Real Estate Data Scraping for Competitive Analysis - Tracking Trends Across 99acres, MagicBricks & Housing.com

July 21

Introduction

India’s real estate landscape has transformed into a fast-paced, data-driven ecosystem. Whether you're an investor identifying emerging trends or a developer exploring untapped markets, the foundation of decision-making today is data, not assumptions. That’s precisely where Real Estate Data Scraping comes into play. This strategic approach enables businesses to track evolving property listings, monitor fluctuations in regional demand, and capture price changes in real-time.

In this blog, we’ll explore how data scraping is reshaping the way real estate professionals track listings and interpret market trends, especially by leveraging platforms such as 99acres, MagicBricks, and Housing.com.

What Is Real Estate Data Scraping?

Real Estate Data Scraping is the automated process of collecting structured, property-specific information from leading portals like 99acres, MagicBricks, and Housing.com. This technique enables the creation of robust datasets for in-depth analysis and informed real-time decision-making.

By scraping these platforms, businesses can extract key metrics such as property type, square footage, listing price, location details, seller type, availability duration, and on-site amenities—far more efficiently than manual browsing.

Here’s a closer look at what scraping typically includes:

- Comprehensive regional property listings across metro and tier-2 cities.

- Historical price data that helps forecast trends and timing strategies.

- Seller behavior patterns, including listing modifications and response cycles.

- Assessment of the demand-to-supply ratio in hyperlocal areas.

- Inferred market sentiment derived from the frequency and type of listings.

This granular view enables property investors to craft well-informed strategies for purchasing, renting, or reselling real estate based on current and predictive market dynamics.

Limitations of Traditional Property Research

In the evolving landscape of real estate, relying solely on traditional research methods presents several limitations that hinder timely and strategic decision-making.

Here's why these conventional approaches are no longer enough:

- Manual collection of property data consumes significant time and effort.

- Cross-platform listing comparisons are often inefficient and prone to errors.

- Information collected is inconsistent, incomplete, or quickly outdated.

- There's no reliable mechanism for historical tracking to support long-term strategies.

Given the dynamic nature of the real estate market, professionals can't afford delays or inaccuracies. This is why Real Estate Data Scraping has emerged as a vital resource, delivering accurate, current, and structured insights that empower better investment decisions and market responsiveness.

Real-Time Property Insights from Leading Portals

Unlock strategic opportunities by scraping real-time data from India’s top three real estate platforms. These sources offer rich, structured information crucial for market tracking, investment planning, and regional demand assessment.

