How Does the Buy Liquor Dataset From Australian Liquor Platforms Unlock 1M+ SKU Insights for Retail Growth?

Feb 20

Introduction

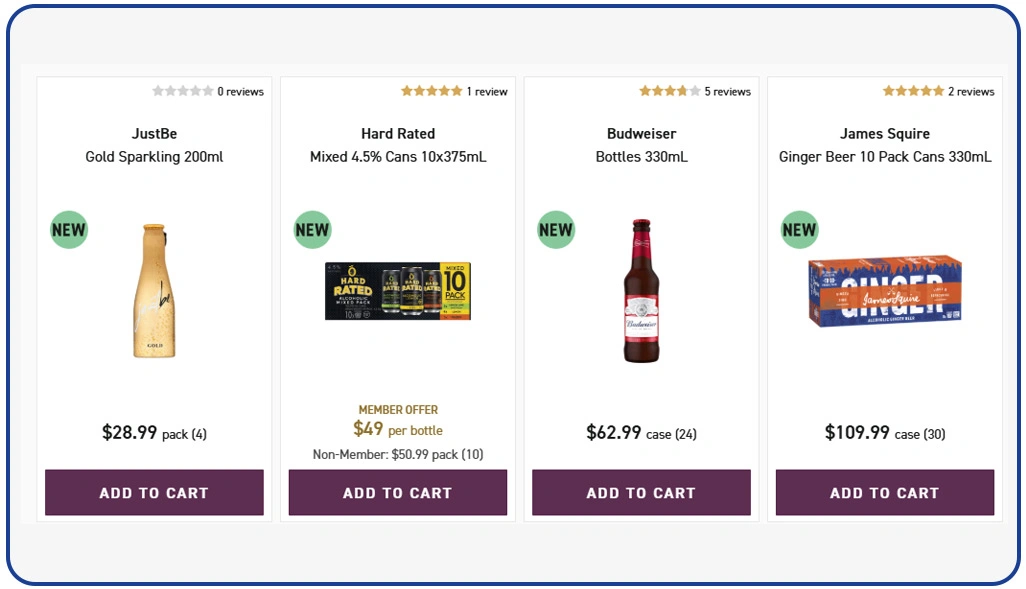

Australia’s liquor retail industry is one of the most competitive and data-driven markets in the Asia-Pacific region. With more than 1 million active SKUs spanning wine, beer, spirits, RTDs, and premium imports, retailers and distributors constantly face challenges in pricing accuracy, stock optimization, and promotion planning. Major chains like Dan Murphy's, BWS, Liquorland, and First Choice Liquor operate across hundreds of stores, updating product listings daily.

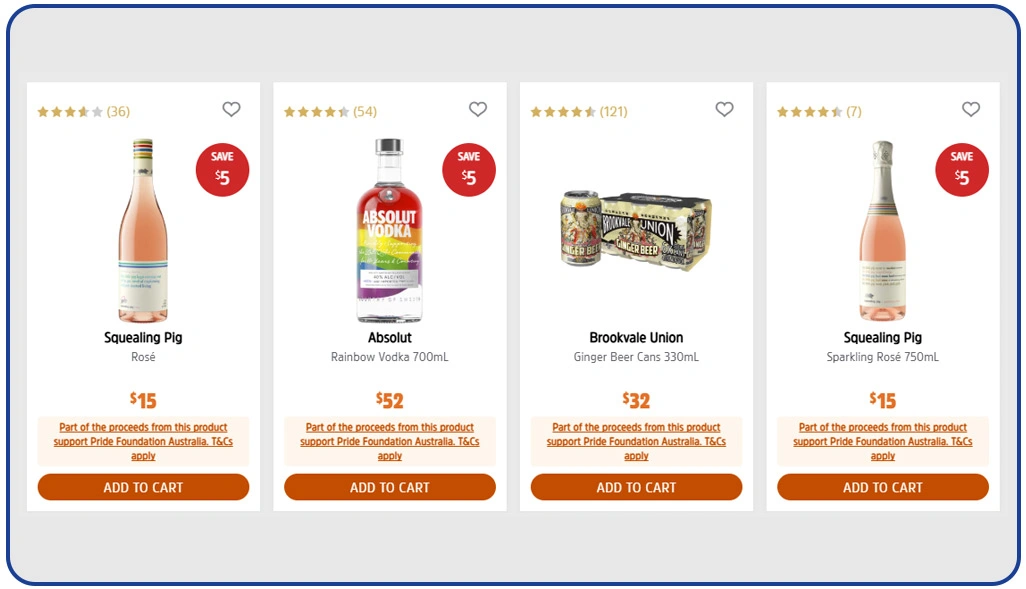

For brands, aggregators, and analytics firms, access to structured Liquor Datasets is no longer optional. Real-time SKU intelligence helps businesses track price shifts, seasonal discounts, bundle offers, regional assortment gaps, and category demand patterns. From premium wines in Sydney to craft beers in Melbourne, each product listing contains valuable insights tied to consumer behavior and revenue growth.

