How to Extract Grocery Promotions and Offers Australia and Monitor 77% Dynamic Price Changes?

Feb 13

Introduction

Australia's grocery market is moving faster than ever, with daily promotional shifts, app-exclusive offers, and location-based price variations influencing consumer buying decisions. Major supermarket apps like Coles, Woolworths, and Aldi regularly update their deals, bundles, weekly specials, and limited-time discounts, making it difficult for brands and retailers to manually track changes at scale.

Smart tools to Extract Grocery Promotions and Offers Australia is no longer a technical advantage, but a strategic requirement for brands aiming to predict pricing trends and measure promotional effectiveness across supermarket ecosystems. The challenge is not only capturing product prices but also understanding when promotions start, how long they run, and what types of discounts drive conversions.

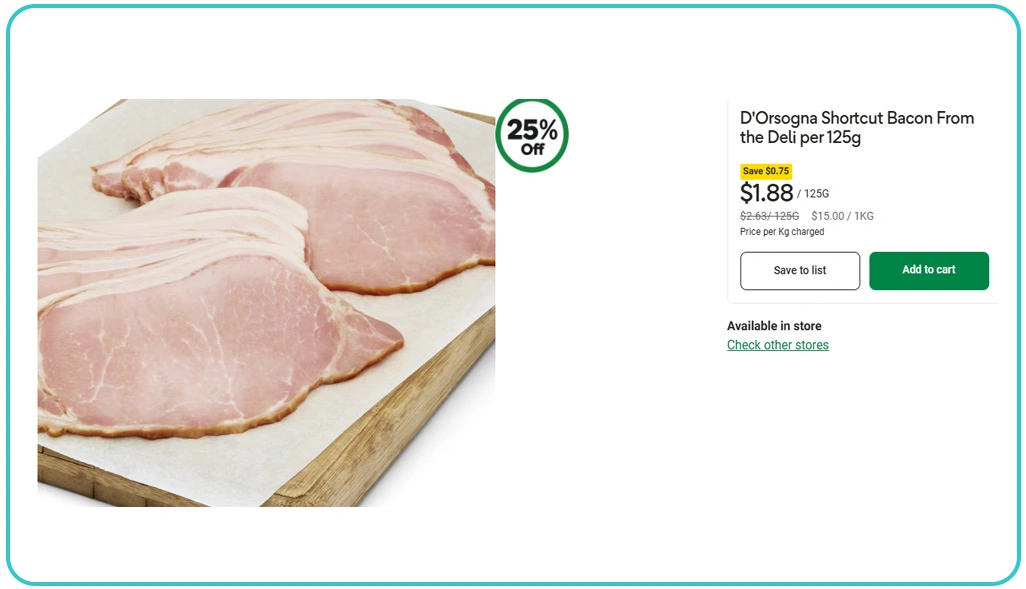

Whether it is "Buy More Save More" bundles, digital coupon discounts, or seasonal markdowns, promotional data becomes the key to understanding real demand behavior. Using Web Scraping Grocery Data enables brands to automate collection of pricing and discount patterns across platforms and create reliable pricing dashboards for smarter decisions.