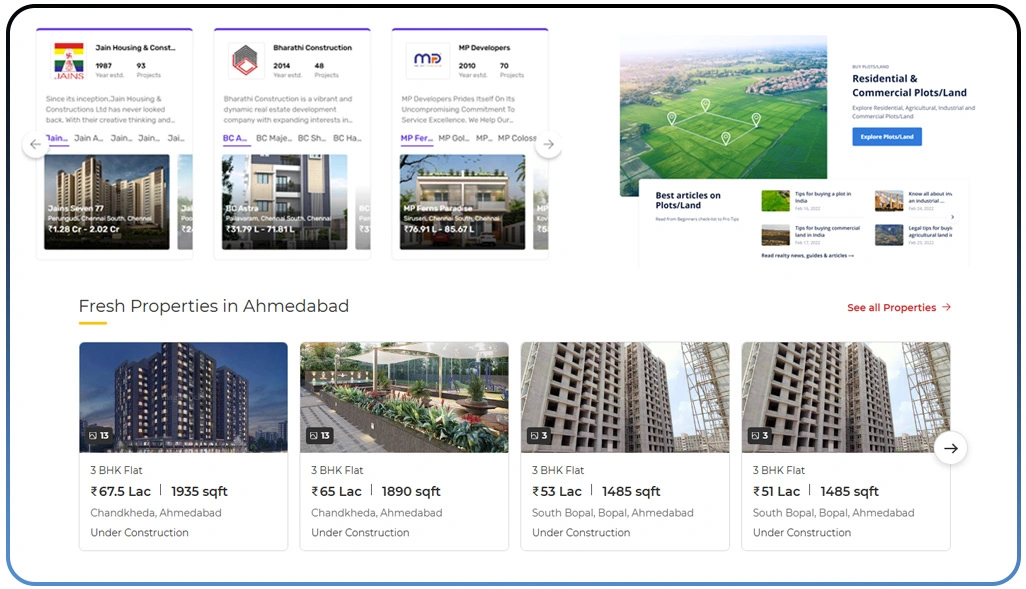

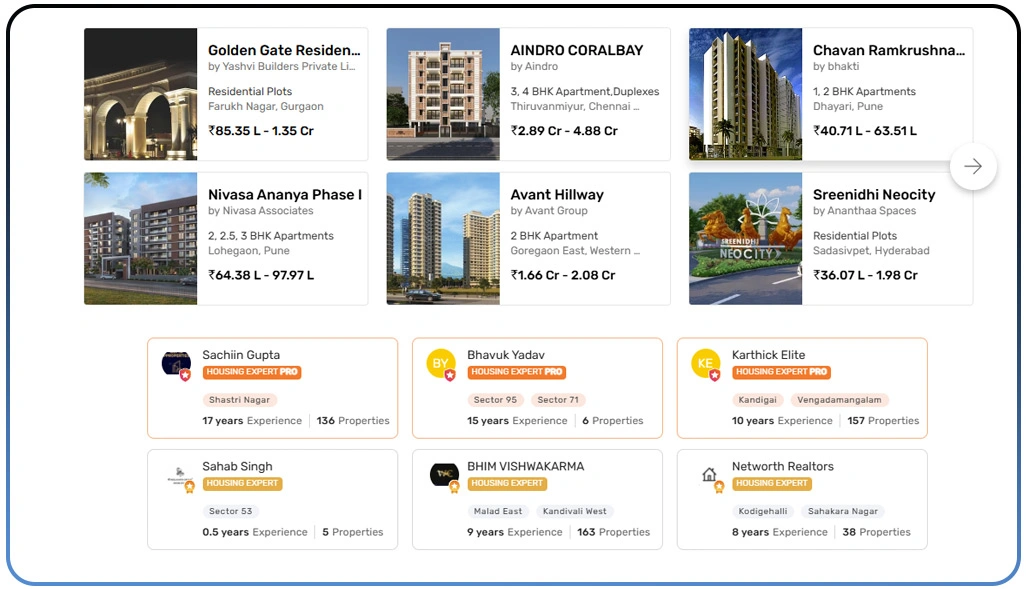

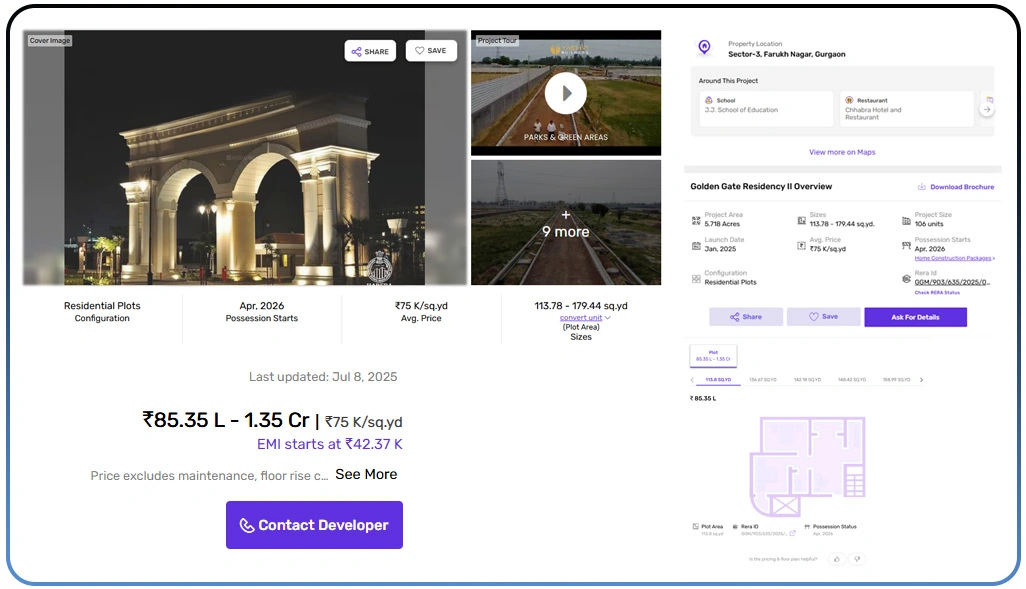

1. 99 Acres

Through 99 Acres Data Scraping, real estate professionals and investors can collect detailed information on both commercial and residential properties. The data supports intelligent filtering by location, price range, property type, and other attributes.

