How to Extract Property Listings and Price Trends From Redfin to Analyze 25% Housing Trends in North America?

Nov 13

Introduction

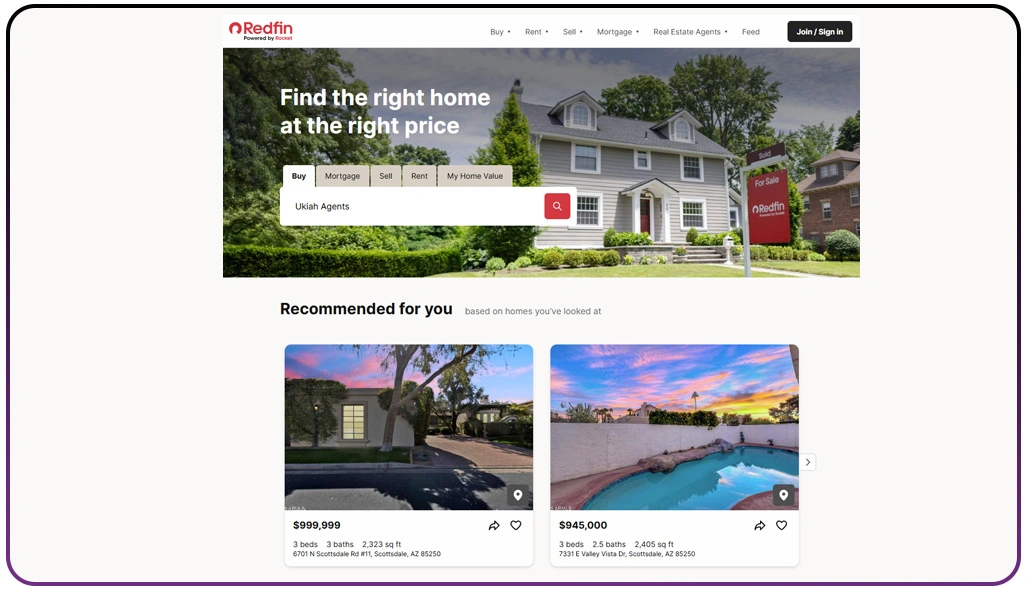

The housing market across North America has seen over a 25% shift in property prices and buyer behavior in recent years. For investors, real estate analysts, and data-driven agencies, accurate insights from online real estate platforms are essential to make informed decisions. When you Extract Property Listings and Price Trends From Redfin, it becomes possible to understand dynamic shifts in property values, supply-demand ratios, and regional market performance.

Through Real Estate Datasets, one can track price fluctuations, identify top-performing cities, and uncover key market factors shaping the industry. Redfin provides a rich source of structured data, making it ideal for analyzing residential listings, trends, and neighborhood-level patterns.

In this blog, we'll explore effective methods to extract and analyze Redfin data, practical problem-solving strategies for different use cases, and how professional data scraping services can empower real estate research.

Tracking Neighborhood Growth Through Market Data Insights

Analyzing regional housing markets has become crucial for professionals seeking accurate data-driven evaluations. The process of gathering information from online property platforms allows investors and analysts to understand neighborhood growth patterns and value fluctuations. This approach highlights areas witnessing higher appreciation and shifting buyer interest across various North American cities.

By implementing Redfin Canada Property Data Scraping Services, researchers can compare Canadian and U.S. market behaviors and establish detailed analytics frameworks. This enables precise evaluation of new development zones and helps identify communities showing consistent appreciation trends. Analysts rely on automated extraction tools that capture relevant variables such as pricing, amenities, square footage, and property type to forecast which localities will deliver better returns over time.

| Metric | Urban Regions | Suburban Regions | Rural Regions |

|---|---|---|---|

| Avg. Price Growth (YoY) | 12% | 25% | 8% |

| New Listings Volume | 45,000 | 65,000 | 12,000 |

| Avg. Days on Market | 22 | 18 | 30 |

Integrating Real-Time Redfin Data Scraping for Housing Market Research allows organizations to maintain current insights across all provinces and states. This technique offers real estate professionals a holistic perspective of micro-market activities and supports predictive modeling for long-term property investments.

The ability to analyze property data across multiple regions creates a deeper understanding of how local demographics, infrastructure projects, and buyer patterns collectively influence housing demand, helping investors position themselves for growth.

Understanding Buyer Behavior and Market Influencing Trends

Advanced extraction methods offer insights into consumer behavior, pricing models, and purchasing motivations that drive regional trends. Real estate companies and investors rely heavily on accurate, time-sensitive data to make confident purchase or selling decisions. Through digital analysis, professionals can visualize how property prices evolve, monitor listing volumes, and study patterns of housing absorption rates across different categories.

Using Real Estate Data Scraping enables continuous tracking of listings, providing visibility into price adjustments and seasonal demand shifts. Researchers can identify significant connections between interest rates, new infrastructure developments, and neighborhood growth cycles. For instance, a recent study shows properties located near transportation routes have experienced approximately 18% higher listing activity compared to properties in less accessible zones.

| Category | Avg. Listing Price (USD) | Sold-Price Ratio | Demand Index |

|---|---|---|---|

| Near Transit Areas | 520,000 | 97% | High |

| Suburban Family Homes | 470,000 | 94% | Moderate |

| Downtown Condos | 610,000 | 92% | High |

With automation powered by Redfin API Data Scraper, data analysts can integrate structured information into advanced forecasting models. It assists real estate firms in understanding what drives buyer intent and how local factors shape listing outcomes.

