How to Extract Nestoria Real Estate Prices for First-Time Buyers and Cut Property Costs by 20%?

Jan 29

Introduction

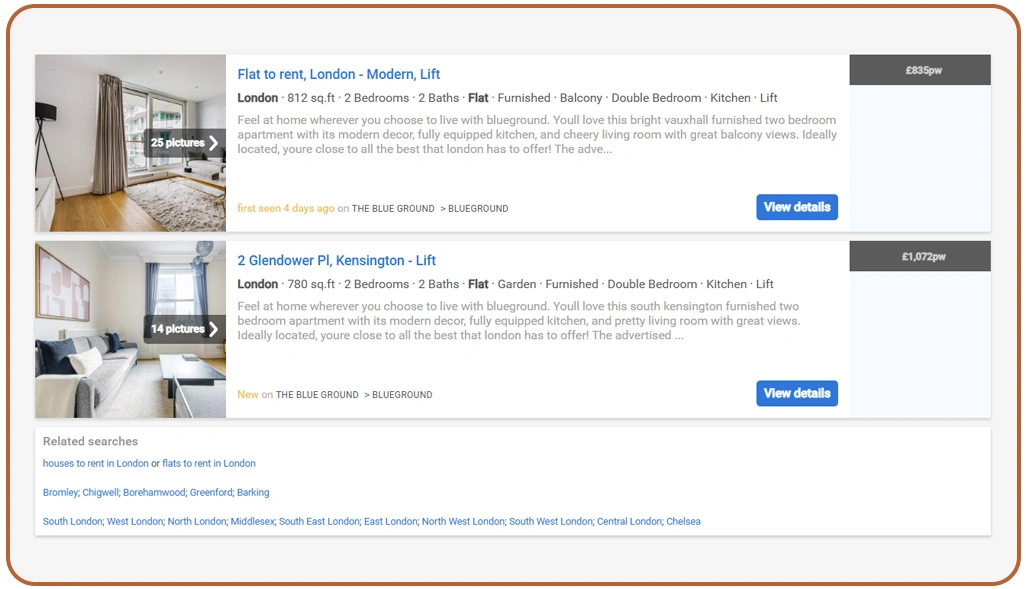

Buying your first home is an exciting yet challenging journey, especially when navigating fluctuating property prices across multiple cities. With rising costs and complex housing markets, first-time buyers often struggle to make informed decisions. One way to simplify this process is by using advanced data techniques that provide clear insights into real estate trends. Nestoria Property Data Scraping Services empower buyers by offering access to comprehensive housing data, enabling smarter and more cost-effective decisions.

Extracting property prices from platforms like Nestoria can reveal hidden patterns, seasonal variations, and city-specific trends that traditional methods often overlook. This information allows first-time buyers to plan budgets efficiently, identify affordable areas, and even negotiate better deals. By learning how to Extract Nestoria Real Estate Prices for First-Time Buyers, you can reduce unnecessary expenses, potentially cutting property costs by up to 20%.

Additionally, using structured data from Nestoria ensures that buyers are equipped with accurate insights rather than relying on anecdotal information or limited listings. In this blog, we will explore practical solutions to extract and analyze Nestoria data, uncovering ways to maximize affordability, improve investment confidence, and streamline the property search process.