Key advantages include:

- Granular filtering for tier 1 and tier 2 city markets.

- Continuous tracking of newly added or delisted properties.

- Identifying growth trends across evolving micro-markets.

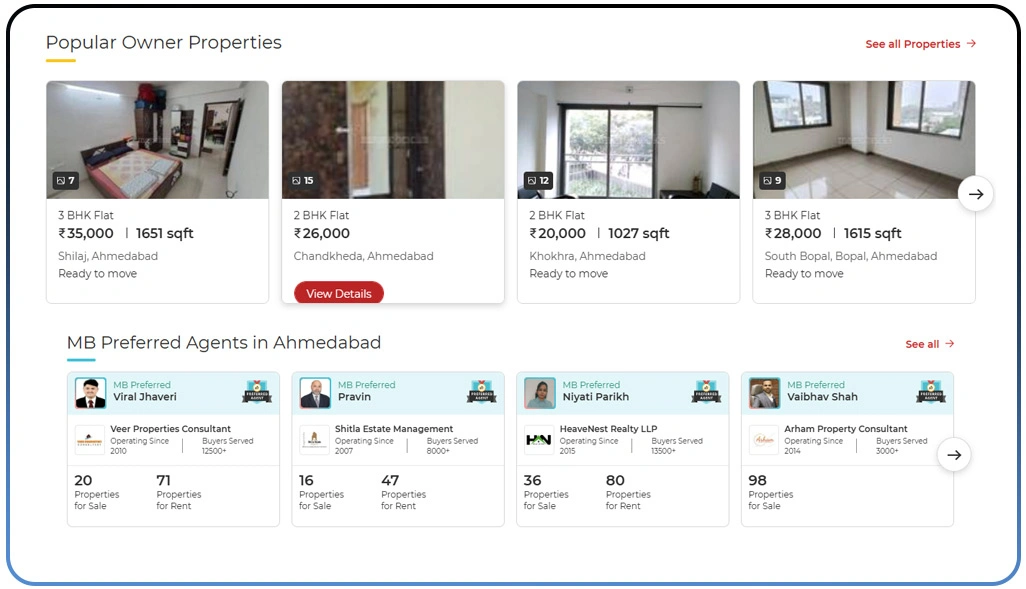

2. Magicbricks

Automating Magicbricks Listings Extraction enables seamless access to historical and real-time data on property listings. This helps track pricing behavior, availability, and listing consistency.

Core benefits are:

- Detailed rental and sale data tailored to specific geographies.

- Consistent updates on changes in listing status or pricing.

- Valuable inputs for developing localized market dashboards.