When businesses Buy Liquor Dataset From Australian Liquor Platforms, they move from reactive decisions to predictive strategies. Whether optimizing retail margins or benchmarking competitor assortments, large-scale SKU intelligence can directly impact revenue performance. The ability to centralize platform-level data into a unified intelligence dashboard creates measurable retail growth opportunities across Australia’s alcohol industry.

Building Transparent Pricing Intelligence Across Multi-Store Networks

Australia’s liquor retail ecosystem operates on highly dynamic pricing structures influenced by regional taxation, supplier agreements, and seasonal demand spikes. With thousands of SKUs updated daily across major chains, manual tracking often results in pricing gaps and delayed responses to competitor campaigns.

Retailers and distributors require automated systems that ensure continuous monitoring of discounts, bundle deals, and limited-time offers. By implementing Alcohol Pricing and Promotion Data Scraping From Australian Markets, businesses gain access to structured price intelligence that improves forecasting accuracy and margin protection.

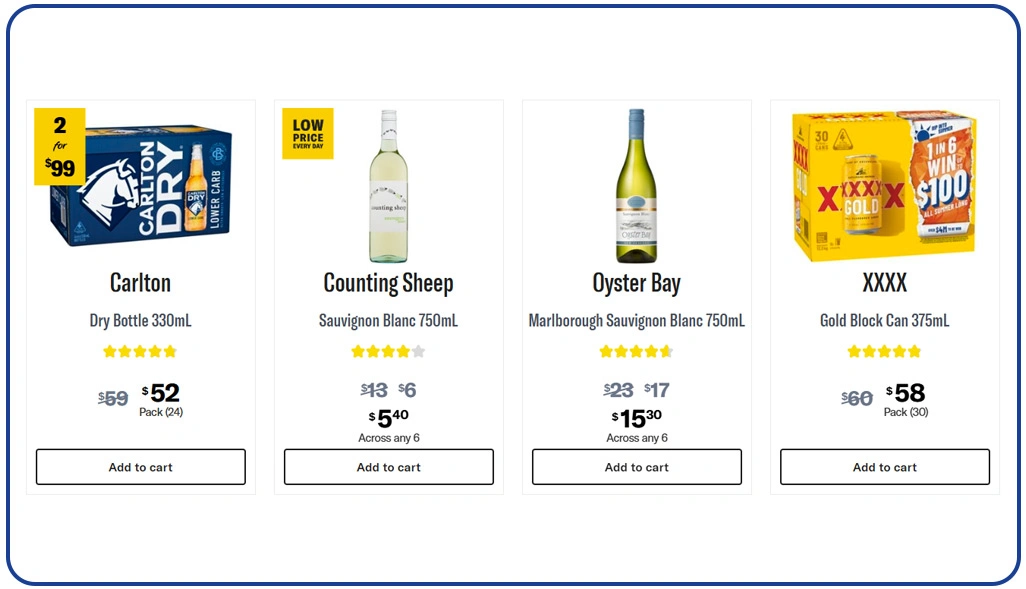

Direct integration with the Dan Murphy’s Liquor Data API enables automated tracking of SKU-level price adjustments, stock updates, and promotional frequency across hundreds of locations. Pricing volatility across metro and regional stores can range between 10–15%, making real-time tracking essential for maintaining competitive positioning.

Pricing Intelligence Overview:

| Metric Category | Data Points Captured | Strategic Value |

|---|---|---|

| Base Pricing | Regular SKU price | Margin benchmarking |

| Discount Depth | % markdown | Promotion comparison |

| Bundle Tracking | Multi-buy offers | Volume projection |

| Stock Movement | Availability status | Demand planning |

| Geo Pricing | State-level variation | Local optimization |

Accurate pricing intelligence supports smarter campaign design, prevents revenue erosion, and strengthens cross-platform price parity strategies in Australia’s evolving liquor market. Data-backed insights allow brands to recalibrate campaign strategies and respond proactively to seasonal trends.

