How Does Extracting Pricing and Bidding Data From Copart Help Analyze Vehicle Trends Across 5000+ Listings?

Nov 14

Introduction

Analyzing vehicle performance across thousands of online auction listings has become essential for automotive buyers, resellers, and analysts who want deeper clarity into real market shifts. With auction volumes rising every month, businesses require structured visibility into price variations, bidding interest, and the evolving lifecycle of used and salvage automobiles. Integrating Extracting Pricing and Bidding Data From Copart into a strategic research workflow empowers brands to understand how different vehicle categories respond to fluctuating demand, seasonal cycles, and buyer engagement.

This also helps stakeholders evaluate how auction timing, listing structure, damage details, and brand reputation influence bid counts and final sale outcomes across more than 5000+ listings. As competition increases, this intelligence becomes a reliable way to identify profitable buying moments, undervalued segments, and pricing benchmarks aligned with real-world purchase behaviour. High-volume platforms produce complex datasets, and businesses often require scalable systems to categorize trends in a uniform structure.

With Enterprise Web Crawling, companies can automate early-stage research, speed up auction monitoring, and generate multi-market insights that otherwise take days to analyze manually. When structured correctly, pricing and bidding signals transform into predictive indicators guiding better sourcing and remarketing decisions.

Analyzing Evolving Price Patterns Across Auctions

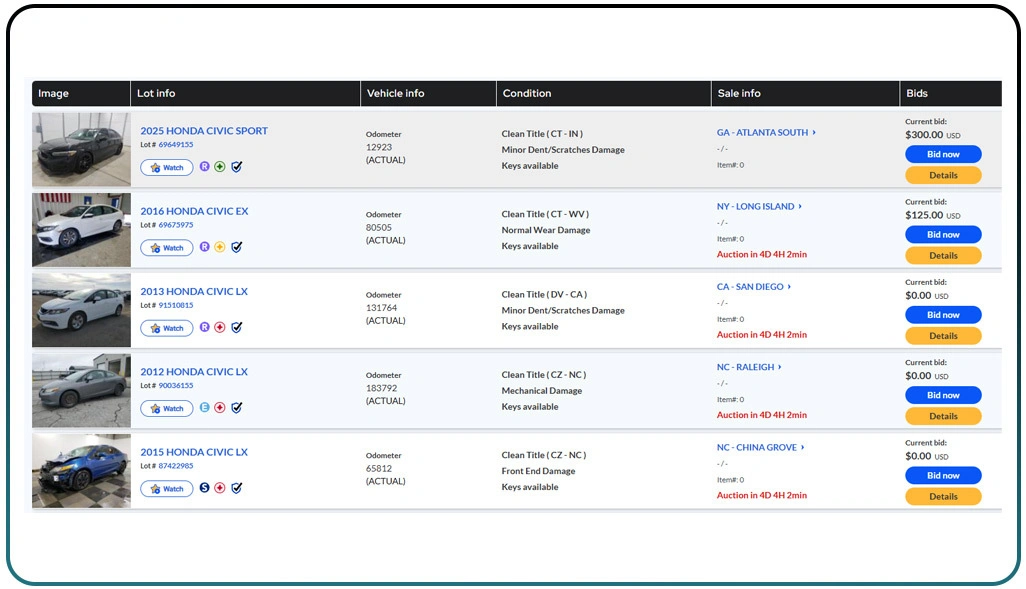

Analyzing extensive auction listing data uncovers clear pricing patterns, buyer engagement trends, and category-specific behaviours that directly influence performance expectations. As researchers review listing activity across various makes, models, and segments to Scrape Vehicle Auction Listings From Copart, they begin detecting shifts tied to demand cycles, brand perception, and seasonal dynamics, allowing for more accurate marketplace insights.

Market observations consistently reveal clear differences between initial listed values and the final sale results. While certain vehicles attract early momentum because of strong brand appeal, others witness intensified bidding only toward the final moments. By combining these behavioural patterns with Real-Time Copart Data Insights, analysts can draw smarter conclusions about ideal sourcing periods, undervalued segments, and consistently reliable performers.

Predictive patterns become more evident when comparing high-engagement categories with those experiencing slow traction. Incorporating E-Commerce Datasets supports additional comparison layers by aligning auction prices with retail-side benchmarks, helping analysts understand how auction outcomes influence retail positioning. These combined interpretations create a stronger foundation for planning acquisition strategies aligned with broader market behaviour.