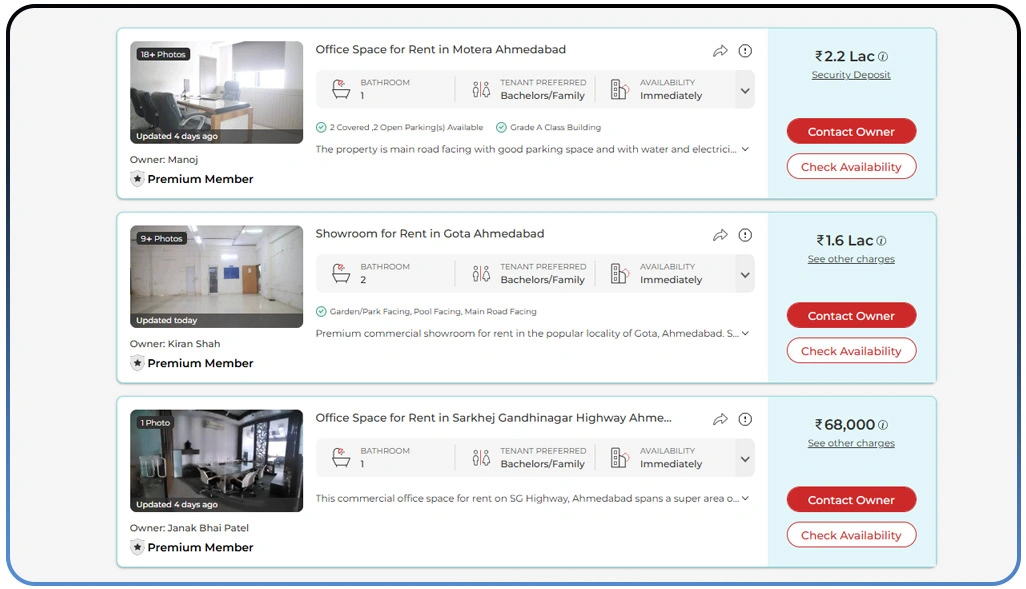

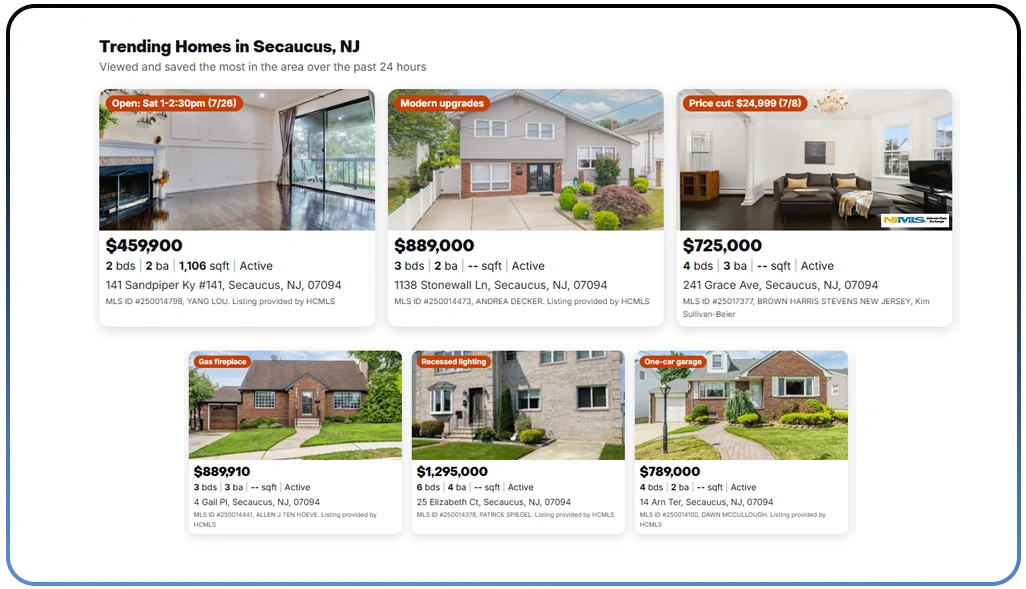

3. housing.com

Scraping housing.com Property Data delivers high-quality, curated property listings from verified sources, ideal for performance-driven analysis.

This data enables:

- Real-time insights into residential inventory supply.

- Evaluating affordability ratios across diverse locations.

- Monitoring active listings with immediate status changes.

Benefits of Market Trend Monitoring through Scraping

Scraping is no longer just a method for pulling property listings—it’s a strategic approach to decoding market signals. When tracking Property Price Trends India, businesses and investors can uncover powerful insights by analyzing price shifts across different cities and neighborhoods.

Benefits include:

- Spotting zones with the highest price appreciation potential.

- Gaining clarity on how both buyers and sellers behave across regions.

- Assessing rental vs. resale market dynamics to gauge ROI.

- Identifying emerging over-supply or under-supply situations before they affect profitability.

- Strategizing the best entry or exit points based on market cycles.

With continuous access to Real-Time Property Data Feeds, you stay aligned with real-world trends and make timely, data-backed investment decisions.

Use Case: How Real Estate Scraping Fuels Smarter Property Investments?

Picture this: you’re planning to invest in a residential property in Pune. Rather than relying on scattered portal browsing, you streamline your research using:

- Real Estate Web Scraping Tools to gather hundreds of active listings in a matter of minutes.

- Insights into average price ranges, unit plans, demand in different localities, and how frequently agents list new inventory.

- Pattern recognition across Housing Market Dataset India to trace affordability fluctuations month-over-month.

- Comparison of locality-level data—sales trends, inquiry volumes, seller activity—to spot real opportunities.