Expanding SKU Visibility and Competitive Assortment Mapping

The Australian alcohol sector now exceeds one million active product listings across wine, beer, spirits, and ready-to-drink categories. Continuous product launches and regional exclusives make assortment benchmarking a complex task for retailers and distributors. Organizations aiming to Scrape Alcohol Prices Across Australia rely on structured intelligence frameworks to compare identical SKUs across platforms.

The integration of BWS Liquor Data API allows seamless monitoring of category expansion, seasonal listings, and price shifts. Through BWS Liquor Pricing Data Extraction, analysts evaluate price positioning between urban and regional outlets while identifying competitive overlaps.

Additionally, the Dan Murphy’s Liquor Dataset provides national-level assortment visibility, enabling businesses to compare premium, mid-tier, and value-based segments across state boundaries. SKU-level mapping enhances portfolio planning and ensures balanced category representation.

SKU Benchmarking Framework:

| Intelligence Layer | Data Coverage | Business Advantage |

|---|---|---|

| Category Split | Wine, Beer, Spirits | Growth tracking |

| Brand Distribution | Domestic vs Imported | Market penetration |

| SKU Volume | Active listings count | Assortment depth |

| New Launches | Recently added items | Trend identification |

| Cross Pricing | Platform comparison | Competitive balance |

With structured SKU intelligence, businesses can refine procurement strategies, identify underperforming categories, and maintain optimized shelf representation across multiple liquor platforms.

Strengthening Regional Analytics and Store-Level Insights

Regional demand patterns in Australia vary significantly due to demographic diversity, tourism activity, and local regulations. Retailers seeking to Extract Alcohol Bottle Shop Data Australia require geo-specific intelligence that reflects state-level consumption trends and store inventory differences. Without structured analytics, forecasting supply chain demand becomes inconsistent and reactive.

Through Liquorland Liquor Data API integration, businesses can access detailed store-level SKU information, promotion cycles, and availability metrics. Tools such as Liquorland Liquor Price Data Scraper and First Choice Liquor Data Scraping help compare pricing density, promotional frequency, and inventory depth between metropolitan and regional locations.

Holiday seasons often generate sales spikes of up to 25%, while regional stores typically stock fewer SKUs than city outlets. Data-driven analytics helps retailers align supply with consumption behavior while identifying high-demand product clusters.

Regional Intelligence Matrix:

| Data Segment | Insights Delivered | Operational Impact |

|---|---|---|

| State Pricing | Inter-state comparison | Local pricing refinement |

| Inventory Depth | SKU count per store | Supply allocation |

| Promo Frequency | Campaign tracking | Marketing optimization |

| Seasonal Demand | Peak period trends | Forecast precision |

| Consumer Mix | Premium vs Value share | Assortment alignment |

Granular regional analytics ensures improved distribution planning, optimized pricing decisions, and stronger performance across Australia’s diverse liquor retail landscape.

How Web Data Crawler Can Help You?

Data-driven retail growth requires comprehensive, structured intelligence across multiple Australian liquor platforms. When businesses Buy Liquor Dataset From Australian Liquor Platforms, they need scalable, automated, and compliant extraction systems that centralize SKU-level insights into actionable dashboards.

We deliver enterprise-grade scraping architecture tailored for alcohol retail analytics.

Our Capabilities Include:

- Multi-platform SKU aggregation.

- Real-time pricing monitoring.

- Promotion and discount tracking.

- Regional assortment mapping.

- Automated data cleansing.

- Custom analytics dashboard integration.

Our expertise in Popular Liquor Data Scraping ensures that brands, distributors, and analytics firms receive consistent, validated, and structured insights that support long-term retail expansion strategies across Australia.

Conclusion

Retail intelligence at SKU-level scale is transforming Australia’s alcohol ecosystem. Businesses that Buy Liquor Dataset From Australian Liquor Platforms gain measurable advantages in pricing accuracy, assortment expansion, and demand forecasting. With structured intelligence and real-time monitoring, retailers transition from reactive decision-making to predictive growth strategies.

Comprehensive analytics powered by Alcohol Pricing and Promotion Data Scraping From Australian Markets helps brands align campaigns, optimize margins, and improve distribution efficiency. Partner with Web Data Crawler today to transform liquor data into scalable retail growth opportunities across Australia.