What Makes Marks & Spencer Data Scraping Essential for 50% Growth in Fashion Insights?

Sep 16

Introduction

The retail fashion market is undergoing a rapid shift, with brands requiring actionable insights to refine their strategies, manage product assortments, and maintain competitiveness. Marks & Spencer, a leading global fashion retailer, presents an immense opportunity for data-driven growth. Businesses are increasingly relying on Marks & Spencer Data Scraping to extract critical information about product listings, pricing trends, promotions, and consumer preferences.

By implementing structured data scraping techniques, fashion brands can evaluate competitor offerings, compare market positioning, and improve assortment planning. Beyond pricing, this approach highlights emerging consumer trends and evolving demand patterns, helping businesses predict the next move in retail fashion intelligence.

For global retailers and fashion-tech firms, leveraging structured product data can lead to improved forecasting, targeted promotions, and enhanced operational efficiency. Data on pricing, inventory, and reviews provides the backbone for analytical insights that support a brand’s strategic roadmap.

Furthermore, businesses looking to refine geographic campaigns can even Scrape Marks & Spencer Store Locations Data in the UK to analyze regional buying behaviors. With digital transformation reshaping retail, actionable datasets from Marks & Spencer are no longer optional—they are fundamental for achieving measurable growth in fashion intelligence.