- Deep dives via Real Estate Investment Data Scraping to evaluate historical performance and predict returns more accurately.

By combining data from multiple dimensions, you transition from speculative investing to a clear, strategic framework for identifying growth-ready neighborhoods.

Turning Raw Property Data into Actionable Investment Intelligence

In the fast-paced world of real estate, the ability to rely on accurate data aggregation plays a critical role in forming sound strategies. Automated aggregation not only minimizes manual errors but ensures continuous updates, keeping your property intelligence both fresh and relevant. This accuracy lays the groundwork for confident decisions by identifying data gaps, filtering unreliable inputs, and helping Extract Property Listings that offer meaningful context such as pricing history, amenities, and market status.

Once data is collected, the actual value emerges through analytics. Platforms like Magicbricks Property Analytics help convert raw information into strategic insights using visual tools and intelligent segmentation. These solutions don’t just simplify vast datasets—they guide investors and realtors toward predictive, high-confidence moves across micro-markets and asset categories.

- Ensure consistent real-time updates for market-ready insights.

- Minimize manual review errors and enhance data reliability.

- Detects anomalies, such as duplicate or overpriced listings, effortlessly.

- Extract Property Listings with detailed metadata for richer segmentation.

- Access trend visualizations through interactive pricing heatmaps.

- Use tools to Scrape housing.com Data based on location, BHK size, and builder type.

Role of Real Estate Intelligence Platforms

Modern Real Estate Intelligence Platforms go far beyond basic data collection. They transform fragmented datasets into actionable insights by cleansing, structuring, and analyzing them to meet specific investment and development needs. These platforms are foundational for informed decision-making across all levels of the real estate value chain.

Here’s how leading platforms contribute to strategic real estate analysis:

- PropertyRadar: Offers property and owner data intelligence to help professionals identify and connect with potential opportunities through geo-targeted filters and predictive analytics.

- Zillow: A widely used consumer real estate platform that also provides valuable data analytics tools, including home value estimates, rental projections, and market trends.

- CoreLogic: Delivers advanced property insights through predictive modeling, market risk assessment, and valuation tools to guide lenders, investors, and insurers.

- Yardi: A full-service property management and investment platform that includes financial performance metrics, leasing analytics, and tenant behavior insights.

- AppFolio: Designed for property managers, it combines leasing, accounting, maintenance, and tenant data into one platform for unified portfolio oversight.

Key functions of these Real Estate Intelligence Platforms include:

- Delivering investor-centric analytics that support due diligence, pricing accuracy, and feasibility studies.

- Equipping developers with interactive dashboards to align pre-launch planning and promotional strategies.

- Enabling agent performance monitoring to reveal who contributes most effectively to deal closures.

- Providing long-term trend projections using datasets like Housing Market Dataset India, ensuring deeper visibility into regional and national patterns.

These tools have become indispensable for enterprise-level stakeholders, enabling them to navigate complex markets and develop scalable, data-driven strategies.

How Web Data Crawler Can Help You?

We specialize in Real Estate Data Scraping solutions designed to give investors, brokers, developers, and research firms a sharper edge in the Indian property market. We help transform fragmented property listings into clean, structured datasets for informed insights and more intelligent decisions.

Our scraping solutions are adaptable, real-time, and built to suit your specific data requirements.

Here’s how we can support your goals:

- Automated pipelines to fetch updated property data.

- Customized logic for location, property type, and price range.

- Seamless integration with dashboards and CRM tools.

- Clean and structured output for analytics.

- Real-time alerts on listing changes or new entries.

- Historical data tracking for trend analysis.

- Support across major portals and listing platforms.

Whether you're monitoring price movements, tracking new projects, or analyzing market dynamics, we ensure high-quality, reliable Property Site Data Collection to fuel your strategy.

Conclusion

Transforming unstructured listings into strategic insights is no longer optional—it's essential. With Real Estate Data Scraping, investors gain real-time visibility into market trends, buyer behavior, and pricing dynamics, helping them make informed and timely investment decisions.

Whether you're analyzing market movements or comparing regional trends, access to reliable Property Price Trends India data can give you the competitive edge you need. Contact Web Data Crawler today to build your custom real estate data pipeline and make smarter, data-driven property decisions.