Category-Level Price Performance Overview:

| Vehicle Category | Avg Starting Bid | Avg Final Bid | Avg Bid Count | Listing-to-Sale Conversion |

|---|---|---|---|---|

| Sedans | $350 | $1,450 | 18 | 71% |

| SUVs | $520 | $2,100 | 25 | 76% |

| Trucks | $600 | $2,850 | 31 | 82% |

| EVs | $480 | $2,400 | 22 | 69% |

Understanding Bidding Behaviours in Large Auction Volumes

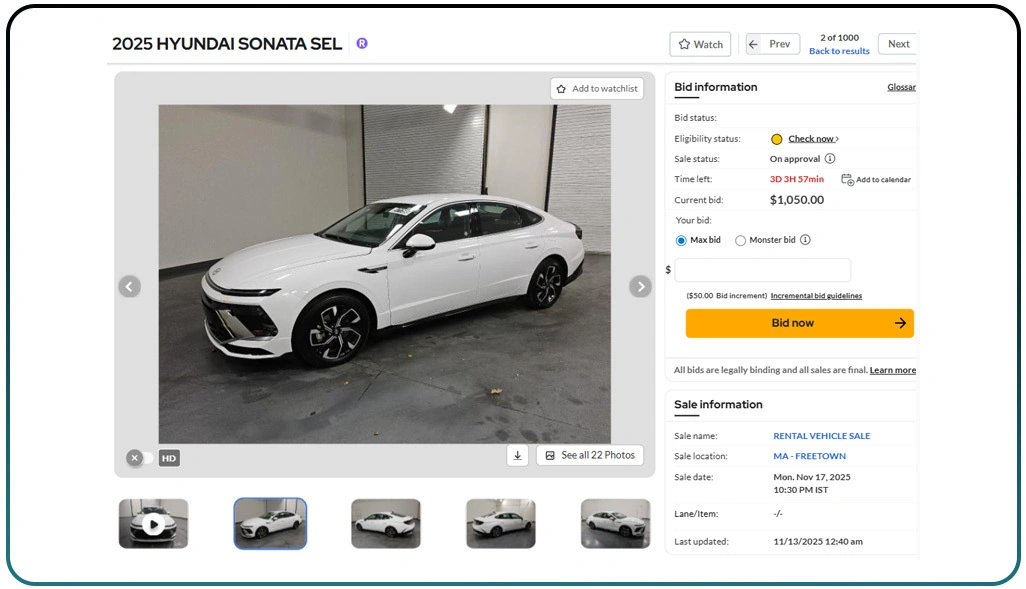

Evaluating bidding behaviour across thousands of listings provides clear insight into buyer activity, value expectations, and overall participation patterns. By examining how bids are built at different stages to Extract Vehicle Market Data Using Copart, teams can understand how diverse buyers engage with listings and identify which vehicle models consistently generate stronger early-stage momentum.

Auction listings often demonstrate a clear relationship between visibility quality and bid frequency. Listings with complete condition reports generally receive higher early interaction, while incomplete descriptions can limit engagement. Seasonal shifts also affect bidding patterns: certain categories rise in participation during specific seasons due to functional demand, weather conditions, or fuel price fluctuations.

High-traction models often display early momentum, while slower categories exhibit engagement closer to closing cycles. Integrating Web Scraping Ecommerce Data enhances evaluation depth by aligning auction interest with the broader retail ecosystem, making it easier to understand overall buyer behaviour. These consolidated findings provide structured direction for analysts planning purchase timing, resale strategy, or inventory allocation.

Bidding Dynamics and Buyer Engagement:

| Listing Type | Peak Bidding Window | Avg Bid Frequency | Buyer Engagement Level | Final Sale Variability |