Capturing Fast-Changing Deals Across Grocery Apps

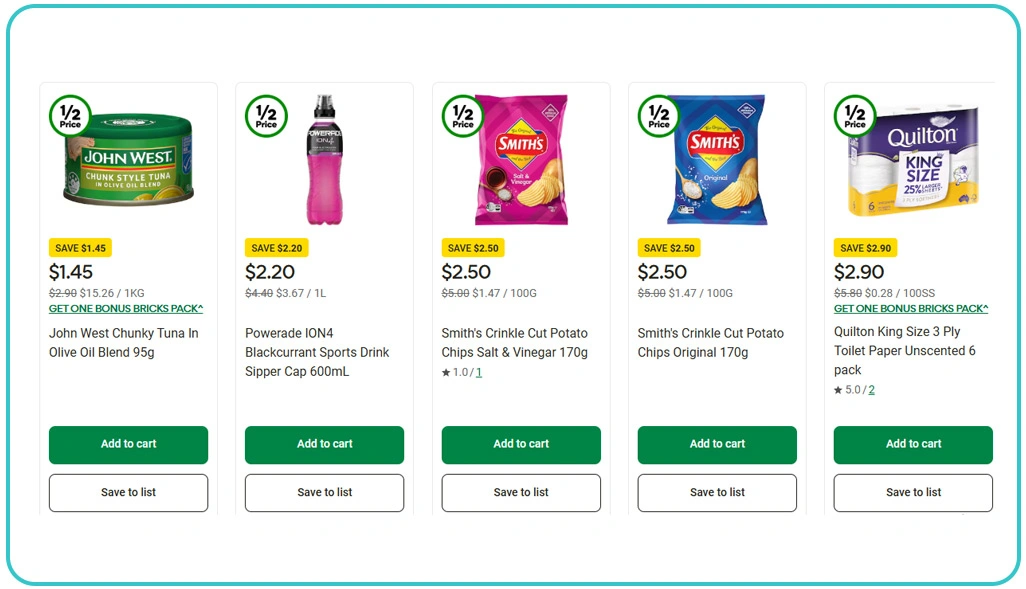

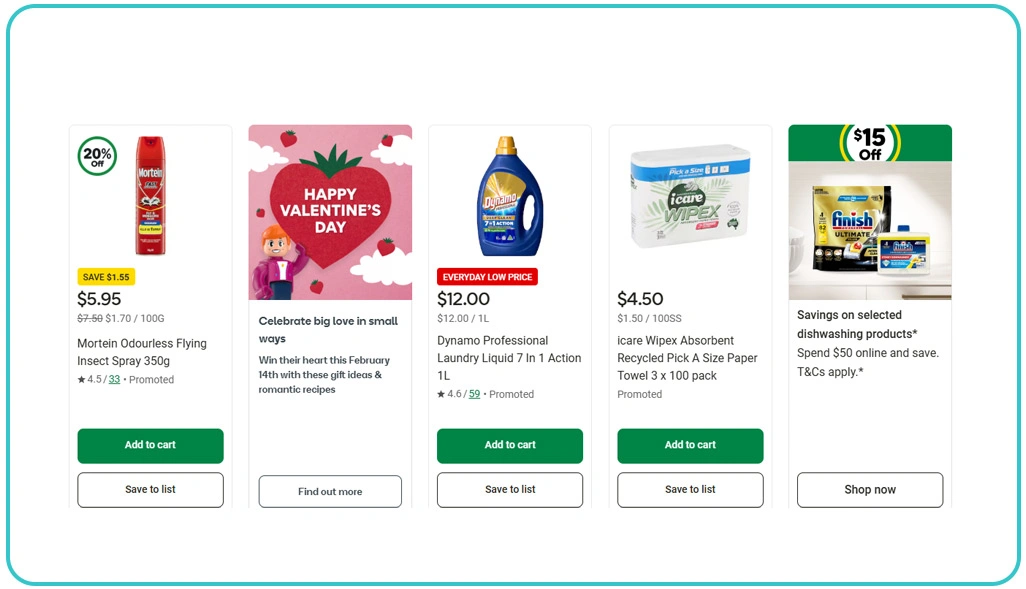

Australia's grocery apps frequently refresh weekly specials, limited-time discounts, and personalized digital deals that can shift without notice. Coles often updates catalog promotions and app-exclusive offers daily, Woolworths rotates Rewards-linked savings and multi-buy bundles, while Aldi follows a seasonal cycle that can quickly influence category pricing.

This becomes extremely useful for understanding how promotional intensity changes across different timeframes. Many retail reports suggest that promotions influence more than 55% of grocery purchase decisions in high-frequency categories such as dairy, beverages, and household essentials.

This is where Quick Commerce Datasets become valuable, as they highlight rapid purchase behavior patterns and real-time discount fluctuations. With automation, brands can also apply to Scrape Australian Grocery Prices in a reliable format, ensuring consistent visibility into daily price changes and short-term offer rotations.

| Supermarket App | Promotion Type Observed | Update Frequency | Strategic Value |

|---|---|---|---|

| Coles | Weekly deals, digital coupons | Daily | Strong discount visibility |

| Woolworths | Member-only savings, bundles | Daily | Better loyalty-based insights |

| Aldi | Seasonal limited-time specials | Weekly | Improved category forecasting |

This type of structured extraction helps reduce manual monitoring time, improves demand prediction, and supports smarter product positioning decisions.