This approach transforms vast property databases into meaningful decision-making insights, giving investors the capability to compare dynamic market segments effectively. The outcome is a more comprehensive understanding of what truly impacts residential purchasing behavior, helping organizations refine their strategies for better results.

Comparing Regional Price Movements and Investment Forecasts

Regional housing dynamics often reveal significant insights about investment opportunities and price movements. Data-centric evaluations help experts identify the potential for appreciation and determine which localities will deliver consistent value in the coming years. Continuous analysis provides actionable insights into how regional demographics, employment rates, and migration patterns affect property pricing cycles.

Through Popular Real Estate Data Scraping, professionals can compile extensive housing information from multiple sources to build reliable forecasting models. These datasets reveal how population growth, urban development, and lifestyle trends impact housing affordability and market resilience. For example, in major tech hubs and rapidly urbanizing zones, prices have risen between 20% and 30% over the last two years, reinforcing strong buyer confidence in these markets.

| Region | 2-Year Price Change | Population Growth | Average Rental Return |

|---|---|---|---|

| West Coast | +30% | +12% | 5.8% |

| Midwest | +18% | +6% | 4.2% |

| Atlantic | +22% | +8% | 4.9% |

The use of Redfin Property Data Extraction enables analysts to gather this vital pricing intelligence systematically, ensuring consistent accuracy across different timeframes. Regional data studies provide the ability to forecast future property values while minimizing risks associated with fluctuating real estate markets.

This method empowers investors to design data-informed strategies that adapt to evolving trends and maximize return potential through calculated decision-making. Ultimately, understanding these regional variations supports better long-term investment planning in competitive housing sectors.

How Web Data Crawler Can Help You?

For real estate professionals aiming to Extract Property Listings and Price Trends From Redfin, we offer powerful and customizable scraping solutions. Our advanced technology automates the extraction of Redfin property data while maintaining structure, precision, and reliability—ideal for researchers, brokers, and analytics teams.

We help you:

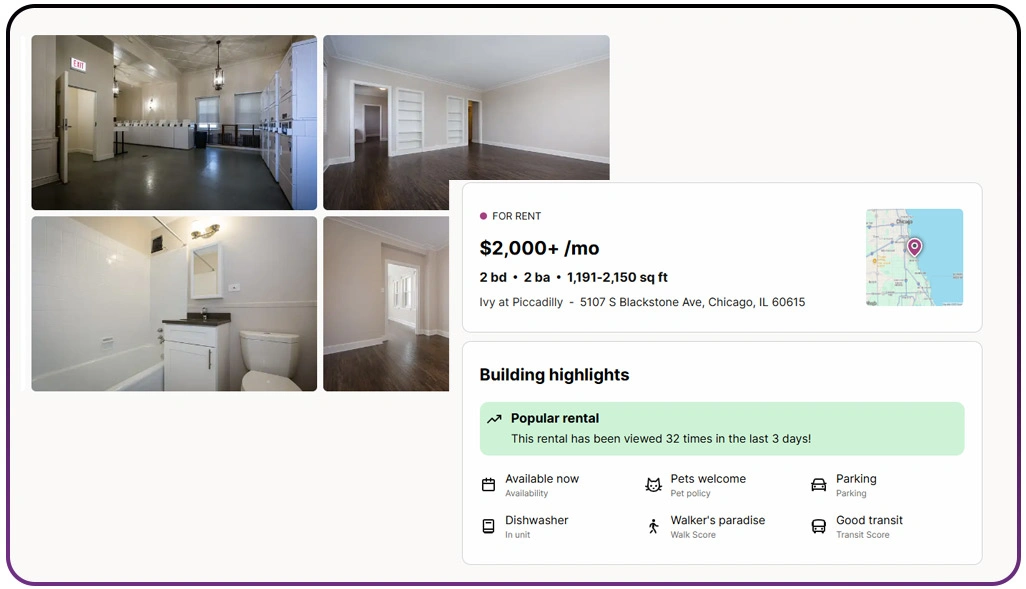

- Collect complete property details, including location, price, and amenities.

- Monitor listing fluctuations in real-time across North America.

- Aggregate and visualize property insights for predictive modeling.

- Build dynamic real estate dashboards for trend tracking.

- Integrate clean data into your business intelligence systems.

- Conduct comparative pricing analysis across multiple property segments.

By partnering with us, businesses gain a strategic edge through consistent, clean, and insightful datasets tailored for housing analytics. With Web Scraping Redfin Data for Real Estate Investors, organizations can elevate research accuracy and optimize investment outcomes efficiently.

Conclusion

Understanding property markets becomes simpler when professionals Extract Property Listings and Price Trends From Redfin to decode market movements, buyer sentiments, and future growth areas. Such insights pave the way for smarter investment decisions and precise forecasting.

Through Scrape Redfin Property Listings and Housing Data, realtors and analysts can capture valuable competitive insights to strengthen their strategy and maximize profitability. Start enhancing your property research with Web Data Crawler today and make data-driven real estate decisions with confidence.