What Bolt vs Uber Mobility Market Research Using Data Scraping Shows 28% Ride Demand Growth Patterns?

Feb 09

Introduction

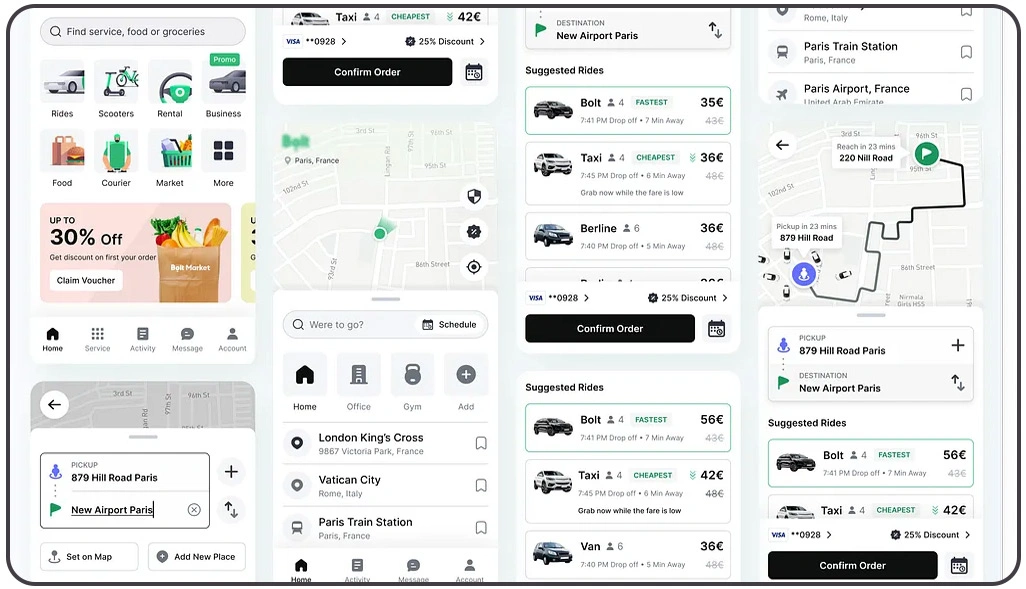

The global mobility industry is transforming rapidly, with ride-hailing platforms redefining how people commute in modern cities. Among the leading competitors, Bolt and Uber continue to battle for market dominance, and Bolt vs Uber Mobility Market Research Using Data Scraping reveals clear differences in their performance across regions.

One of the most reliable approaches today is using a Scraping API to extract structured information from publicly available ride-hailing sources. This enables analysts to monitor price fluctuations, peak-time demand, service availability, and ride volume changes across multiple geographies. With large-scale scraped datasets, researchers can uncover patterns that highlight how certain cities are expanding rapidly while others are stabilizing.

This article presents a detailed breakdown of demand growth patterns, focusing on how scraped ride data indicates a 28% rise in ride demand in key regions. It also compares platform performance across markets and explains what these insights mean for investors, fleet operators, mobility startups, and transport planners looking to make smarter strategic decisions.

Mapping Demand Shifts Across High-Activity Cities

Urban ride-hailing demand rarely grows evenly. Some cities experience sharp spikes due to population movement, tourism surges, fuel price hikes, or public transport disruptions, while others show steady but slower growth. By applying How Web Scraping Supports Mobility Market Research, businesses can monitor daily ride availability, ride request volume signals, and peak-hour usage changes across multiple locations.

Morning office traffic and evening commuting windows contribute the highest ride volume increase, while weekend nightlife hours create demand surges in metro areas. This is where Market Research becomes more accurate through extracted ride datasets, allowing analysts to compare demand patterns city-by-city and interpret which platform has stronger consumer engagement.

Using City Wise Bolt and Uber Ride Demand Analysis Data Scraper, researchers can compare demand fluctuations between regions and identify cities where ride adoption is rising faster than expected. This city-focused approach also helps ride aggregators, fleet operators, and mobility investors forecast expansion opportunities with higher precision.

City-Level Ride Demand Growth Snapshot:

| City | Growth Pattern | Peak Demand Window | Key Growth Trigger |

|---|---|---|---|

| Warsaw | High upward shift | 7 AM – 10 AM | Office commuting |

| Nairobi | Rapid expansion | 5 PM – 9 PM | Limited public transit |

| Lisbon | Consistent growth | 6 PM – 11 PM | Tourist movement |

| Berlin | Moderate rise | 7 AM – 9 AM | Metro congestion |

| Accra | Strong surge cycles | 4 PM – 10 PM | Weekend ride volume |

These insights show that city-level demand tracking is essential for planning platform strategy, driver supply, and operational forecasting.