Tracking Product Listings for Smarter Fashion Positioning

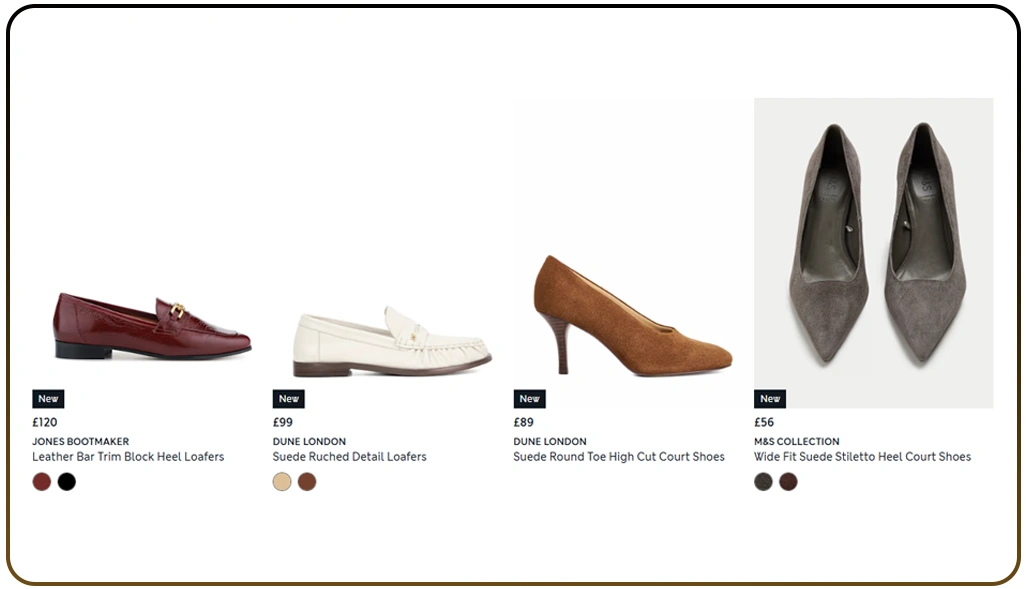

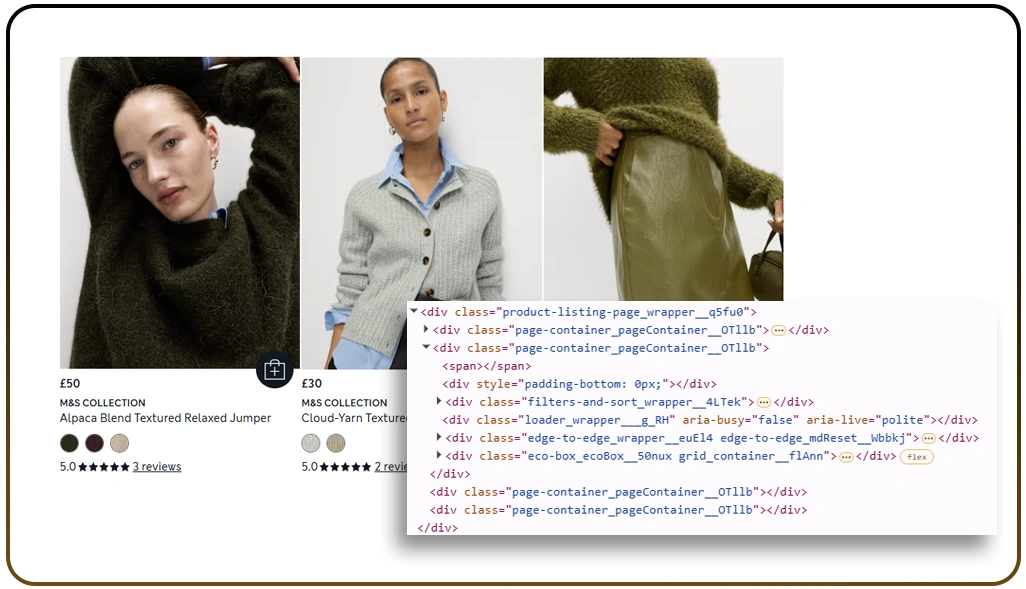

In the retail fashion industry, product listings are more than simple catalog entries—they are windows into consumer demand, emerging style trends, and competitive positioning. Monitoring listings at scale provides invaluable insights into how categories are performing and where businesses should channel focus. Brands that extract structured listing data can evaluate product depth, detect seasonal launches, and refine their assortment strategies with precision.

With M&S Product Data Extraction, businesses can segment listings by category, gender, or price bracket, which helps align assortments with evolving customer needs. For example, tracking weekly new arrivals alongside clearance items reveals both trending preferences and lagging inventory. Retailers can further identify assortment gaps, providing them with an opportunity to expand their portfolios strategically.

Structured product listing data also helps identify how fast competitors are introducing fresh collections. Businesses that adapt quickly to such cycles often report up to 25% stronger engagement from target audiences. Integrating this intelligence into product development ensures retail strategies remain customer-centric and data-backed.

Illustrative Data Snapshot:

| Metric | Weekly Trend | Business Value |

|---|---|---|

| New Arrivals | 200+ SKUs | Detect emerging demand |

| Clearance Listings | 15% of total | Guide pricing strategy |

| Out-of-Stock Items | 12% | Manage replenishment |

By applying solutions to Scrape M&S Product Listings, businesses strengthen their competitive advantage and improve long-term customer loyalty.

Evaluating Pricing Structures for Competitive Intelligence

Price remains one of the most influential factors in consumer decision-making. A structured view of retail pricing enables brands to position themselves competitively and adapt their strategies in near real-time. Extracting and comparing price points across fashion categories provides actionable insights for informed decision-making.

Businesses using M&S Pricing Intelligence can identify competitor gaps, track seasonal markdowns, and align promotions more effectively. Historical datasets offer an additional layer of value, illustrating how price fluctuations impact purchase cycles over time. This insight supports demand forecasting and ensures brands don’t over- or under-price key product lines.

For instance, tracking price gaps of £2–£5 in categories such as men's wear jackets or women’s tops can help determine whether customer loyalty is based on value perception or premium positioning. Beyond direct competitor comparisons, evaluating discount patterns provides insight into how rivals balance promotions with full-price sales.

Pricing Intelligence Table:

| Category | Avg. M&S Price | Market Average | Difference |

|---|---|---|---|

| Women’s Tops | £25 | £28 | -£3 |

| Men’s Jackets | £75 | £82 | -£7 |

| Kidswear | £19 | £21 | -£2 |

When combined with M&S Competitor Price Monitoring, businesses can pinpoint pricing opportunities and align promotional timing to drive higher ROI. Data from Popular E-Commerce Data Scraping further expands this view by incorporating competitor platforms beyond M&S, ensuring retailers optimize across the broader fashion ecosystem.

Extracting Customer Review Insights for Fashion Growth

Customer reviews are one of the most direct signals of product performance and consumer expectations. They influence purchase decisions, shape brand reputation, and highlight recurring patterns that can inform future strategies. For fashion retailers, review analysis can reveal crucial insights into design, sizing, and quality.