Techniques for Identifying Valuable Property Opportunities

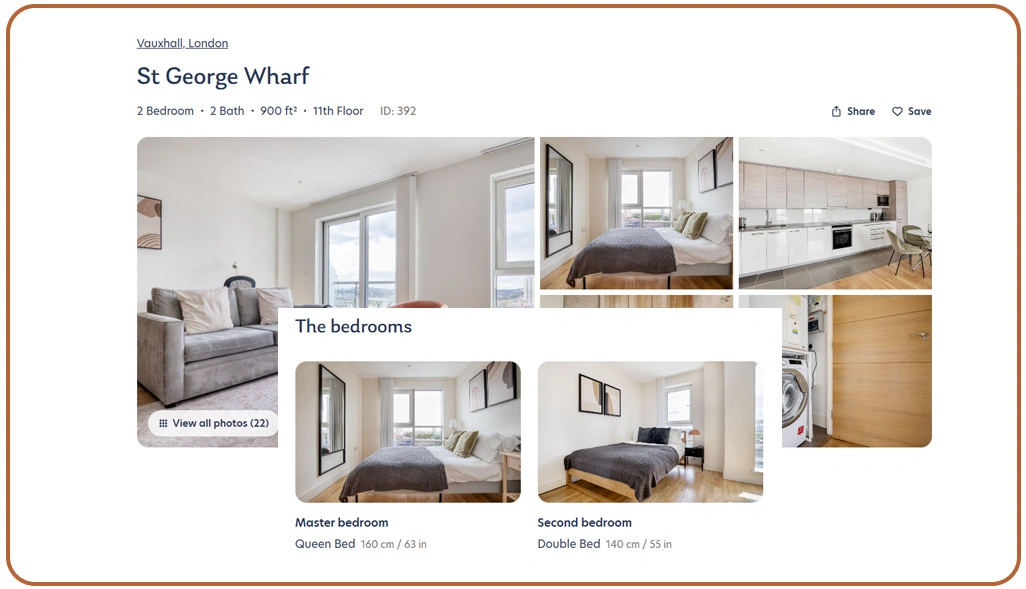

Identifying the best property opportunities requires more than just browsing listings—it requires access to dynamic and reliable information. Many buyers miss out on lucrative deals because they rely solely on outdated sources or scattered listings. With Web Scraping Real Estate Data, it's possible to collect real-time property details including prices, availability, and neighborhood characteristics.

| City | Average Property Price | Price Trend (Last 12 Months) | Potential Savings |

|---|---|---|---|

| London | £420,000 | +3% | £8,400 |

| Manchester | £280,000 | +2% | £5,600 |

| Birmingham | £310,000 | +4% | £6,200 |

| Leeds | £260,000 | +1% | £5,200 |

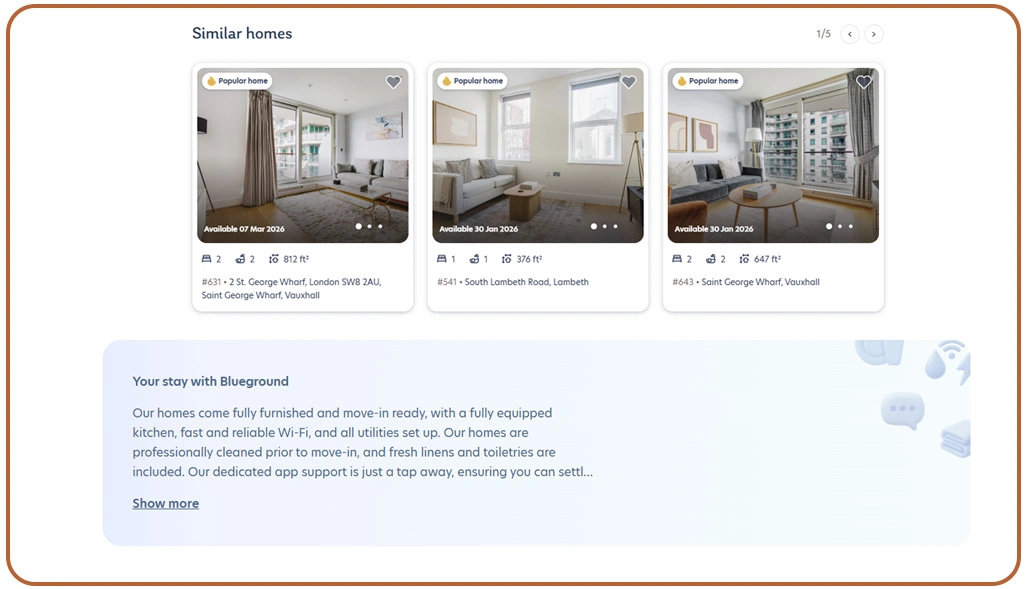

By gathering comprehensive information from property portals, buyers gain a clear view of pricing trends, square footage comparisons, and nearby amenities. Additionally, tools to Scrape Nestoria Property Listings help users analyze patterns and fluctuations that may otherwise go unnoticed.

Access to accurate data allows for better negotiation and budget planning. Real-time insights reveal which areas are rising in value, which neighborhoods are underpriced, and which properties have the best potential for long-term investment. Implementing these methods ensures that buyers can identify hidden opportunities while avoiding overpaying.