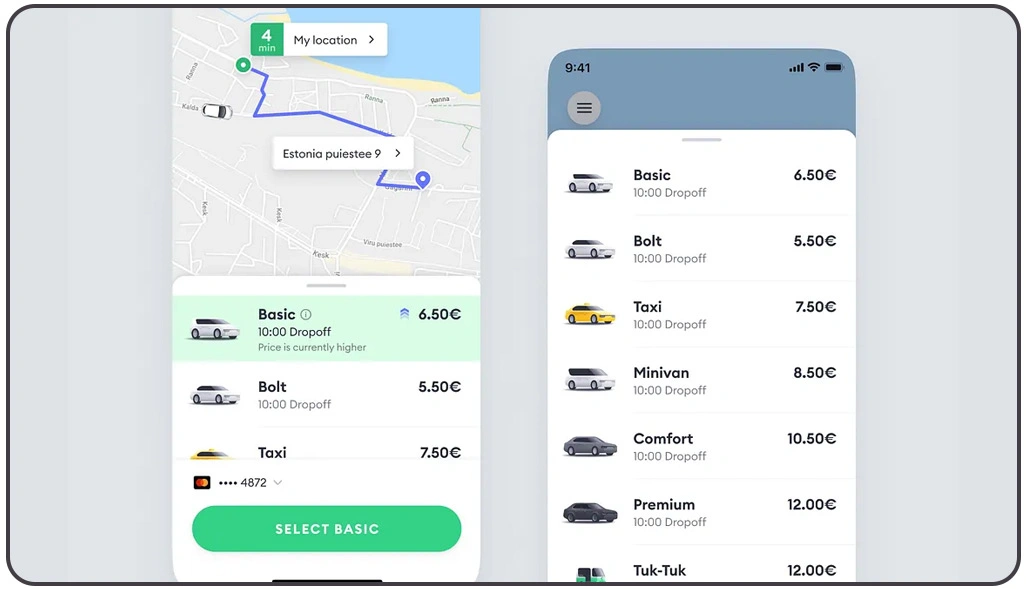

Comparing Price Fluctuations and Surge Behaviors

Ride-hailing competition is strongly shaped by pricing instability. Through Web Scraping Bolt and Uber Ride Hailing Trends, analysts can monitor pricing changes, surge multipliers, and ride cost variations across multiple cities, giving businesses an evidence-based view of real commuter affordability trends.

In many markets, surge pricing occurs frequently during heavy traffic, airport rush hours, rain events, or large public gatherings. This is why data-driven mobility monitoring is now critical for fleet owners, transport startups, and mobility analytics firms trying to evaluate platform performance.

Using Enterprise Web Crawling, companies can collect fare variations consistently and identify which cities show aggressive surge patterns versus stable ride pricing. Scraped pricing datasets often reveal that riders in emerging economies respond more strongly to fare spikes, while metro cities show slightly higher tolerance due to premium service expectations.

Surge Pricing Frequency Comparison Snapshot:

| Surge Level | Platform A Frequency | Platform B Frequency | Rider Response Trend |

|---|---|---|---|

| Low Surge (1.1x–1.3x) | High | Medium | Minimal switching |

| Medium Surge (1.4x–1.7x) | Medium | High | Higher comparison behavior |

| High Surge (1.8x+) | Low | Higher | Increased cancellations |

With Mobility Sector Insights via Bolt and Uber Scraped Data, businesses can also identify how quickly prices normalize after peak periods.

Evaluating Coverage Strength and Driver Availability Trends

Ride demand growth depends heavily on whether driver supply can keep up. When vehicle availability drops, pickup times rise, ride cancellations increase, and customer satisfaction declines. By using Real-Time Web Scraping Datasets, analysts can monitor pickup time changes, service delays, and ride availability patterns across multiple regions in near real-time.

A key finding from mobility datasets is that service coverage expands differently depending on local driver onboarding capacity. Some cities experience strong demand growth but face temporary drops in ride completion rates due to limited driver supply. Other locations maintain stable performance because the platform already has an established driver base.

With structured data extraction, analysts can compare pickup time impact on ride completion and measure how service reliability influences user retention. If pickup time rises beyond a certain threshold, riders often switch platforms instantly or cancel trips altogether.

Pickup Time vs Ride Completion Performance:

| Avg Pickup Time | Ride Completion Rate | Customer Satisfaction Level |

|---|---|---|

| Under 4 minutes | 92% | Very High |

| 4–6 minutes | 84% | High |

| 6–9 minutes | 73% | Medium |

| Over 9 minutes | 61% | Low |

These insights allow mobility firms to predict supply shortages, detect weak coverage zones, and optimize operational planning.

How Web Data Crawler Can Help You?

Mobility analytics requires more than surface-level information. With the right automation strategy, Bolt vs Uber Mobility Market Research Using Data Scraping becomes a reliable method to build accurate competitive intelligence for decision-making.

We can support your organization by delivering actionable ride-hailing intelligence through:

- Automated extraction of ride pricing variations across locations.

- Tracking pickup times and service delays during peak hours.

- Monitoring surge frequency trends and ride demand patterns.

- Collecting city-level performance data for platform benchmarking.

- Identifying seasonal travel spikes and event-driven ride demand.

- Structuring raw mobility data into analysis-ready formats.

By integrating City Wise Bolt and Uber Ride Demand Analysis Data Scraper, companies can create location-specific mobility models that support smarter forecasting, pricing strategy development, and investment planning across expanding transport markets.

Conclusion

When analyzed correctly, demand increases, surge frequency, pickup time reductions, and service coverage expansion reveal exactly why certain cities are experiencing a 28% growth surge. This is why Bolt vs Uber Mobility Market Research Using Data Scraping is becoming a core strategy for mobility forecasting.

Applying Web Scraping Supports Mobility Market Research enables transport planners, investors, and mobility startups to make decisions backed by measurable evidence. Connect with Web Data Crawler today and start building your next mobility strategy with confidence.