With M&S Customer Review Scraping, businesses can build structured sentiment databases that allow for systematic analysis. For example, reviews may consistently praise the material quality in menswear but highlight sizing inconsistencies in women’s dresses. Acting on such insights enhances customer satisfaction and reduces the number of returns.

Analyzing recurring keywords across large datasets enables brands to identify trends more quickly. If multiple customers mention “excellent fabric durability,” that attribute can be emphasized in marketing campaigns. On the other hand, frequent mentions of “tight fit” suggest the need for product redesign or the expansion of size ranges.

Customer Sentiment Analysis Snapshot:

| Category | Positive Mentions | Negative Mentions | Action Needed |

|---|---|---|---|

| Women’s Dresses | 320 | 75 | Refine size chart |

| Men’s Shirts | 210 | 120 | Improve fit accuracy |

| Kidswear | 280 | 65 | Highlight fabric strength |

Pairing review analysis with M&S Fashion Data Scraping allows businesses to identify sentiment-driven opportunities. Retailers that adopt structured review analysis often see repeat purchase rates 15–20% higher due to improved product alignment with customer expectations.

Monitoring Inventory and Product Availability Patterns

Inventory plays a crucial role in enhancing customer satisfaction and driving sales performance. Out-of-stock products not only result in missed opportunities but also risk driving customers to competitors. With Marks & Spencer Data Scraping, businesses can monitor availability in real time, evaluate restocking cycles, and align inventory strategies with consumer demand.

The use of M&S Inventory Tracking Scraper ensures visibility across SKUs, sizes, and regional assortments. Retailers can pinpoint which items are selling out fastest, identify patterns in replenishment frequency, and forecast demand during promotional periods. For example, monitoring women’s footwear or seasonal jackets provides clues into demand spikes that can support supply chain adjustments.

Inventory Tracking Insights:

| Category | Avg. In-Stock Rate | Restock Frequency | Recommended Action |

|---|---|---|---|

| Women’s Shoes | 88% | Weekly | Prepare seasonal surges |

| Men’s Jackets | 76% | Bi-Weekly | Strengthen supply contracts |

| Kidswear | 91% | Weekly | Maintain availability |

By integrating Real-Time M&S Product Data, retailers can reduce lost sales from stockouts while ensuring operational efficiency. Moreover, tying availability data with promotional events helps businesses predict demand surges more accurately.

At scale, structured pipelines supported by Web Scraping Ecommerce Data provide the backbone for enterprise-wide analysis. This ensures that businesses can consistently track inventory health and make smarter replenishment decisions, thereby avoiding overstocking and potential sales losses.

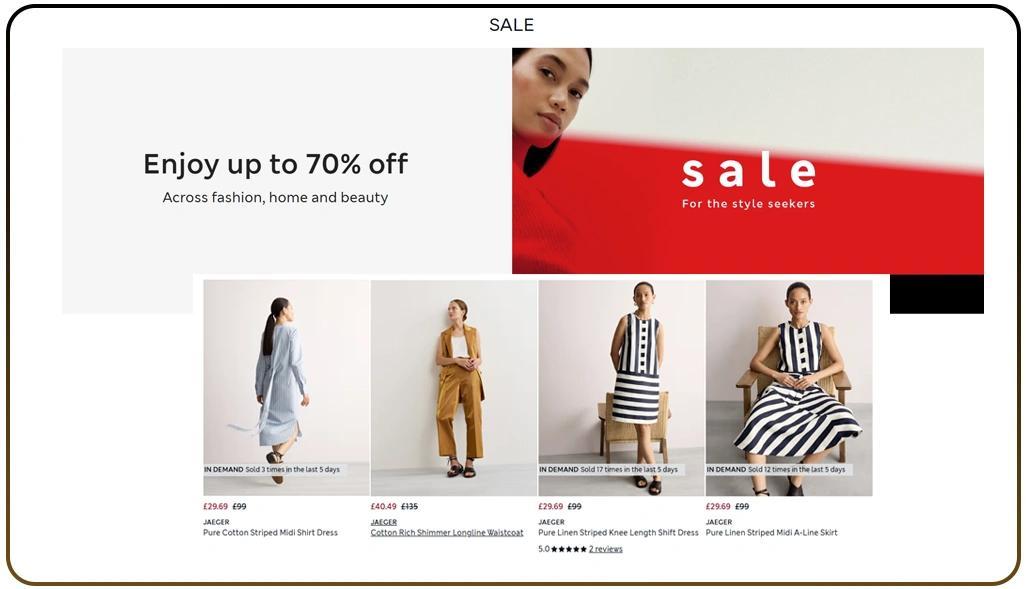

Optimizing Promotions and Seasonal Campaign Strategies

Seasonal campaigns and promotional offers play a significant role in shaping consumer buying behavior. Tracking competitor campaigns enables businesses to measure the effectiveness of discounts and create promotions that resonate with their target audience. Extracting promotional data provides a structured view of discount depth, timing, and consumer engagement.