|---|---|---|---|---|

| Clean Title Cars | 2nd Hour | High | Strong | Low |

| Salvage Vehicles | Last 30 Minutes | Medium | Moderate | High |

| Luxury Models | 1st Hour | Very High | Strong | Medium |

| High-Mileage Cars | Final Hour | Low | Low | High |

Evaluating Multi-Region Trends Through Structured Insights

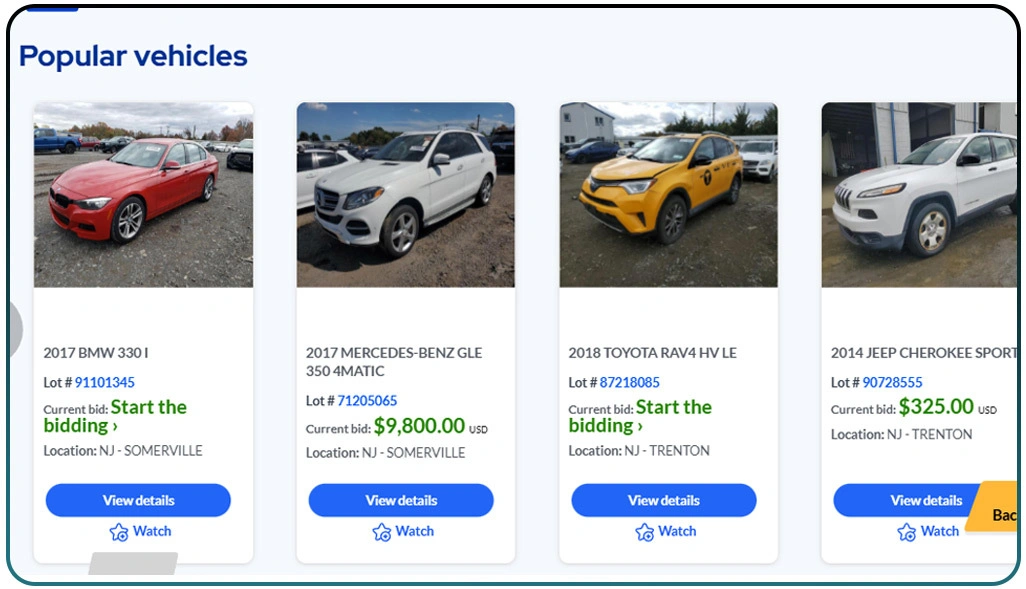

Understanding regional variations in auction performance allows analysts to interpret market preferences, pricing differences, and buyer behavior that influence long-term value patterns. When insights are compared across multiple geographic zones using a Copart Auction Data Extractor, consistent trends often appear, highlighting which vehicle categories align best with specific markets.

Cross-regional pricing gaps offer valuable context for identifying where profitability can improve most effectively. Some locations consistently generate stronger sale outcomes because of focused buyer demand, while others show higher fluctuation influenced by shifting economic patterns or seasonal movements. When combined with Real-Time Copart Data Insights, these patterns help clarify which markets hold the most reliable opportunity for strategic decision-making.

Automated multi-market comparisons further simplify the analysis, allowing researchers to compile location-based bid trends, sale conversions, and demand spikes. These insights help identify high-value markets, stable performers, and listing types more sensitive to regional fluctuations. Incorporating Web Scraping Services strengthens this evaluation by enabling larger-scale data integration across multiple platforms.

Regional Auction Performance Indicators:

| Region | Avg Sale Price | Avg Bid Count | High-Demand Segment | Market Volatility |

|---|---|---|---|---|

| West Coast | $2,850 | 27 | SUVs | Medium |

| Midwest | $2,300 | 22 | Trucks | High |

| East Coast | $2,600 | 24 | Sedans | Low |

| Southern States | $2,150 | 19 | High-Mileage Cars | Medium |

How Web Data Crawler Can Help You?

Automotive teams aiming to scale their research workflows benefit greatly when Extracting Pricing and Bidding Data From Copart becomes supported by automated systems capable of processing thousands of listings daily. We provide structured intelligence pipelines that help businesses collect pricing signals, bidding frequency, vehicle categories, listing metadata, and region-wise data at scale.

- Automated extraction of auction listings for repeating daily cycles.

- Aggregation of large-scale pricing patterns across multiple categories.

- Tracking bidding frequency windows for performance comparison.

- Identifying buyer engagement variations across vehicle types.

- Delivering unified reporting dashboards for internal analysis.

- Supporting multi-region comparisons for strategic planning.

With these capabilities, teams can streamline automotive decision-making processes while enhancing visibility across thousands of active listings. By the end of the workflow, analysts also gain access to Scrape Vehicle Auction Listings From Copart, helping them accelerate performance evaluations.

Conclusion

Meaningful market assessments become easier when teams integrate Extracting Pricing and Bidding Data From Copart into structured research processes that highlight value cycles, buyer intent, and segment-specific behaviour. This approach simplifies comparison across thousands of listings and helps automotive analysts measure auction efficiency more accurately.

Businesses that aim to scale their insights benefit greatly from unified datasets powered by to Extract Vehicle Market Data Using Copart, enabling deeper price modelling and bidding intelligence. Contact Web Data Crawler today to get custom-built Copart auction data solutions for your automotive intelligence needs.