How Does Florida Grocery Price Comparison Reveal 12% Cost Gap Between Walmart, Publix, and Winn-Dixie?

Jan 01

Introduction

Florida shoppers face noticeable price differences across major grocery chains, influenced by location, sourcing strategies, and store-level pricing policies. Recent statewide analysis highlights a consistent cost gap when comparing everyday essentials such as dairy, packaged foods, produce, and household items across leading retailers. Through Florida Grocery Price Comparison, analysts observed that regional price variations can quietly add up to significant monthly spending differences for families.

Advanced data collection methods enable analysts to compare shelf-level pricing across regions, revealing patterns that were previously difficult to quantify. Using structured datasets, analysts can examine staple categories such as dairy, produce, packaged foods, and household essentials. These insights highlight how competitive strategies differ across retailers and how regional demand influences pricing stability.

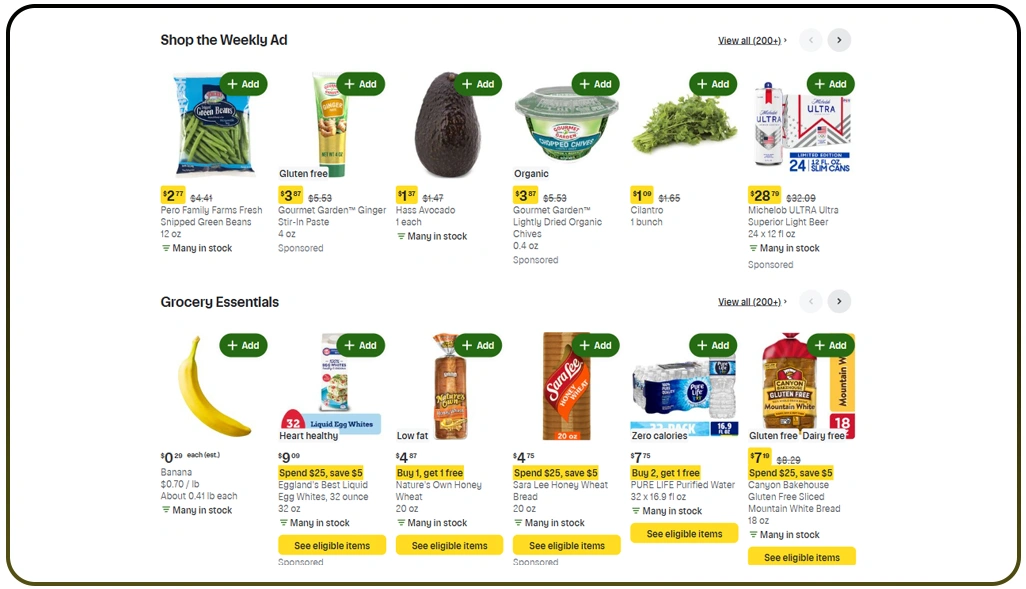

The integration of Publix Grocery Data API further supports granular analysis by enabling structured access to category-level pricing and product availability. When combined with historical pricing trends, this approach clarifies why certain retailers maintain consistent pricing while others show noticeable fluctuations. The result is a clearer picture of how Florida grocery pricing dynamics shape consumer spending decisions across the state.

Measuring Retail Price Variations Across Chains

Price variation among leading grocery chains reflects deeper operational and strategic differences rather than random fluctuations. Each retailer structures pricing based on supply agreements, store footprint, customer volume, and competitive pressure within specific Florida regions. When identical grocery baskets are compared, the resulting differences reveal how retailers position themselves within value-driven or experience-focused segments.

Large-format retailers often prioritize cost efficiency through bulk sourcing and centralized distribution. In contrast, regionally dominant chains focus on curated assortments and localized sourcing, which can elevate shelf prices. Mid-tier competitors frequently balance both approaches to retain price-sensitive shoppers while maintaining acceptable margins.