The use of M&S Promotions and Offers Scraping enables retailers to capture datasets on bundled discounts, flash sales, and seasonal promotions. By comparing promotional activities across competitors, businesses can evaluate which types of campaigns generate the strongest ROI.

Promotional Campaign Snapshot:

| Campaign Type | Avg. Discount | Engagement Rate | ROI Growth |

|---|---|---|---|

| Summer Sale | 30% | 68% | 22% |

| Winter Discounts | 25% | 60% | 19% |

| Festive Offers | 35% | 75% | 26% |

Historical analysis reveals that well-timed promotions can increase engagement by 20–25%. Retailers that align campaigns with consumer demand peaks, such as festive periods, often achieve higher conversion rates.

Additionally, M&S Fashion Trends Analysis helps ensure that promotions align with current styles and customer preferences. For businesses handling large-scale datasets, Enterprise Web Crawling provides scalability by structuring data from multiple seasonal cycles. This ensures brands can track, compare, and refine promotional strategies with greater accuracy, driving long-term growth.

Integrating Retail Ecosystem Data for Better Decisions

For fashion retailers, fragmented data often leads to incomplete insights and missed opportunities. A unified view of the retail ecosystem—encompassing pricing, promotions, inventory, and customer sentiment—enables more informed decision-making. Extracting structured retail datasets ensures every layer of intelligence feeds into a cohesive strategy.

With M&S Retail Data Scraping, businesses can evaluate multiple categories at once. This includes menswear, womenswear, and kidswear, ensuring assortment planning is backed by real-time data. Integrated analysis allows brands to minimize costs, optimize assortments, and improve profitability.

Retail Data Ecosystem Table:

| Data Type | Insights Extracted | Strategic Use |

|---|---|---|

| Pricing | 10K+ entries | Optimize competitive positioning |

| Inventory | 5K SKUs | Improve replenishment cycles |

| Promotions | 500+ events | Align seasonal strategy |

| Reviews | 1M+ comments | Enhance product quality |

Scaling this intelligence is possible through M&S E-Commerce Scraping Services, which streamline delivery into enterprise systems. By integrating datasets through a Web Scraping API, businesses can automate workflows for continuous intelligence. This ensures decision-makers have timely insights that drive sustainable growth while reducing reliance on fragmented reporting.

How Web Data Crawler Can Help You?

We specialize in providing tailored solutions for Marks & Spencer Data Scraping that empower businesses with actionable insights. Our advanced scraping frameworks are designed to handle structured product, pricing, inventory, and review data, ensuring accuracy and reliability across retail categories.

Our key strengths include:

- Scalable retail data extraction models.

- Accurate SKU-level monitoring and reporting.

- Structured review and sentiment analysis.

- Inventory tracking and restocking insights.

- Competitor pricing intelligence integration.

- Real-time delivery for actionable decision-making.

As a result, businesses not only strengthen their decision-making but also gain measurable ROI from structured insights. Whether you need large-scale datasets or specialized intelligence, our expertise ensures precision and performance. With dedicated solutions like M&S Fashion Trends Analysis, we deliver strategic value to fashion retailers worldwide.

Conclusion

In today’s fashion-driven marketplace, harnessing the power of Marks & Spencer Data Scraping enables brands to refine pricing, optimize assortments, and develop strategies based on real-time intelligence. Businesses that apply structured scraping solutions can improve decision-making while achieving sustainable growth in an increasingly competitive retail landscape.

Furthermore, integrating M&S E-Commerce Scraping Services provides a unified framework to analyze product listings, promotions, and consumer feedback. By combining these insights into actionable strategies, brands can deliver better experiences while driving profitability.

Partner with Web Data Crawler today to transform raw data into fashion intelligence that powers more innovative retail strategies.