Preventing Pricing Gaps Across Retail Competitors

One of the most common challenges for grocery brands is losing visibility into how competitors adjust pricing across major supermarket platforms. Coles may reduce prices on pantry staples, Woolworths might introduce app-only bundles, and Aldi can create strong category disruption through seasonal offers.

A consistent monitoring model supports Australian Grocery Discount Price Monitoring, helping teams identify when discounts become deeper, how often products are promoted, and which retailers run the most aggressive markdown cycles. When this happens, even a minor delay in detection can impact competitive positioning and pricing decisions.

Incorporating Competitor Price Monitoring enables brands to track rival promotional frequency, compare discount levels, and identify which products are receiving the strongest promotional push. Businesses can also build an automated pipeline similar to an Australia Grocery Supermarket Price Scraper, extracting real-time discount tags and promotional price updates from supermarket apps.

| Insight Category | What It Tracks | Business Benefit |

|---|---|---|

| Discount Alerts | Sudden markdown events | Protects profitability |

| Promotion Frequency | Repeat offers on same SKUs | Measures discount dependency |

| Price Change Tracking | Daily price volatility | Supports pricing models |

| Seasonal Spike Detection | Holiday and event promotions | Improves campaign planning |

This approach reduces blind spots, improves forecasting, and strengthens category-level decision-making across competitive environments.

Turning Promotions Into Long-Term Retail Intelligence

Promotional tracking is no longer limited to simply recording price drops. Coles frequently highlights weekly specials, Woolworths pushes member-driven app promotions, and Aldi creates demand spikes through seasonal offers that influence both private-label and branded product performance.

By building structured datasets, businesses can conduct Australian Grocery Supermarket Price Comparison and measure how pricing differs across retailers over time. This helps brands understand which supermarkets consistently promote specific categories and which retailers create the highest promotional intensity.

Using Popular Grocery Data Scraping, brands can capture additional intelligence such as stock availability, promotional labels, offer structures, and bundle formats. It also supports better campaign planning, because brands can align their promotional investments with retailer-specific discount patterns.

| Analytics Focus | Data Captured | Strategic Outcome |

|---|---|---|

| Offer Visibility Tracking | Featured deal placement | Stronger campaign targeting |

| Discount Trend Mapping | Weekly promotion cycles | Improved forecasting accuracy |

| Bundle & Multi-Buy Insights | Offer formats and structures | Better packaging strategy |

| Category Promotion Share | Category-level discount intensity | Smarter retail negotiations |

When promotional data is structured and analyzed correctly, businesses gain the ability to predict pricing shifts, reduce dependency on manual tracking, and strengthen their long-term market strategy.

How Web Data Crawler Can Help You?

Modern grocery pricing changes rapidly, and brands require automated systems that can track supermarket app promotions without delays. This enables brands to Extract Grocery Promotions and Offers Australia efficiently while creating reliable pricing dashboards and automated alerts.

What We Provide:

- Automated collection of promotional pricing and discount tags.

- Daily or hourly updates based on project requirements.

- Structured datasets in CSV, JSON, or API formats.

- Product-level tracking across categories and brands.

- Historical pricing archive for long-term analysis.

- Custom alerts for sudden price drops or offer changes.

This framework supports faster business decisions, reduces manual tracking effort, and strengthens pricing strategies across the Australian market. It also enables scalable Australia Grocery Supermarket Price Scraper capabilities for brands that need consistent and verified pricing data.

Conclusion

Australian grocery promotions are shifting faster than traditional weekly cycles, and relying on manual monitoring is no longer sustainable. With automation, businesses can Extract Grocery Promotions and Offers Australia while creating stronger retail planning models and measurable promotional performance insights.

In today’s competitive supermarket landscape, consistent Australian Grocery Discount Price Monitoring ensures brands can react instantly to pricing volatility, reduce margin losses, and improve campaign alignment. Connect with Web Data Crawler today and turn supermarket pricing into a competitive advantage.