations, particularly when analyzing demand patterns or competitive behaviors influenced by local market conditions. To strengthen competitive intelligence further, solutions like John Lewis Product Intelligence Extractor for Competitor Analysis support more accurate performance measurement by comparing feature variations, price differentials, and availability trends.

Factors Influencing Data Accuracy:

| Challenge | Impact |

|---|---|

| Attribute Mismatch | Leads to flawed product comparison. |

| Delayed Updates | Causes outdated pricing intelligence. |

| Missing Stock Data | Affects demand forecasting accuracy. |

| Product Inconsistency | Restricts precise benchmarking. |

By streamlining extraction quality and ensuring consistent validation, retailers minimize errors that can influence strategic decisions and maintain stronger analytical alignment across their pricing and benchmarking workflows.

Enhancing Competitive Decision-Making Through Comprehensive Market Evaluation

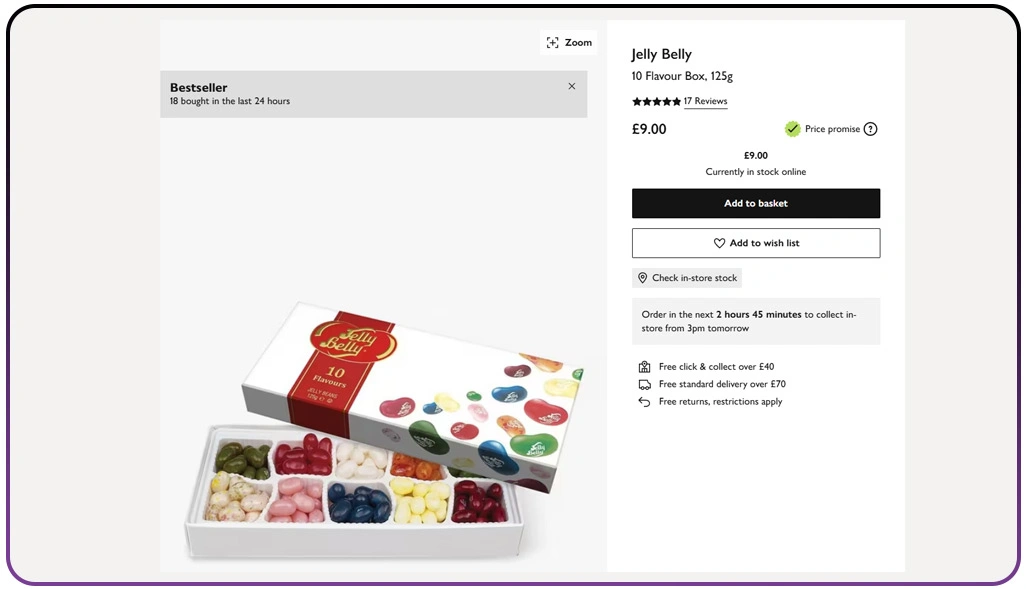

To achieve stronger market positioning, retailers must understand how competitors adjust pricing, manage stock levels, and introduce new product variations. This competitive visibility becomes essential for evaluating performance gaps, identifying opportunities, and strengthening category alignment.

Modern extraction solutions help teams evaluate pricing structures with precision by ensuring product data is consistently aligned with real-time marketplace behaviors. For competitive pricing assessment, the application of John Lewis Competitor Product Comparison Extractor enables businesses to analyze attribute-level differences, compare pricing movements, and understand the value positioning of similar products across competitors.

The ability to conduct detailed evaluations significantly improves when teams incorporate methodologies associated with Extracting John Lewis Pricing, Stock Levels, and Catalog Details for Retail Analytics, ensuring full visibility into product variations and stock fluctuations. Additionally, retailers aiming for deeper performance evaluation benefit from integrating insights associated with Competitive Benchmarking, which acts as a crucial reference for analyzing category performance and product-level pricing consistency.

Key competitive indicators tracked by retailers:

| Indicator | Purpose |

|---|---|

| Stock Level Variations | Predict competitor supply cycles. |

| Discount Changes | Identify promotional opportunities. |

| Attribute Differences | Compare feature and value positioning. |

| Frequent Price Shifts | Track competitor responsiveness. |

By building comprehensive oversight through streamlined extraction workflows, businesses enhance competitive decision-making and refine pricing outcomes with greater accuracy.

How Web Data Crawler Can Help You?

To refine operational efficiency, retailers often seek structured extraction methods that support data accuracy, competitive evaluations, and improved visibility across multiple channels. These enhancements ensure that retailers integrating John Lewis Product Data Extraction for Retail Pricing Insights experience improved clarity and faster decision workflows.

Our approach includes:

- Clean and structured datasets for detailed evaluation.

- Automated monitoring schedules for continuous data visibility.

- Real-time updates to improve pricing efficiency.

- Scalable extraction systems supporting large catalogs.

- Detailed reporting tailored to your analytical goals.

- Custom logic mapping for product-level filtering.

With a strong delivery framework driving consistent output, teams can conduct deeper analysis supported by actionable insights delivered with precision, strengthened further by Web Scraping John Lewis Retail Data for London.

Conclusion

Retailers operating in fast-moving digital environments require actionable insights that help them refine pricing strategies and strengthen competitive positioning. Accurate datasets supported by John Lewis Product Data Extraction for Retail Pricing Insights allow brands to analyze pricing structures with clarity, optimize category-level decisions, and maintain stronger operational control across marketplaces.

With comprehensive datasets strengthened by Extracting John Lewis Pricing, Stock Levels, and Catalog Details for Retail Analytics, retailers can accelerate growth and drive more strategic outcomes. Connect with Web Data Crawler today to elevate your retail pricing intelligence with reliable, real-time structured data.