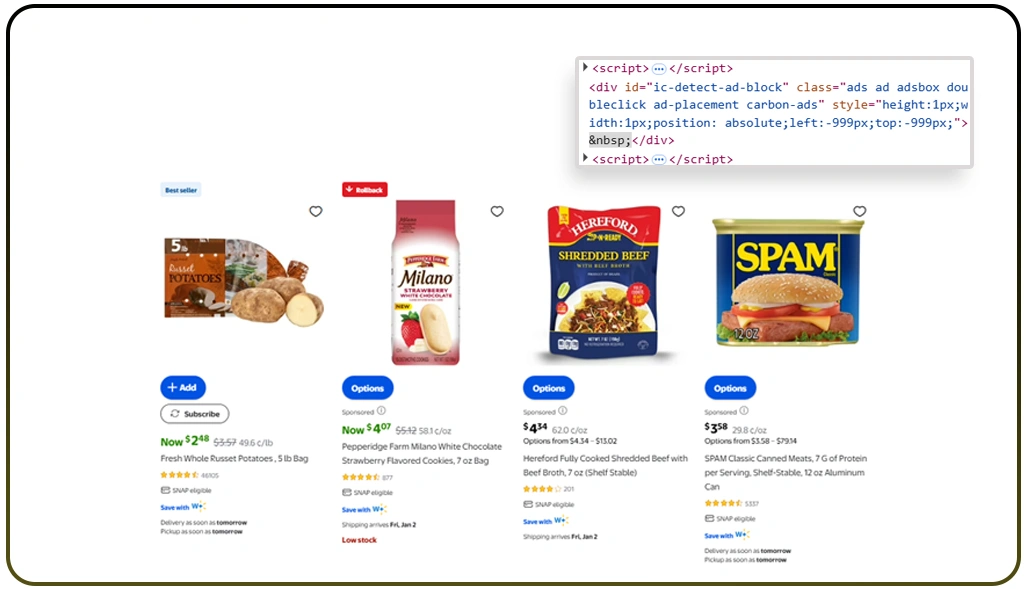

Access to structured datasets through Walmart Grocery Data API enables consistent collection of SKU-level pricing across multiple store locations. This structured access makes it possible to compare identical products without discrepancies caused by packaging or regional assortment changes. Data accuracy improves further when supported by Walmart Grocery Price Scraper, which validates real-time shelf prices across store formats.

| Retail Chain | Pricing Approach | Basket Cost Trend | Competitive Position |

|---|---|---|---|

| Walmart | Volume-driven | Lower | Cost Leader |

| Publix | Experience-focused | Higher | Premium |

| Winn-Dixie | Balanced | Moderate | Value Hybrid |

These comparisons show that pricing gaps are deliberate outcomes of retail strategy. When analyzed collectively, they help businesses and analysts understand how retailer positioning directly affects consumer spending patterns across Florida markets.

Geographic Market Dynamics Influencing Store Pricing

Grocery pricing patterns vary significantly between urban, suburban, and rural locations due to differences in logistics, demand density, and consumer behavior. Urban stores typically experience higher operational expenses, which influence shelf pricing, while rural outlets emphasize affordability to retain loyal, repeat shoppers. These geographic dynamics shape how retailers compete across Florida.

Delivery-focused consumption has further intensified these differences. The inclusion of Quick Commerce Datasets reveals that convenience-oriented pricing models in dense metro areas prioritize speed over cost efficiency. As a result, prepared foods and fresh items show higher variability in city centers compared to rural regions, where pricing remains more stable.