Furthermore, using structured extraction techniques reduces the risk of errors that come with manual research. The combination of automated data collection and careful analysis makes it possible to make more informed decisions, ultimately ensuring that property investments are both smart and cost-effective.

Analyzing Data Trends to Make Smart Investments

Making property investments without understanding broader trends can lead to unnecessary expenses. Buyers often struggle to see which neighborhoods or cities offer the best value. Real Estate Datasets collected from multiple sources provide a comprehensive view of price dynamics, seasonal patterns, and city-specific fluctuations, giving buyers a strategic advantage.

| Metric | London | Manchester | Birmingham | Leeds |

|---|---|---|---|---|

| Average Price per Sq Ft | £650 | £480 | £500 | £430 |

| Month-on-Month Price Change | 2.5% | 1.8% | 3.2% | 1.5% |

| Top Affordable Neighborhood | Hackney | Salford | Edgbaston | Headingley |

Using Nestoria Housing Market Data Extraction, buyers can track which markets are emerging and which areas are seeing price increases. The datasets allow users to compare city-wide trends and prioritize locations that offer better affordability.

Analyzing these datasets helps buyers forecast potential changes, identify investment hotspots, and plan purchases with greater precision. Understanding the metrics behind average prices, price-per-square-foot, and neighborhood rankings ensures that financial decisions are backed by evidence rather than intuition.

Moreover, combining multiple data sources improves decision accuracy. By visualizing trends and comparing historical data, first-time buyers can spot cost-saving opportunities and evaluate markets that may offer better long-term value. These structured insights reduce uncertainty and provide a clear roadmap for making smarter housing choices.

Using Market Insights to Minimize Investment Risks

Investing in property involves inherent risks, especially for first-time buyers navigating new cities. Systematic Market Research is essential to reduce uncertainties, including price volatility, neighborhood stability, and time-on-market trends. Detailed analysis provides clarity on areas where investments are safer and where properties may be overpriced.

| Risk Factor | London | Manchester | Birmingham | Leeds |

|---|---|---|---|---|

| Price Volatility (%) | 5.2% | 3.1% | 4.5% | 2.8% |

| Average Days on Market | 45 | 60 | 50 | 55 |

| Potential Cost Reduction | £12,000 | £7,500 | £9,000 | £5,600 |

With the right insights, buyers can predict areas likely to experience fluctuations and avoid overpaying. Using Web Scraping Buyer Insights via Nestoria API, investors gain visibility into buyer behavior, competitive bids, and neighborhood trends that affect property values.

Risk reduction also comes from comparing cities and neighborhoods using structured tables and visualized trends. By evaluating historical performance, buyers can prioritize locations with consistent growth and avoid areas with high volatility. This ensures more secure investments and improved long-term affordability.

First-time buyers armed with these insights can plan their budgets effectively, make timely offers, and feel confident about property purchases. Combining trend data, buyer behavior analytics, and market research results in a comprehensive strategy that minimizes risk and maximizes the value of every real estate decision.

How Web Data Crawler Can Help You?

When navigating complex property markets, having a reliable partner in data extraction can save time and reduce errors. Tools to Extract Nestoria Real Estate Prices for First-Time Buyers efficiently, we employ advanced scraping methods that gather comprehensive property information from multiple cities and housing markets.

Our services include:

- Consolidated property listings for comparison.

- Automated updates on price changes.

- Trend analysis across neighborhoods.

- Visualization of affordability patterns.

- Historical price tracking for future planning.

- Alerts on newly listed or discounted properties.

Using Nestoria Property Price Data Extractor, buyers can transform raw property information into actionable insights, ensuring smarter decisions without the usual hassle of manual research.

First-time buyers can significantly improve their property investment strategies by employing data-driven approaches. By using methods to Extract Nestoria Real Estate Prices for First-Time Buyers, individuals can make well-informed choices that reduce costs and identify hidden opportunities across cities.

Integrating tools like Nestoria Property Data Scraping Services ensures access to accurate, up-to-date market information, enabling buyers to negotiate better deals and optimize budget allocation. Contact Web Data Crawler and start extracting, analyzing, and saving on your next property purchase now!