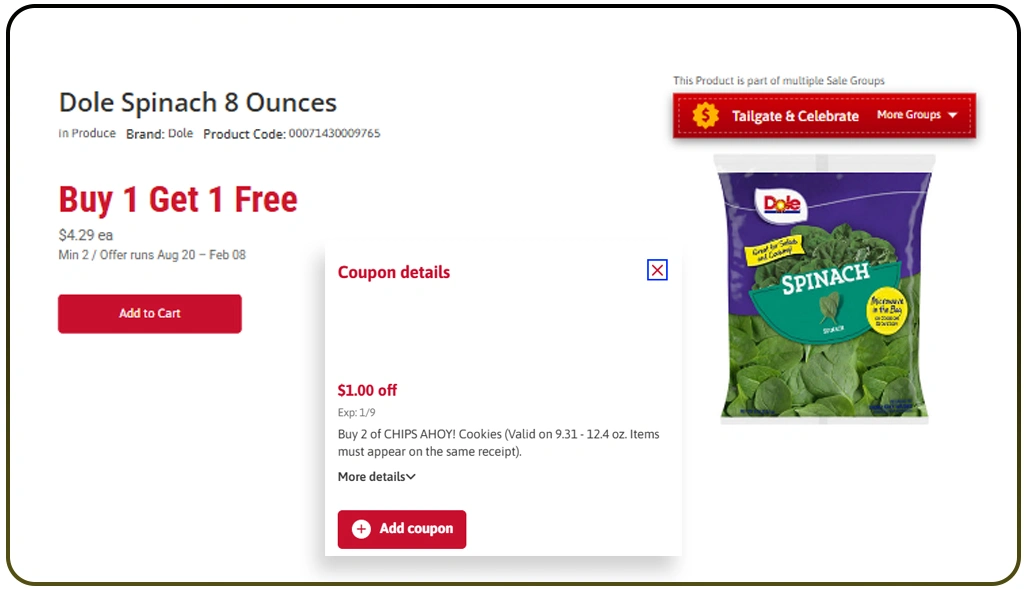

To monitor these shifts accurately, Publix Product Price Monitoring via Crawler supports location-level tracking, capturing how prices change based on demand cycles and seasonal fluctuations. At the same time, Winn-Dixie Pricing Data Extraction highlights how discount-led strategies are deployed in suburban and rural markets to maintain competitiveness.

| Market Type | Price Stability | High-Variation Categories | Dominant Strategy |

|---|---|---|---|

| Urban | Low | Fresh, Ready Meals | Convenience |

| Suburban | Medium | Packaged Goods | Balanced |

| Rural | High | Staples | Affordability |

These findings demonstrate that geography plays a central role in shaping grocery pricing behavior. When location-based insights are combined with retailer strategy, businesses gain a clearer understanding of how regional market conditions influence consumer costs.

Strategic Pricing Approaches Shaping Retail Competition

Retail competition increasingly depends on how effectively pricing strategies respond to market signals. Rather than relying on static pricing, successful retailers adjust prices dynamically based on competitor movements, demand elasticity, and inventory turnover. These strategic adjustments directly influence basket retention and customer loyalty.

Data-driven evaluation using Pricing Intelligence allows retailers to identify competitor pricing shifts and optimize their own strategies accordingly. Analysis shows that retailers implementing frequent price adjustments experience stronger short-term engagement, while those maintaining stable pricing benefit from long-term trust and predictability.

Aggregating large-scale datasets through Web Scraping Florida Supermarket Data provides a consolidated view of market behavior across chains and regions. This unified data approach supports comparative analysis, enabling businesses to assess promotional effectiveness, price sensitivity, and category-level competitiveness.

| Pricing Model | Adjustment Frequency | Customer Impact | Revenue Effect |

|---|---|---|---|

| Dynamic | Weekly | High Engagement | Variable |

| Stable | Low | High Trust | Consistent |

| Promotion-led | Event-based | Short-term Spikes | Fluctuating |

These insights confirm that pricing success depends on balance rather than extremes. Retailers that combine competitive awareness with disciplined execution are better positioned to sustain margins while remaining relevant in evolving grocery markets.

How Web Data Crawler Can Help You?

Modern grocery analytics require more than manual observation. Businesses and analysts increasingly rely on structured data pipelines to evaluate regional pricing behavior accurately. Through Florida Grocery Price Comparison, decision-makers can transform scattered price points into actionable intelligence that supports smarter planning and market responsiveness.

How we supports your goals:

- Collects large-scale retail pricing data consistently.

- Tracks regional pricing shifts across store formats.

- Enables historical trend comparisons for forecasting.

- Supports category-level and SKU-level analysis.

- Improves visibility into competitive positioning.

- Reduces dependency on manual data collection.

By integrating advanced crawling systems, businesses can further enhance insights using Winn-Dixie Pricing Data Extraction for targeted competitive analysis and regional benchmarking.

Conclusion

Retail pricing transparency is no longer optional in today’s data-driven economy. When analyzed systematically, Florida Grocery Price Comparison highlights how even modest percentage differences can significantly influence long-term household spending and retailer positioning across diverse Florida markets.

Strategic decisions become more effective when supported by accurate datasets. By combining structured analysis with Web Scraping Florida Supermarket Data, businesses gain clarity, agility, and confidence in their pricing strategies. Connect with Web Data Crawler today to turn grocery pricing data into measurable market advantage.